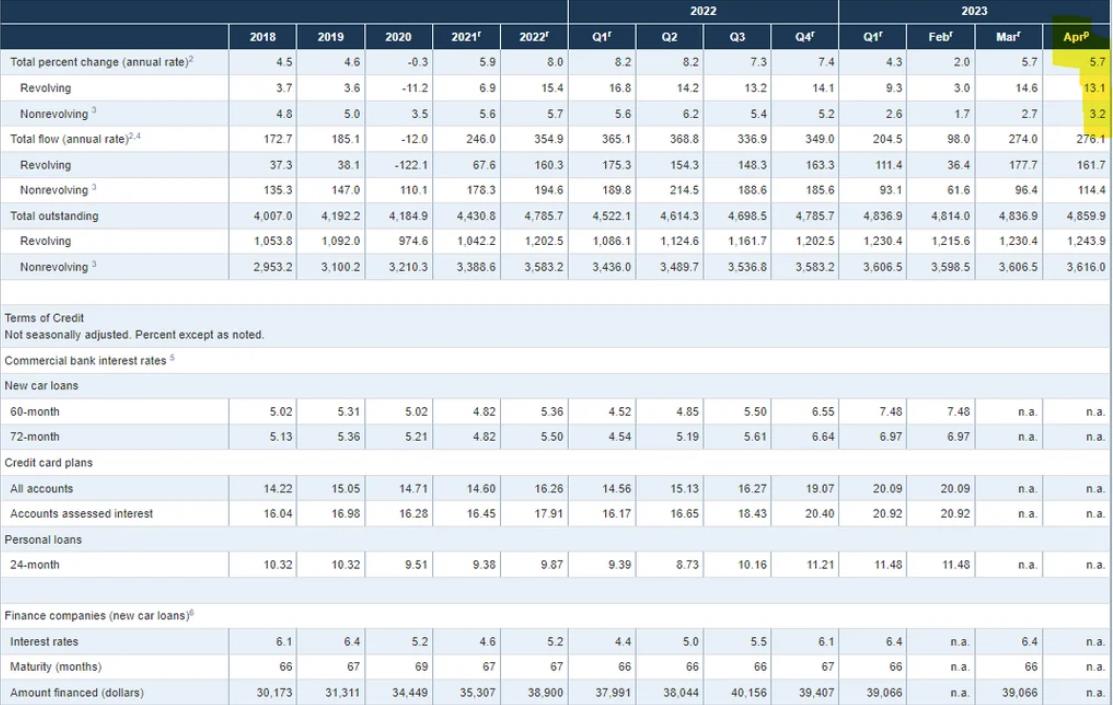

Source: www.federalreserve.gov/releases/g19/current/g19.pdf

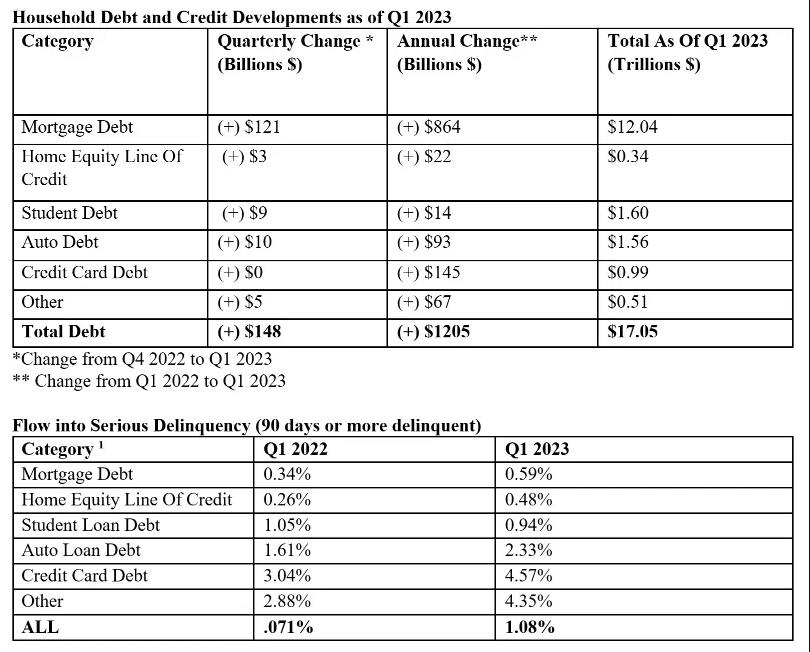

- Total household debt has risen by $148 billion, or 0.9 percent, to $17.05 trillion in the first quarter of 2023.

- Mortgage balances climbed by $121 billion and stood at $12.04 trillion at the end of March.

- Auto loans to $1.56 trillion.

- Student loans to $1.60 trillion.

- Credit Card debt $986 billion.

However, unlike the banks above, there are no fancy programs designed to keep households afloat in this inflating economy–and boy are households starting to feel it, especially in the areas like services and housing (that are BIG components of CPI–and way more ‘sticky’ than goods).

Views:

45