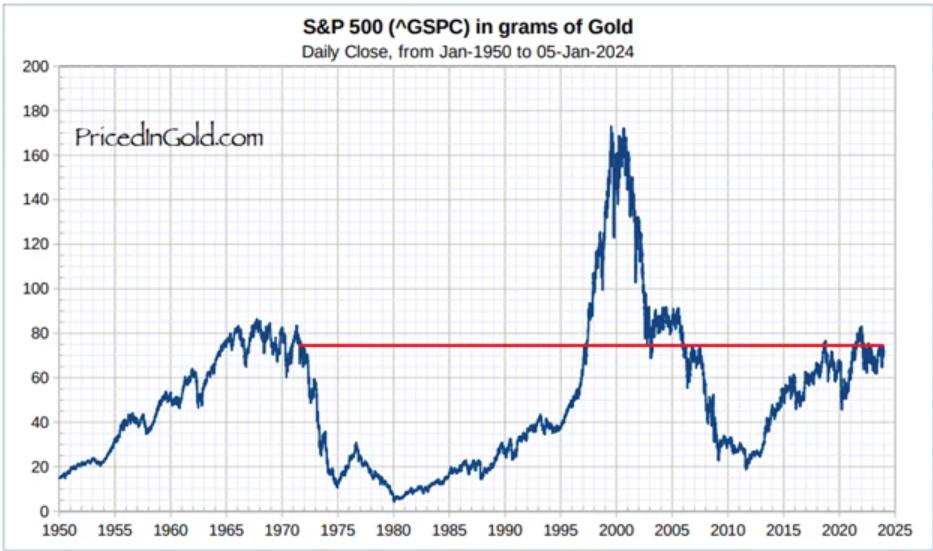

If you traded a bar of gold in 1972 for a share in the S&P 500, over 50 years later your share would be worth that same bar of gold.

Since we went off the gold standard, the stock market has not increased in real value. It has only preserved wealth. This can be further illustrated by dividing the S&P 500 by the M2 Money Supply.

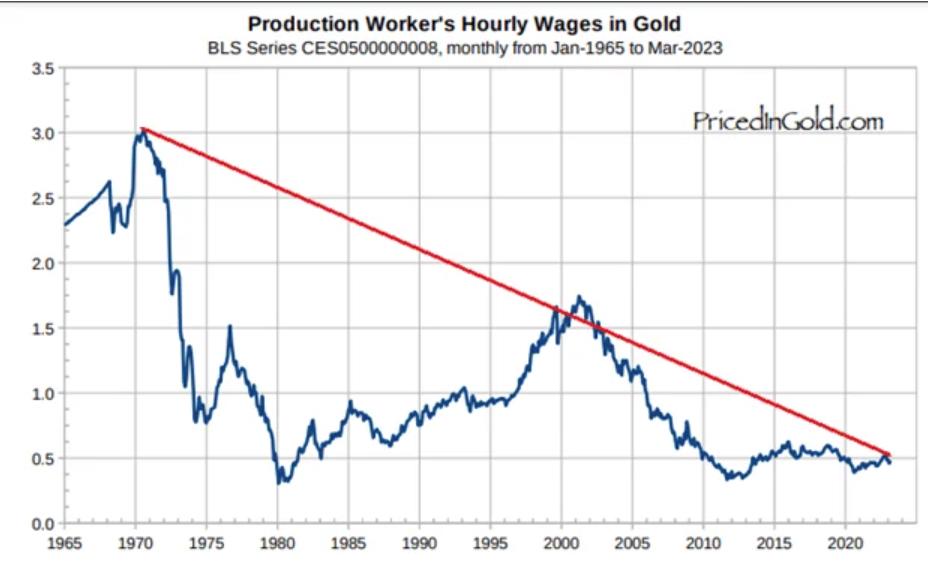

But we have had gains in productivity over the last 50 years – Computers, The Internet, Automation, Globalization, Artificial Intelligence – where have all the gains in productivity gone? To the middle class? Obviously not, but let’s illustrate it anyways.

Which leaves one final culprit. The government.

The government has effectively taxed all productivity gains in society at an average rate of 100% over the last 50 years – since we went off the gold standard.

If enough people care, I’ll post a part 2 explaining how I think they’ve done this.

Edit: I had no idea so many people invested in the S&P just for the 1.5% dividend, nor that they were able to perfectly reinvest their dividends without incurring any commissions, management fees, or taxes, for the last 50 years. You’ll all have to tell me your secrets.

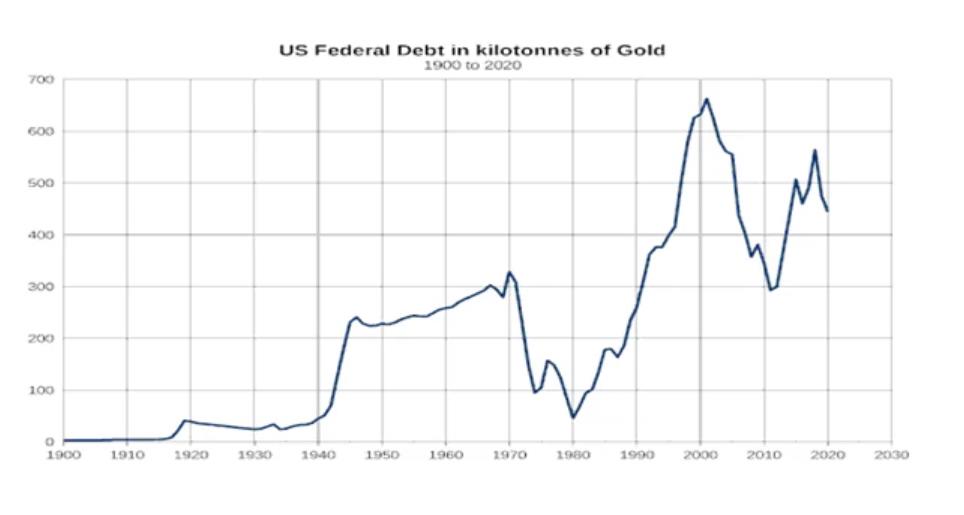

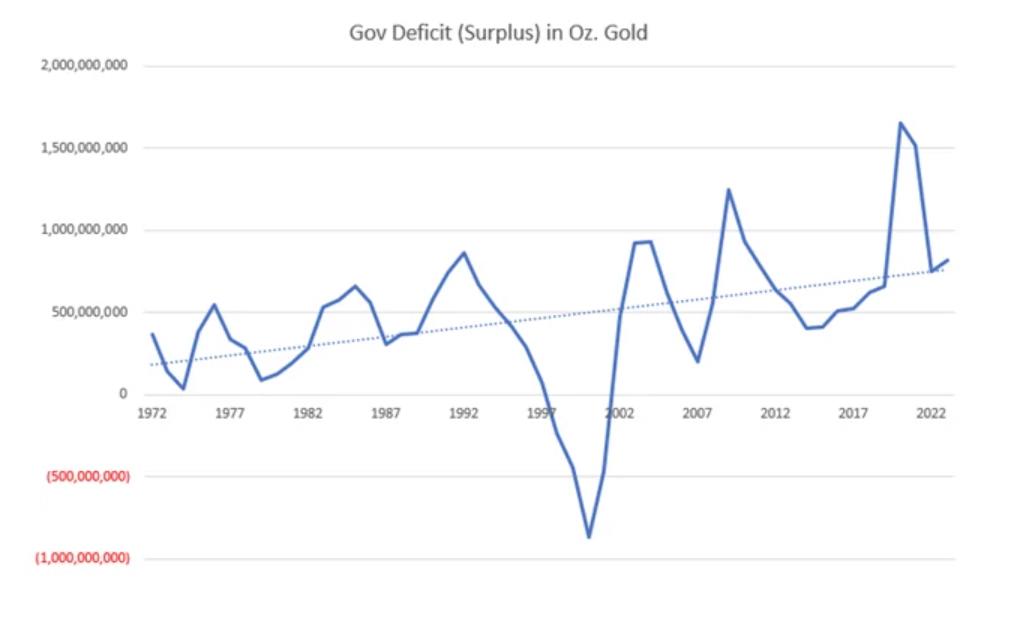

To recap, the only accounts that have, on average, increased in real terms, as measured by the most common and reliable store of value (gold), are government debt and government deficits.

The S&P 500 has been flat:

Middle class wages have steeply declined:

While Government debt and deficits have both increased:

If any of this was purely the result of fluctuations in gold prices, we would assume all of these charts would look similar.

They do not. The government is clearly benefiting from something unique.

The answer: Inflation. Not consumer prices, but *real* inflation.

Here is real inflation:

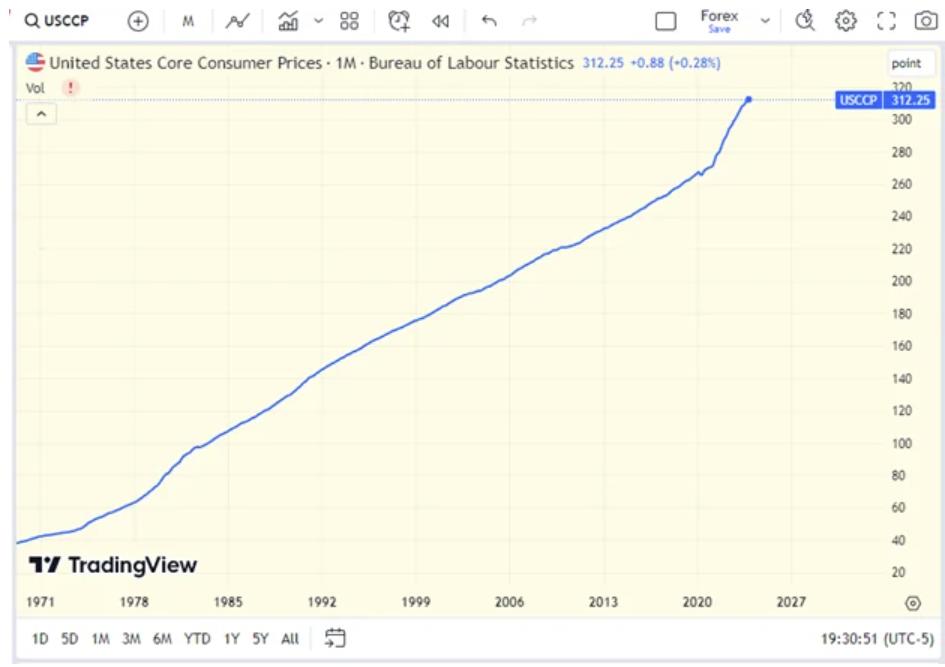

Here is government-reported inflation (consumer prices):

And here is real inflation compared to government-reported inflation:

Most of the difference between these two values is the productivity gains that the government has stolen from you.

They do this by conflating CPI with real inflation.

—-

Inflation is not prices, inflation is the expansion of the money supply.

Imagine that the aggregate productivity increases of globalization (to use just one example) should have translated into a 10% decrease in consumer prices across the board.

Enter, Keynesian Economics. A decrease in consumer prices is bad! Without much evidence to support it, the assumption is that a reduction in consumer prices will create a negative feedback loop that will cause Recession.

Enter, The Federal Reserve. Their Keynesian mandate: a 2% year-over-year increase in consumer prices, and they’ll inflate the money supply at what ever level is necessary to achieve this.

The result is that the entire benefit of any productivity increases that should have been realized by the consumer through reduced prices is stolen by The Federal Reserve through monetary inflation.

The primary benefactor of this becomes the government, who will realize a relative reduction in the real value of their massive debt and deficit burdens, allowing them to rapidly expand both – in real terms, not just nominally – as shown in the charts above.

This works, effectively, as an average 100% tax on all productivity gains that society has generated (and will generate) since our abandonment of sound money in the early 1970s.

—

You are a squirrel gathering nuts. You are allowed to keep only what you gather, less capital gains tax, of course. The only entity allowed to grow in real terms and in league with the technological advancements of humanity is the government – and this will continue until we return to sound money that is backed by something finite.

This is a lesson that has already been taught by history before. It’s the entire reason the country was founded on sound money to begin with, and, sadly, it’s a lesson that’s going to have to be eventually retaught again.