In a surprising twist, the purportedly savvy hedge funds, often deemed the “smart money” of the market, are facing a staggering $43 billion in losses. This downturn serves as a harbinger of shifting tides in the financial landscape, raising questions about the broader implications for investors.

Smart money, traditionally viewed as astute and strategic, losing significant sums prompts a reassessment of market dynamics. When the stalwarts of investment stumble, it implies a reevaluation of conventional wisdom. It suggests that even the most sophisticated players are grappling with a market environment that is becoming increasingly unpredictable and challenging to navigate.

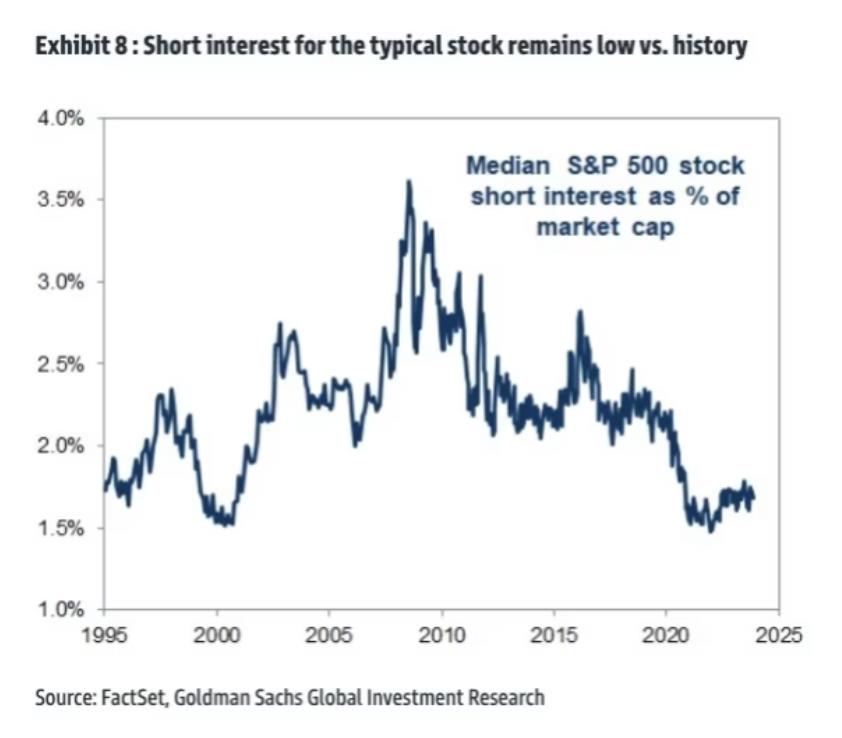

Moreover, the low levels of short interest in the S&P 500 ($SPY) hint at an interesting paradox. Historically, a scarcity of short positions has been associated with market peaks. When short interests are low, it often suggests that investors are overwhelmingly optimistic about stocks, potentially signaling an overvaluation.

Adding another layer to this intricate puzzle is the remarkable transformation of the bond market. From nosebleed valuations with a price-to-earnings ratio of 319x in 2021, bonds have executed a full-circle turnaround to a more conservative 20x today. Inverting a bond’s yield offers a P/E of sorts, revealing the price paid for future coupons. At these current levels, bonds are reemerging as competitive contenders across various asset classes.

This juxtaposition of hedge fund losses, historically low short interests, and the resurgent competitiveness of bonds paints a nuanced narrative. It suggests a market reaching a zenith, where exuberance might be outpacing fundamentals. The smart money’s struggles and the subdued interest in shorting could be interpreted as a collective sentiment that stocks have peaked, or at the very least, are on the cusp of a correction.

Investors are now faced with a pivotal moment, as the narrative of the market undergoes a transformation. The adage that “smart money knows best” is being challenged, and traditional indicators are signaling caution. Navigating this landscape demands a reevaluation of investment strategies, with an emphasis on adaptability and a keen understanding of the evolving market sentiment.

In a world where the smart money faces setbacks and bonds reclaim competitiveness, investors must tread carefully, recognizing that the landscape they once knew may be undergoing a fundamental shift. The journey ahead demands a recalibration of expectations and a readiness to navigate the unpredictable currents of the financial markets.

Sources:

FT: Hedge fund short sellers suffer $43bn of losses in market rally

Bonds have come full circle from their nosebleed valuations in 2021—a P/E of 319x!—to 20x today. (Invert a bond’s yield to get a P/E of sorts, the price paid for future coupons). At current levels, bonds are competitive with most other asset classes again. pic.twitter.com/jBXsuA0jQW

— Jurrien Timmer (@TimmerFidelity) November 24, 2023