by Virtual_Crow

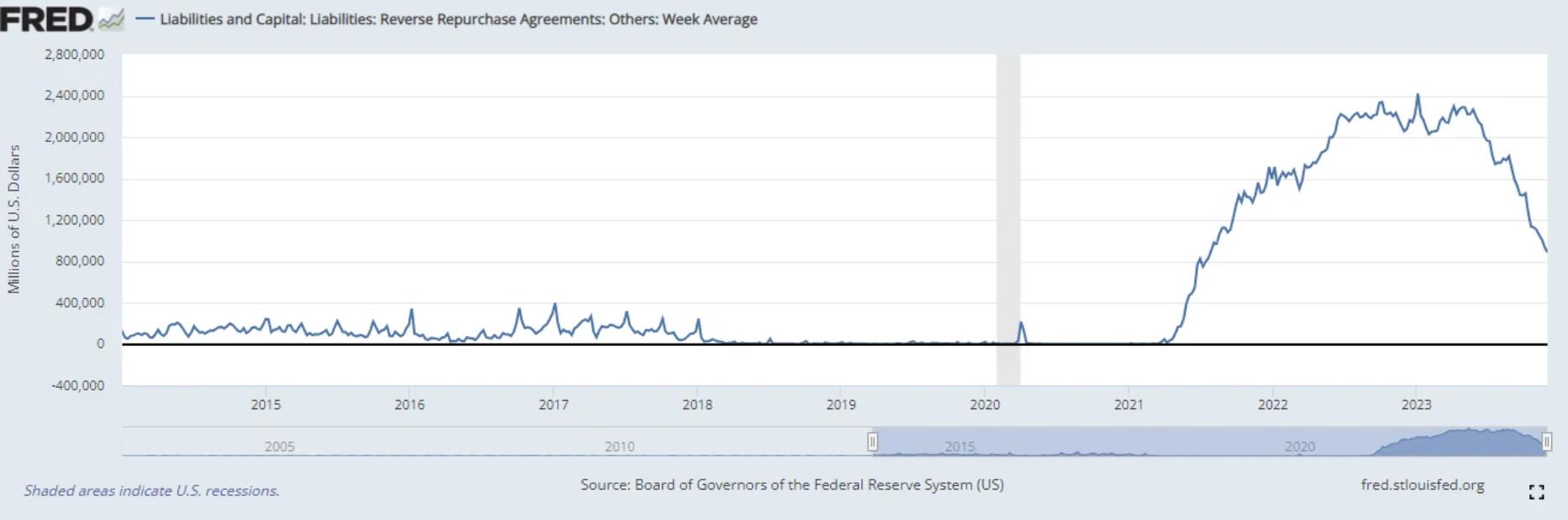

The RRP facility is used to take excess liquidity out of the system. Banks have a ton of extra deposits that they would loan out, and if there’s too little demand for loans they’d loan it at less than 5% (for short term loans). The Fed doesn’t want that because loaned deposits multiply the money supply due to fractional reserve banking, so they pay banks 5.3% to borrow the money (and sit on it) overnight.

The reason the RRP facility is in free fall is because the Treasury is funding trillions of new borrowing with bills that pay 5.4%, so this money is going there instead.

A small part of the reduction may be depositors withdrawing money to go in the markets but it’s not the primary driver.

When the RRP runs out, there is a shortage of liquidity to buy new bills, so short term rates will rise and every other asset class will see some liquidity move out of it.