Because it has to be in order to fund Bidenomics.

As Powell clasps his hands in desperate hope without any evidence to back his hope, the US Treasurer today, like the Treasurer in yesteryear, is giving a solid thumbs-up to his plan, which is already accomplishing everything the Treasury desperately needed.

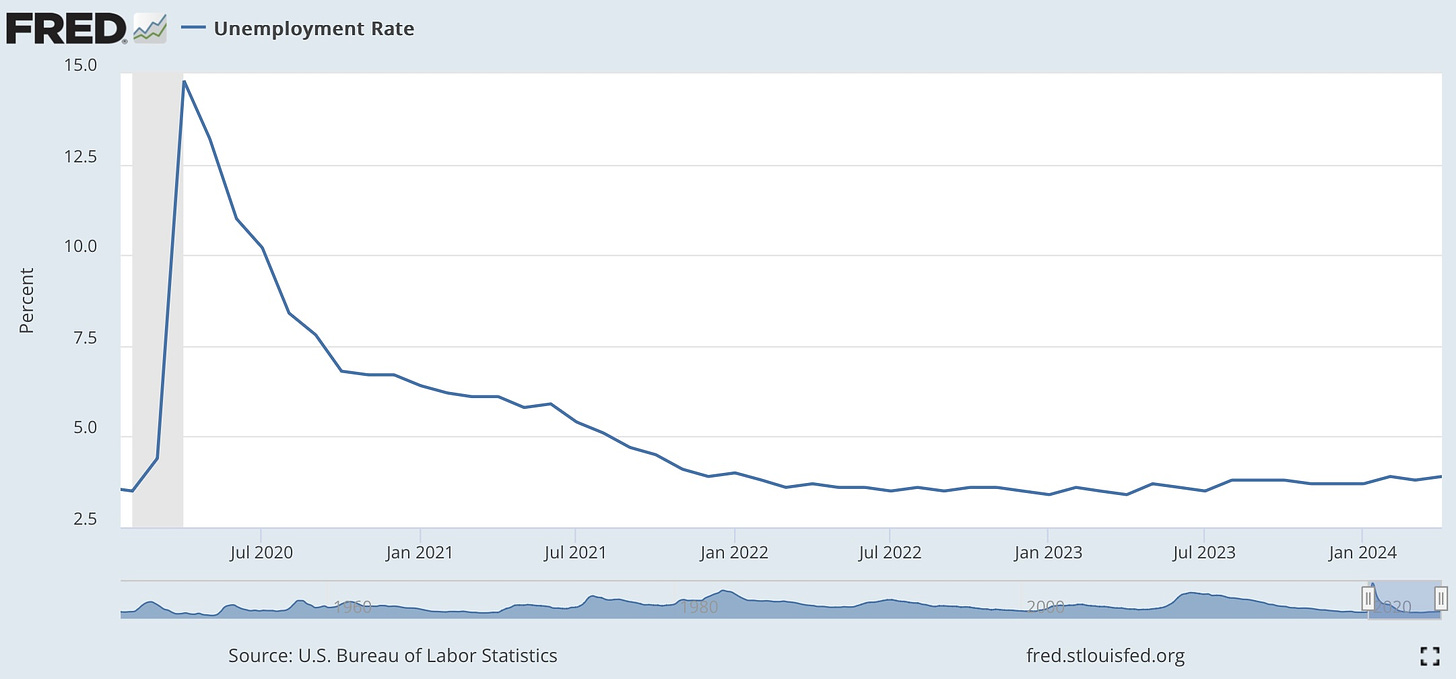

After yesterday’s low “jobless claims” report that held unemployment steady and that looked rigged to hit a targeted goal (again), today delivered a “new jobs” report that came in (at 175,000 new jobs), well below expectations of 240,000. By that report, the unemployment rate ticked higher from 3.8% to 3.9%.

As I commented yesterday, we may be nearing the point where all the layoffs this year and last year are bringing jobs down enough to where they will finally start to come in line with available workers. Once that threshold in met, unemployment can rise when if layoffs are higher than normal. We’ll have to see if this minute rise becomes a trend, though, since the numbers pulled a head fake to his level in February, too, then dipped back down in March to the familiar 3.8 level they had hovered along in August, September and October of last year.

As usual, the slightest hint of a softening labor market caused stock and bond investors to back markets down from the recent financial tightening investors had brought back to the marketplace. Brains smoked in the fumes of hopium and fueled with pure testosterone bid stocks and bonds and rate cuts hopes all back up again today in response to this slight hint that the Fed’s jobless gauge may finally allow it to cut rates. Same pipe dream from the same glass-pipe smokers. Powell’s limp comments about fighting inflation this week had already given lift back to falling markets.

What was notable about Powell’s presser after the FOMC meeting, however, was how much he had to talk about the possibility of a rate hike in order to deny that one was likely coming. Talk of a rate hike had never even occurred in recent Fed meetings until now. Methinks he doth protest too much. Equally interesting was how the mainstream press was now pointing out that talk of a rate hike, instead of a cut, has become popular. A few months ago, I was the only one I heard saying it. Now it’s popular because the need has become obvious.

As Wolf Richter notes,

“Hike” and “rate hike” were mentioned 8 times by reporters and by Powell during the FOMC’s post-meeting press conference today. Those terms weren’t mentioned at all in the press conferences during Rate-Cut Mania, which were all about “rate cuts,” how many and when.

Powell was obviously unenthusiastic about rate hikes, and thought it “unlikely that the next policy rate move will be a hike” – “our policy focus is really how long to keep policy restrictive,” he said. But rate hikes weren’t even on the table before, so that alone was a big shift, from a bunch of rate cuts to having to deal with the possibility of a rate hike. One step at a time….

Powell took noticeable pains to try to knock down the idea of something he is loathe to do now that the US government is completely dependent on the Fed for lower interest on its massively ballooning and hemorrhaging debt to which ratings agencies have given a dismal outlook. The help Powell gave to the US Treasury at the latest FOMC meeting was immediately apparent in how bond interest came down on the US10YR Treasury bond for three days in a row since Powell spoke (from 4.7% to 4.5%). Yellen can breathe easier now.

However, the rapid loosening once again of financial conditions as a result of Powell’s dulcet love notes to Yellen virtually assures loss of the Fed’s fight with higher inflation down the road. Today’s loosening of financial conditions all over again will necessitate an even more hostile fight against inflation than would have been necessary, had he responsibly tapped inflation on the head with one (likely last) hike now to get slackening financial markets to tighten back up a little, rather than sending the slutty market’s loose hopes back to lusting for rate cuts.

Instead, hoping the recent rise in inflation might prove transitory, Powell said he would need more evidence to believe it is a problem that requires a rate hike—apparently a lot more, so much does he hate the risk of raising interest another notch. Asked what it would actually take to get him to hike rates another notch, Powell replied,

“We need to see persuasive evidence that our policy stance is not sufficiently restrictive to bring inflation down to 2%,” he said. “We look at the totality of the data to answer that question. That would include inflation. Inflation expectations and all the other data, too.”

In fact, he kind of waffled all over that question with fluff about a lot more evidence necessary to make that move:

The Fed could hike rates “if we were to come to that conclusion that policy wasn’t tight enough to achieve that, so it would be the totality of all the things we’re looking at; it could be [inflation] expectations, it could be a combination of things. If we reach that conclusion – and we don’t see evidence supporting that conclusion – that’s what it would take for us to take that step,” he said.

“So, if we were to conclude that policy is not sufficiently restrictive to bring inflation sustainably to under 2%, then that would be what it would take for us to want to increase rates,” he said.

The hope that the present rise in inflation will prove transitory could be seen in the rest of his waffling:

“These are going to be judgment calls. Clearly restrictive monetary policy needs more time to do its job. That’s pretty clear based on what we’re seeing. How long that will take and how patient we should be depends on the totality of the data and how the outlook evolves,” he said.

To say this a little more on-the-nose: “Clearly restrictive policy has been failing for some months now to accomplish anything, so we hope that waiting a long time will get us to where data finally starts to show us it is moving in the right direction again.”

Sounds like Powell is about to repeat his transitory mistake at a time when he could just give it another tap to make sure it starts going back down; but then how would he help the Biden Administration fund Bidenomics?

When you just listen to Powell say the same thing over and over, you know he is waffling because he has no solid answer other than vague “totality of data” as to why the Fed is not doing rate hikes when inflation has clearly returned to rising before it gets out of hand. It’s the “he doth protest too much” part:

Obviously, our decisions we make on our policy rate will depend on the incoming data, how the outlook is evolving, and the balance of risks, as always. We’ll look at the totality of the data. We think that policy is well positioned to address different paths that the economy might take.

We don’t think it would be appropriate to dial back our restrictive policy stance until we’ve gained greater confidence that inflation is moving down sustainably to 2%.

If we had a path where inflation proves more persistent than expected, and where the labor market remains strong, but inflation is moving sideways, we’re not gaining greater confidence. That would be a case in which it could be appropriate to hold off on rate cuts….

There are other paths that the economy could take which would cause us to want to consider rate cuts. [One path] would be that we do gain greater confidence if inflation is moving sustainably down to 2%…. Another path could be an unexpected weakening in the labor market, for example.

For us to begin to reduce policy restriction, we want to be confident that inflation is moving sustainably down to 2%. For sure, one of the things we would be looking at is the performance of inflation. We would be looking at inflation expectations. We would be looking at the whole story. Clearly, incoming inflation data would be at the very heart of that decision….

My colleagues and I today have said that we didn’t see progress [on inflation] in the first quarter. And I’ve said that it appears then that it’s going to take longer for us to reach that point of confidence. I don’t know how long it will take. I can just say that when we get that confidence, then rate cuts will be in scope. And I don’t know exactly when that will be….

We see three [bad] inflation readings. I think you’re at a point there where you should take some signal. We don’t like to react to one or two months of data. But this is a full quarter. We are taking signal. And the signal we’re taking is it’s likely to take longer for us to gain confidence that we’re on a sustainable path to 2% inflation. That’s the signal we’re taking….

But my confidence in that is lower than it was because of the data we’ve seen.

Waffle, waffle, data, data, no confidence, no confidence. What I hear in that mush over and over is that there is no data coming in that gives anyone at the Fed, even Powell, any confidence that inflation is still retreating so they are going to hope that if they wait longer they will finally get the data they want. They see the signal now that three reports in a row establish a clear trend, but the meaning they are taking from the signal is just that they have to keep doing longer the thing that is no longer working.

This is just like the wistful thinking we saw from Powell’s Fed many, many long months ago when they were waiting for transitory inflation to start going down as they hoped (and, therefore, believed) it would.

I don’t have a probability estimate for you. But all I can say is that we didn’t think it would be appropriate to cut until we were more confident that inflation was moving sustainably at 2%. Our confidence in that didn’t increase in the first quarter. And, in fact, what really happened was we came to the view that it will take longer to get that confidence.”

But there are paths to not cutting. And there are paths to cutting. It’s really going to depend on the data.

But apparently, there are no paths to HIKING. There are in Powells hopeful mind only two paths: One is to cutting rates; the other is to just holding off on cutting rates. That’s dangerous because it means inflation has to run hotter for longer, getting further out of control, if it is ever going to shake that limited set of options out of Powell’s head and get him to face the one option he is avoiding that would actually bring inflation down more.

And then Powell averred to his real fears about how the Fed blew its tightening last time, causing the kind of repo crisis that I’ve predicted for this year, though the Fed’s sudden backing down on QT makes that less likely but also shows the Fed became as concerned about that risk as I was:

Why even slow QT? “It’s really to ensure that the process of shrinking the balance sheet down to where we want to get it is a smooth one and doesn’t wind up with financial market turmoil, the way it did the last time we did this,” Powell said in reference to the repo market blowout in the second half of 2019, which caused the Fed to step back in with large-scale repo operations that quickly undid a big part of QT-1.

Yeah, we don’t want you to do that again! You can tell the scale of the problem by the scale of the Fed’s rescue to stop it from getting worse!

Now, if only you weren’t so hell-bent on doing your “inflation is transitory” mistake all over again.

Anything short of hell, however, would be a lot to hope for from this gang.