by welp007

IN a few months we will realize, no one was ever planning on paying anything back

— axcilla (@axcilla) November 28, 2023

Banks Face Large Losses and Potential Job Cuts Due to China’s Property Sector Bailouts

China’s banking sector is under severe stress, tasked with propping up its faltering $57 trillion property industry. Banks like ICBC face the prospect of issuing risky, unsecured loans to financially unstable developers. This move could dramatically spike their bad debt provisions, with an estimated additional $89 billion needed in 2024, severely impacting their profits. The situation is dire, forcing banks to contemplate drastic measures like reducing growth targets and cutting jobs, while juggling government demands and business sustainability. This predicament poses a significant threat to the overall stability and profitability of China’s major banks.

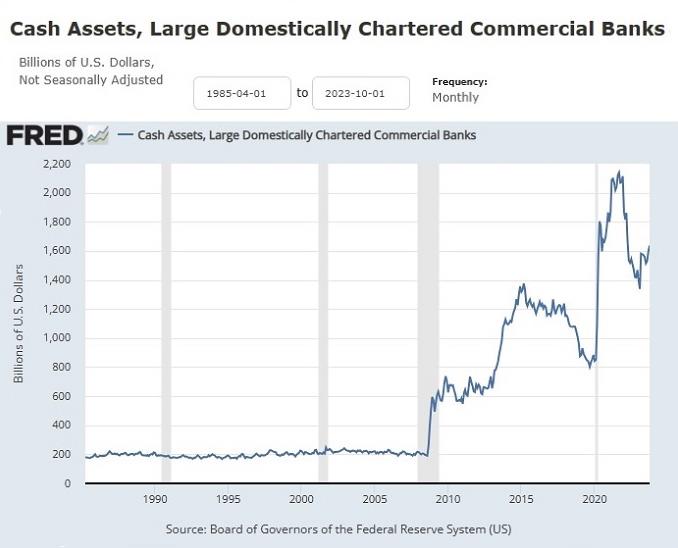

FRED is a giant online database at the St. Louis Fed that allows anyone to graph the financial and economic data stored in its repositories. We use the data regularly to bring our readers a crystal-clear snapshot of the increasingly dangerous underpinnings of the U.S. financial system.

Let’s start with the first chart above. This chart depicts the cash assets held by the 25 largest U.S. commercial banks. The Fed defines the term “cash assets” as “vault cash, cash items in process of collection, balances due from depository institutions, and balances due from Federal Reserve Banks.” Notice that from April 1, 1985 to just before the financial crash of 2008, cash levels at the biggest banks were as steady as a soft breeze on a spring day. But from that point on through today, there have been freakish spikes and plunges in cash levels. Soft-breeze banking has turned into chaotic hurricane banking, with the Fed pumping in trillions of dollars in emergency cash and the mega banks careening from one crisis to the next.

How did this happen? A brief walk through U.S. banking history is in order.

Following the Wall Street crash in 1929, more than 9,000 banks in the United States failed over the next four years. In just the one year of 1933, more than 4,000 banks closed their doors permanently as a result of insolvency.

The 1930s banking crisis came to a head on March 6, 1933, just one day after President Franklin D. Roosevelt was inaugurated. Following a month-long run on the banks, Roosevelt declared a nationwide banking holiday that closed all banks in the United States. On March 9, 1933 Congress passed the Emergency Banking Act which allowed regulators to evaluate each bank before it was permitted to reopen. Thousands of banks were deemed insolvent and permanently closed. There was no federal deposit insurance at that time and it is estimated by the Federal Deposit Insurance Corporation (FDIC) that depositors lost $1.3 billion to failed banks in that era. That would be approximately $25.5 billion in today’s dollars.

After a brief decline, the % of yield curve inversions has returned to extreme levels, now approaching 90% again.

The Treasury market continues to scream a recession ahead.

Here is a reminder:

The fact that a recession hasn’t happened doesn't necessarily mean the likelihood… pic.twitter.com/VkgPvwruBU

— Otavio (Tavi) Costa (@TaviCosta) November 28, 2023

Rubino: US Housing Bubble About To Pop