by TonyLiberty

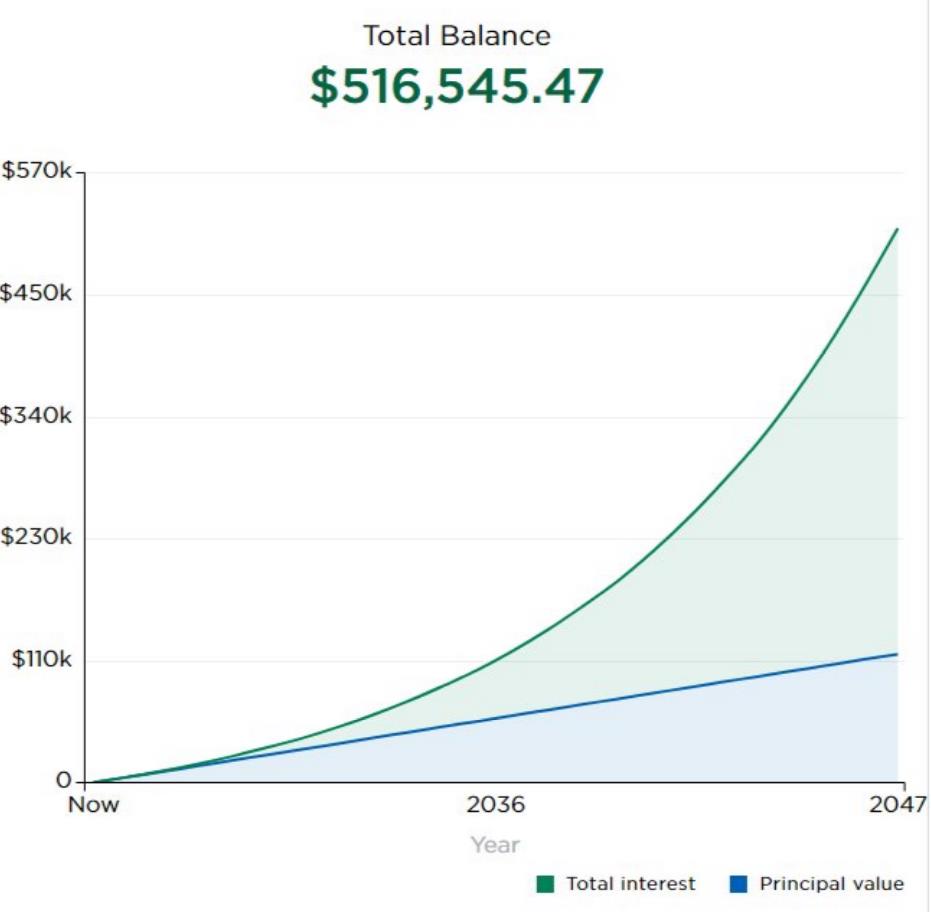

If you open a Roth IRA at 18 and invest $100/week into an S&P 500 index fund until you’re 40, you should have $500,000 tax-free. You’ll only spend $100,000 of your own cash and the gains are due to compounding returns. This is the power of time.

Views:

58