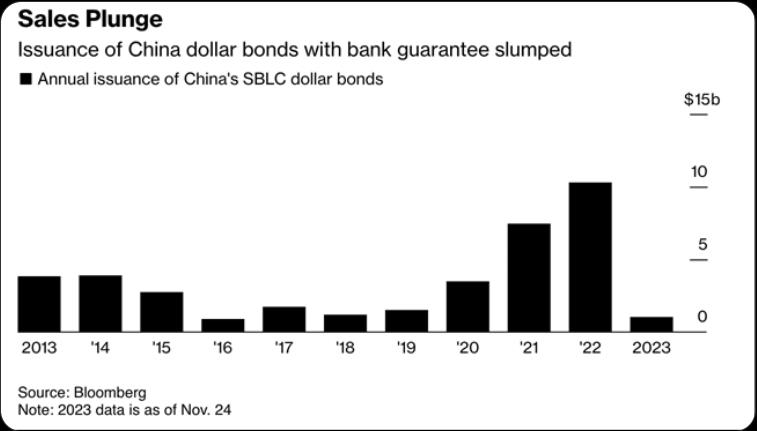

Cash-strapped Chinese borrowers are encountering a new wave of financial challenges, with fears of widespread defaults rattling a market that heavily relies on quasi guarantees from banks. Sales of China dollar notes, accompanied by standby letters of credit—a lender’s commitment to repayment if the issuer defaults—have plummeted by a staggering 90%, totaling just $1.04 billion so far this year compared to the previous year, according to Bloomberg-compiled data.

This decline outpaced an already concerning 52% drop in China dollar bond sales, which now stand at $52.2 billion for the same period. The situation is exacerbated by a surge in bank funding costs in Hong Kong, with a gauge of one-month Hong Kong interbank offered rate (Hibor) rising to 5.53%, the highest in 16 years. This spike is due to a growing demand for local currency as banks accumulate cash for regulatory requirements, draining capital from the interbank system.

Adding to the economic turmoil, one of China’s largest shadow banks, Zhongzhi Enterprise Group, has issued a stark warning of being “severely insolvent.” In a letter to investors, Zhongzhi revealed that its liabilities, amounting to $64 billion, have surpassed its estimated assets of about $38 billion. This revelation triggered an immediate investigation by Chinese authorities into “suspected illegal crimes” against the shadow banking giant.

The struggling financial firm’s plight further highlights the challenges facing China’s financial sector, raising concerns about the stability of the nation’s economy. With the government now probing major shadow banks, including Zhongzhi Enterprise Group, the already precarious situation is intensifying, casting a shadow on the future of China’s financial landscape.

Sources:

China Bank-Backed Dollar Bond Sales Plunge Amid Default Jitters – Bloomberg

HongKong Cash Demand Sends Local Bank Rate to 16-Year High – Bloomberg

China’s Troubled Shadow Bank Zhongzhi Warns of Insolvency – Bloomberg

Zhongzhi Enterprise Group: China investigates major shadow bank for ‘crimes’

🚨JUST IN: MAJOR CHINESE SHADOW BANK DECLARES ITSELF 'SEVERELY INSOLVENT'

China's major shadow bank Zhongzhi declares 'severe insolvency' with a $36 billion shortfall, signaling liquidity problems in the $2.9 trillion Chinese shadow banking sector.

Known for real estate… pic.twitter.com/DQnIoXziCv

— Mario Nawfal (@MarioNawfal) November 25, 2023