Regulators seized their first bank of the year on the same day that regulators are telling other regulators and financial institutions to ready themselves for possible trouble in the major financial clearing houses. (At least, same day in terms of when it hit the news.)

Reminder: It was a badly failed clearing house that became the epicenter of the repo crisis that I referred to as the “Repocalypse” back in 2019, and I have been saying 2024 looks poised for possible similar problems later in the year in that deep layer of interbank lending that keeps financial institutions running through the night to the next day—keeps the system from seizing up.

Clearing houses are often enormous, handling trades totaling trillions of dollars. One might reasonably wonder if the concern to ready financial institutions against a systemic failure that could happen from one of these institutions, as the warning was put, suggests one or more such institutions may be showing signs of trouble. (Nothing in the information provided indicates that is the case, but then nothing ever does. We typically find out on a Monday morning after something crashes … or on a Friday after markets close for the weekend.)

Clearing houses are intermediaries for settling financial transactions of many kinds.

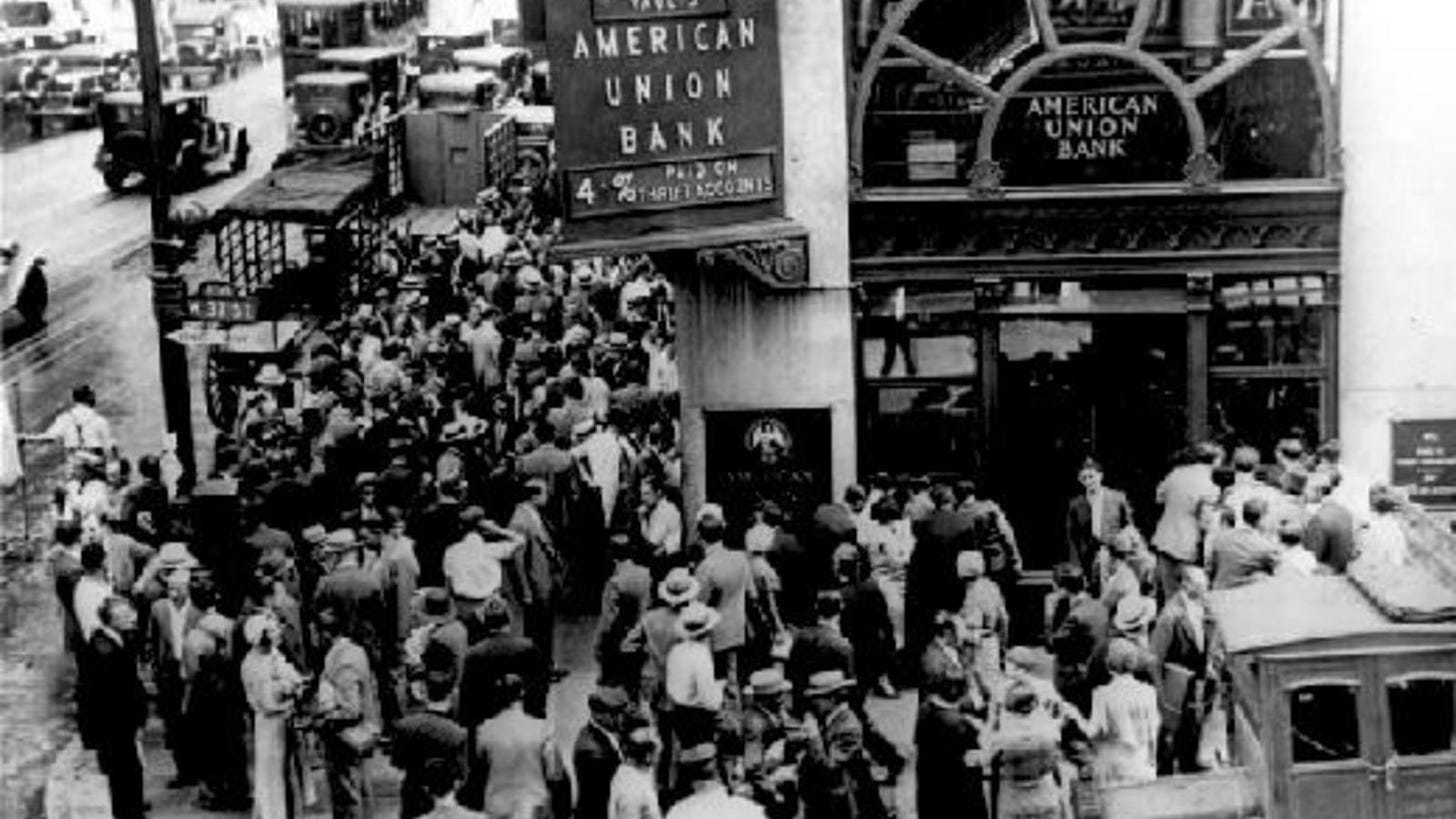

As for Republic First, the small regional bank that failed in the Pennsylvania area, there are no indications in initial announcements that commercial real-estate played an outsized role in the bank’s failure, and 4-5 good seizures of this kind a year are normal. So, with this being the first of the year to be seized by the FDIC, and sold as meat that ran past its sell-by date to Fulton Bank, based in Lancaster, Pennsylvania, there are no immediate fears to be had from the announcement unless something more endemic or systemic is revealed in the days ahead. Just your garden-variety bank failure for now.

The bank’s failure is expected to cost the deposit insurance fund $667 million.

A pittance. The last FDIC seizure was of Citizens Bank, based in Iowa, last November.

This time, maybe there really is nothing to see here folks, but stay tuned because you never know.