In the hallowed halls of economic discourse, a sobering truth reverberates with ominous resonance: America’s fiscal mess is not just a domestic concern—it is a crisis that reverberates across the globe. With each passing day, the world watches in trepidation as the United States hurtles towards a fiscal precipice of its own making.

A recent article by @TheEconomist pulls no punches, warning of the dangers posed by America’s reckless borrowing—a danger not just to its own economy, but to the very fabric of the global financial system. Against the backdrop of the “longest stretch of sub-4% unemployment in half a century,” the article lays bare the gravity of the situation, detailing how unusual high budget deficits and soaring debt levels have become.

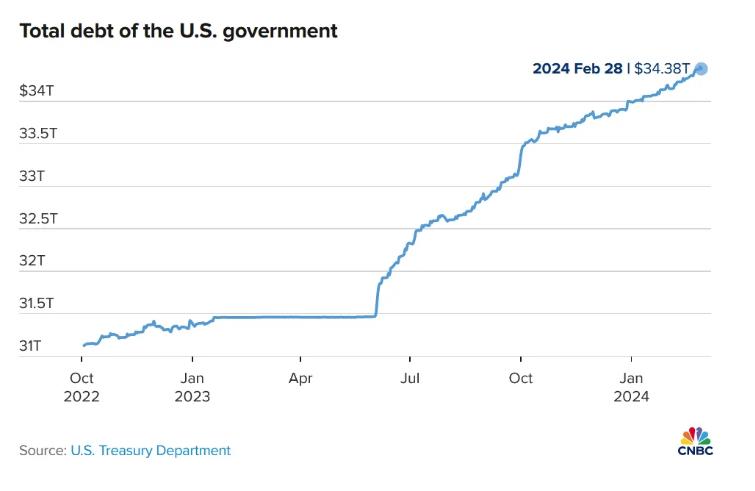

The numbers speak for themselves: the US debt has been skyrocketing at an alarming rate, ballooning by $1 trillion every 100 days. The debt-to-GDP ratio, a key indicator of economic health, now stands at a staggering 124%, inching dangerously close to the record high of 126% set in 2020. And according to sobering estimates by the Congressional Budget Office (CBO), this ratio is set to soar to 131% by 2034—a level unseen in modern history.

But perhaps most chilling of all is the historical precedent: since 1800, a staggering 51 out of 52 countries with a debt-to-GDP ratio above 130% have defaulted—a grim reminder of the perils that lie ahead. And as if that weren’t enough, the specter of persistent inflation looms large, with the money supply (M2) surging to levels not seen since March 2023.

In the face of this mounting crisis, all eyes turn to Federal Reserve Chairman Jerome Powell, as calls grow for decisive action to avert disaster. The recent surge in commodities and gold serves as a stark reminder of the perilous road ahead, as unemployment rates inch ominously upwards and labor markets teeter on the brink of collapse.

Meanwhile, across the Pacific, China’s insatiable appetite for gold paints a picture of a modern-day gold rush, as the western world grapples with the consequences of its own fiscal folly. With a reported gold stockpile worth a staggering $170 billion, China emerges as a titan on the global stage, buying up gold mines and solidifying its position as the world’s largest importer and producer of the precious metal.

As the world wakes up to the grim realities of America’s fiscal recklessness, one thing becomes abundantly clear: this is not just America’s problem—it is the whole world’s problem. And unless decisive action is taken, the consequences could be catastrophic indeed.

Sources:

“America’s fiscal mess is home-made. But make no mistake: it is the whole world’s problem. “

From @TheEconomist article, “America’s reckless borrowing is a danger to its economy — and the world.”

In addition to detailing how unusual high budget deficits and debt are in the midst… pic.twitter.com/pyUrh97KG8— Mohamed A. El-Erian (@elerianm) May 5, 2024

globalmarketsinvestor.substack.com/p/the-us-national-debt-reached-345

Persistent inflation is not a coincidence.

The money supply (M2) has bounced above March 2023 levels, while deficit spending offsets any Fed balance sheet reduction.

Table via Federal Reserve pic.twitter.com/Fhfx8EBAOC

— Daniel Lacalle (@dlacalle_IA) May 5, 2024

I suggest J. Powell to consider this indicator for the “stag”, and the recent surge in commodities or gold for the “flation”.

Every time unemployment rates have crossed above its 24-month moving average, it marked the beginning of a significant deterioration in labor markets. pic.twitter.com/j8QFR1OuXA

— Otavio (Tavi) Costa (@TaviCosta) May 4, 2024

Like clockwork.

The New York Times just dropped an article that China is buying gold like there’s no tomorrow.

In other words,

A modern day gold rush.

The western world is waking up. Who likes 3D chess? t.co/hlMD1ILE1q

— Gold Telegraph ⚡ (@GoldTelegraph_) May 5, 2024

China buying more gold mines:

“Deal of the week was Pan American Silver (NYSE: PAAS) announced today it will sell its 100% interest in La Arena S.A. , which owns the La Arena gold mine as well as the La Arena II project in Peru, to Zijin Mining Group” pic.twitter.com/eGMbSppie2

— 🤠Weimar Silver Baron🤠 (@BankerWeimar) May 4, 2024