by TonyLiberty

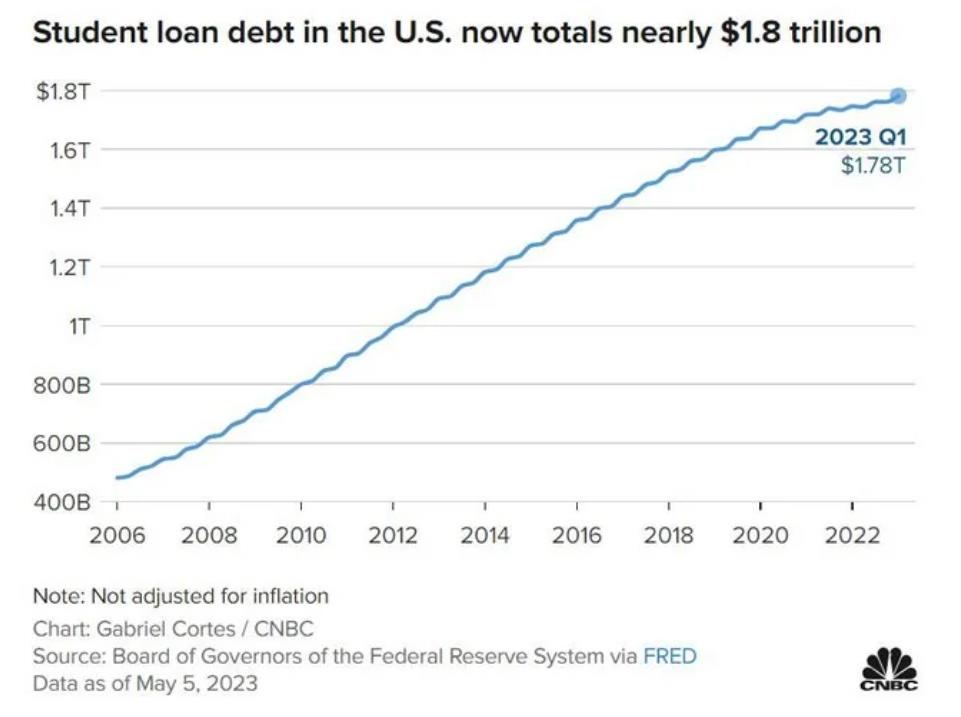

It is no surprise that student loan debt in the United States has reached such a high level. With the cost of college tuition continuing to rise, more and more students are taking out loans to pay for their education. This problem is only compounded by the fact that many graduates are struggling to find good-paying jobs after they leave school. As a result, it is not surprising that student loan debt has become one of the biggest financial problems facing young Americans today.

Views:

45