Yesterday, I outlined how the Fed and the Treasury are actively working to juice the financial system to aid the Biden administration’s re-election bid.

By quick way of review:

1) The Fed will soon begin cutting interest rates while stocks are at all time highs, the economy is still growing, and financial conditions are in fact looser than they were before the Fed raised rates for the first time in March 2022.

2) The U.S. is running emergency levels of social spending at a time when the economy is still growing. It’s added $5 trillion in debt since President Biden took office. And the pace of debt issuance is speeding up, not slowing down: the U.S. has added $2 trillion in debt in the last 12 months alone. You can thank Treasury Secretary Janet Yellen for signing off on this insanity.

Today, I’d like to delve a bit more into one of the more nefarious schemes the Fed is using to juice stocks higher. To fully grasp this, we need to wind the clock back to March 2023, when the U.S. regional banking system was on the verge of collapse.

At that time, a number of large regional banks collapsed due to:

1) Bad risk management: their leadership teams failed to appropriately hedge their interest rate risk while the Fed was raising rates.

2) Banks were only paying 0.1% on deposits, while money market funds and short-term Treasuries were yielding 4% or more. As a result of this, depositors were pulling funds out of the banks, resulting in the banks having to sell large portions of their loan portfolios at a loss (banks must maintain certain capital requirements based on deposits).

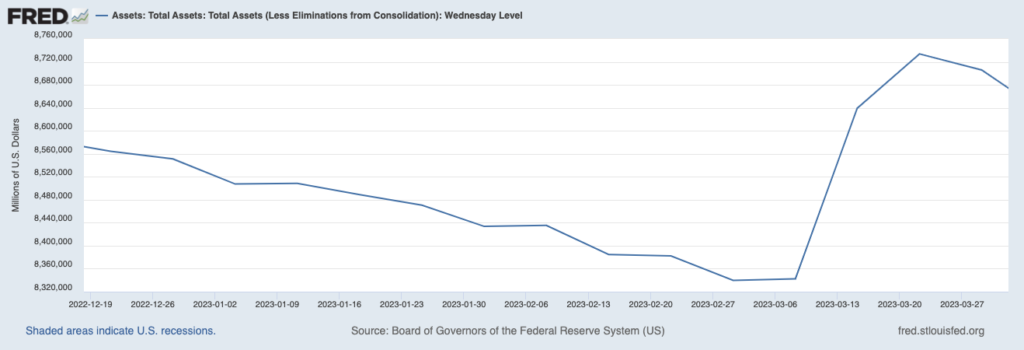

The Fed took action to stop a crisis from unfolding, pumping $400 billion in liquidity into the financial system in just three weeks. Prior to that, the Fed’s balance sheet was falling due to its Quantitative Tightening (QT) program. The Fed reversed NINE months worth of that program in just three weeks!

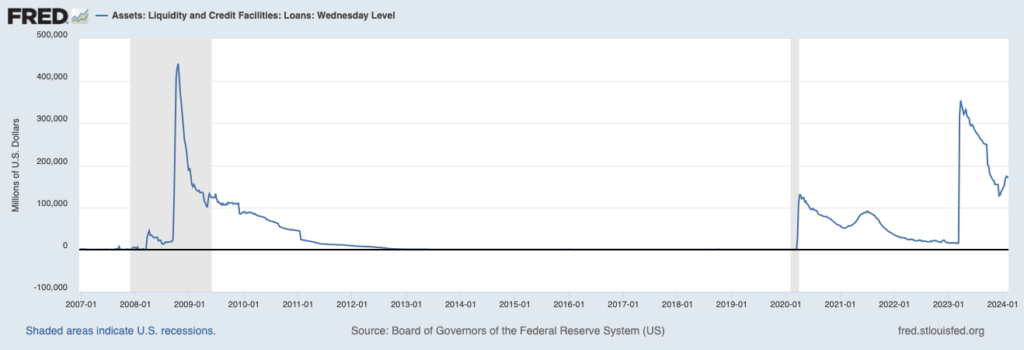

That staved off a crisis from hitting. But the Fed then began a back-door bailout of the banks through which it gave them additional access to credit and liquidity. And not just a little… but a LOT.

The below chart shows this facility’s use running back to 2005. And no, you’re not imagining things: the Fed’s use of this facility to juice the financial system in 2023 was greater than what it did during the pandemic, and almost as great as that used during the Great Financial Crisis of 2008! In fact, today it’s higher than it was during the absolute depth of the pandemic in March 2020!

We’re now almost a year out from the regional banking issues and the Fed continues using this facility to the tune of over $200 BILLION. So again, the Fed is juicing the financial system for political purposes. It’s abhorrent and corrupt, but it’s reality. And well prepared investors can take steps to insure they profit from what’s happening with the right investments.