Last week, I started speaking of reported “real GDP” verses “real, real GDP” and of reported actual inflation v. “actual, actual inflation.” Today, Wolf Richter has begun to do the same thing with Biden’s Treasury reports of how much they will have to issue in new debt (Treasuries), saying,

The actual actual increase in marketable Treasury securities is far higher than the “actual” increase announced in the “Marketable Borrowing Estimates.”

This seems to be the new norm for Bidenomics where we have to distinguish between what is “really dead” and what is “really most sincerely dead.”

Maybe we should call it “hidenomics.”

Black Swan author Nassim Nicholas Taleb said the US deficit is swelling to a point that it would take a miracle to reverse the damage.

“So long as you have Congress keep extending the debt limit and doing deals because they’re afraid of the consequences of doing the right thing, that’s the political structure of the political system, eventually you’re going to have a debt spiral,” he said Monday night at an event for Universa Investments, the hedge fund firm he advises. “And a debt spiral is like a death spiral.”

Yet, the Treasury says it can reduce its issuances of new debt in a time when Biden has his foot to the floor on economic stimulus. It’s hard to square that up. Yellen’s department claims it will be due to more tax revenue.

Taleb described an …

economy that’s far more vulnerable to shocks than in prior years.

The reason for that, he said, is that the world is far more interconnected due to globalization, with issues in one region able to ricochet around the world.

Perhaps this somehow explains why stock and bond markets have thought the Fed must certainly be deciding to cut rates during what market analysts keep calling a really strong economy. It is an interesting question: Why would the Fed cut rates at all in a “strong economy?”

Perhaps the economy is not “really most sincerely strong.” It is popping right along at the moment based on fake “real” GDP created from fake actual inflation, but vulnerable to falling backward into its grave at any moment due to numerous structural problems … like, for example that interconnected global economy that is lot more disconnected these days.

This month, former Treasury Secretary Robert Rubin said the world’s biggest economy is in a “terrible place” with regard to its federal deficits, while BlackRock Inc. Vice Chairman Philipp Hildebrand has warned that any default could imperil the dollar as a global currency.

So, “strong,” but ready to fall apart in a moment’s notice? JPMorgan, for example, warns that the beautiful flying white swan of a stock market could be about to darken its plumage quickly:

The dominance of the 10 biggest stocks in US equity markets is increasingly drawing similarities with the dot-com bubble, raising the risk of a selloff, according to JPMorgan Chase & Co. quantitative strategists….

While parallels between the current environment and the speculative frenzy surrounding internet stocks at the turn of the century are frequently dismissed, the strategists’ analysis shows the circumstances “are far more similar than one may think…. The key takeaway is that extremely concentrated markets present a clear and present risk to equity markets in 2024…. Drawdowns in the top 10 could pull equity markets down with them.”

OK, so the stock market’s ready to do a swan dive as soon as a critical Jenga piece is pulled.

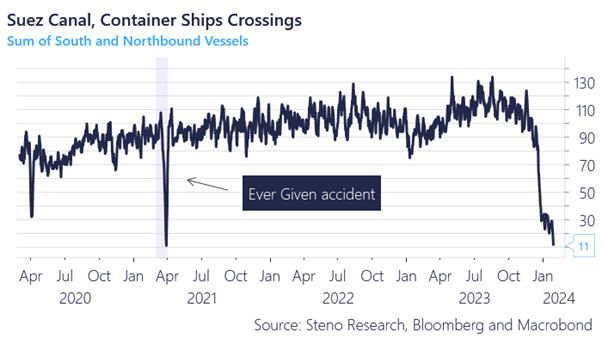

The interconnected, global economy is, of course already on the rocks due to some Houthis who aren’t such a hoot anymore. Shipping is foundering at virtually zero ships through the Suez Canal now and shows no signs of changing soon:

The Ever Given blockage was a quick-fix spike down. This one is a plunge into a lingering trend.

Whereas the Ever Given blockage was a relatively brief interruption, the remarkably effective Houthi blockade of the Red Sea has no easy resolution and continues despite several belated and incremental retaliatory strikes. It is very likely part of a broad strategy by Iran and its regional proxies (Hamas, Hezbollah, militias in Iraq, etc…) to draw the US into another amorphous Middle-Eastern conflict that diverts resources away from Ukraine or Taiwan, where Iran’s allies Russia and China are waging major power wars of expansion (or soon will be).

Iran likely sees itself at the pinnacle of its regional power and so close to a nuclear weapon that the distinction is irrelevant, and likely sees the US as politically divided, financially constrained, and lacking the focus needed to win/support any conflict, let alone a trans-national one in the Middle East.

I must say that the Hidenomics of the Biden administration seem about as real as his border enforcement where he tries to talk a tough game while doing less than any president on record, blaming lack of funding while he spends record amounts of money elsewhere, piling up record debts by helping rich people build shiny new factories for themselves on the government dime. (Fascist economics.)

It is not as though the Republican’ts really want to stop immigration either. I’m sure the really agitated ones do, but they are agitated because the rest of the Repubs have talked a tough game while doing nothing for years, too. If the uniparty Demicans really wanted to really, most sincerely end illegal immigration, they’d tighten the laws to simply start putting the people who hire illegal immigrants in jail upon their second offense.

I’m pretty sure, if you started locking up those who employ illegal aliens, they would reform their hiring policies after their first thirty days in jail and probably after their first warning and stop hiring aliens that don’t have the right paperwork. It would be up to the government to make the right paperwork difficult to counterfeit. The jobs would dry up overnight, and it would never take a wall to keep illegal aliens back. The jobless illegals would take themselves back so they could find a job somewhere.

But we don’t do that because …

Gotta keep that peasant class maintained, and how better to do that in a “free world” than to, first, make a certain group of free people illegal so they have to keep their heads down, making them unable to protest working conditions or benefits or wages and then turn a blind eye to letting them freely cross the border? By this means, we’ve kept the wages in agriculture suppressed for about a hundred years so, of course, no American wants to take those jobs. We’ve also kept wages deeply suppressed in many other industries by making millions of people illegal and then letting them in the country to work anyway. Occasionally, we arrest a few to make it look like we’re trying.

Can anyone seriously doubt (I mean, really most sincerely doubt) that both parties are essentially Fascist economically, using government power to enrich the richest and suppress the middle class, while maintaining a solid peasant pool to pick their tomatoes?