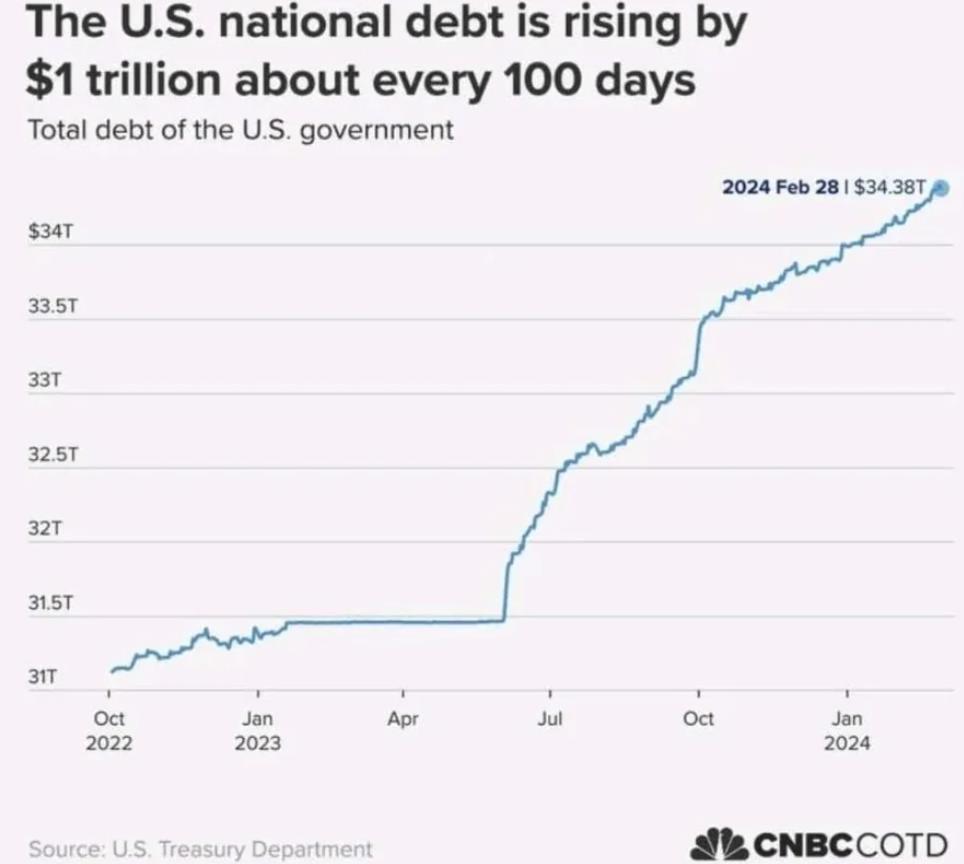

As the United States hurtles into an era of unprecedented national debt, concerns are mounting over the implications of the staggering financial trajectory. The national debt, surging by an alarming $1 trillion approximately every 100 days, paints a concerning picture for the nation’s fiscal health. Starting the year at $34 trillion, the debt catapulted to $34.5 trillion by the close of February, reflecting an alarming addition of $470 billion in just two months.

This surge in national debt, occurring even during a period marked as a “non-recession,” raises serious questions about the sustainability of the government’s spending practices. If the current spending spree persists, projections indicate a potential eye-watering increase of $2.8 trillion in the national debt. However, the ominous reality is that this projection does not encompass the additional strain often imposed during economic recessions, which typically leads to further federal deficits.

The looming debt bubble poses a critical challenge, as people may not fully grasp the implications of debt growing at a rate exceeding 10% annually. Such growth demands a corresponding inflation rate to monetize the escalating debt, and the consequences of this interplay between debt and inflation could be profound for the economy.

Despite seemingly positive economic indicators, such as a reported 3.2% increase in the economy’s fourth-quarter output, a closer look reveals a complex reality. Government spending, totaling a substantial $560 billion in the same period, raises concerns about the sustainability of the current fiscal path.

Sources:

The nation’s debt now stands at nearly $34.4 trillion, as of Wednesday.

Since June, the last two $1 trillion jumps occurred in about 100 days. (92 days and 95 days for the most recent $2 trillion in debt added)

Within a few years it will grow at $1 trillion every 30 days. Will… pic.twitter.com/lF9dniB4Iv

— Wall Street Silver (@WallStreetSilv) March 2, 2024

"US national debt rising $1tn every 100 days ($32tn to $33tn took 92 days, $33tn to $34tn 106 days, $34tn to $35tn will take 95 days)" – BofA t.co/Z4JF11EbEW

— zerohedge (@zerohedge) March 2, 2024

Recessions typically lead to more federal deficit

But the debt bubble cannot go on forever… pic.twitter.com/SbUgxtAyjc

— Game of Trades (@GameofTrades_) March 2, 2024