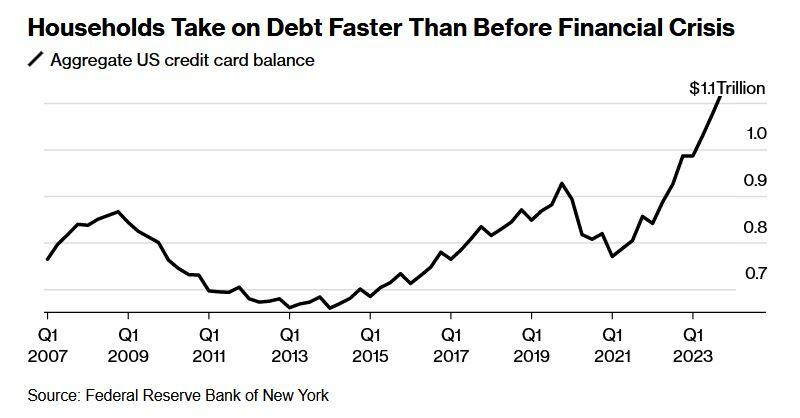

Households have too much debt, thanks to trying to cope with Bidenomics and Bidenflation.

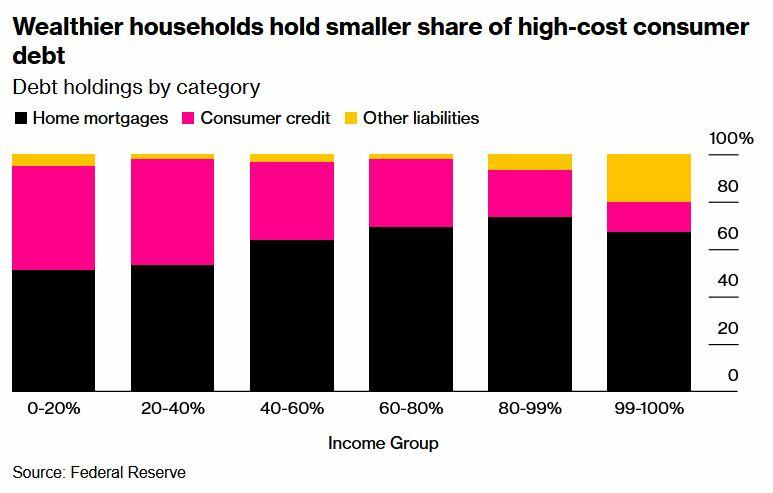

And much of the debt burden falls on the middle class.

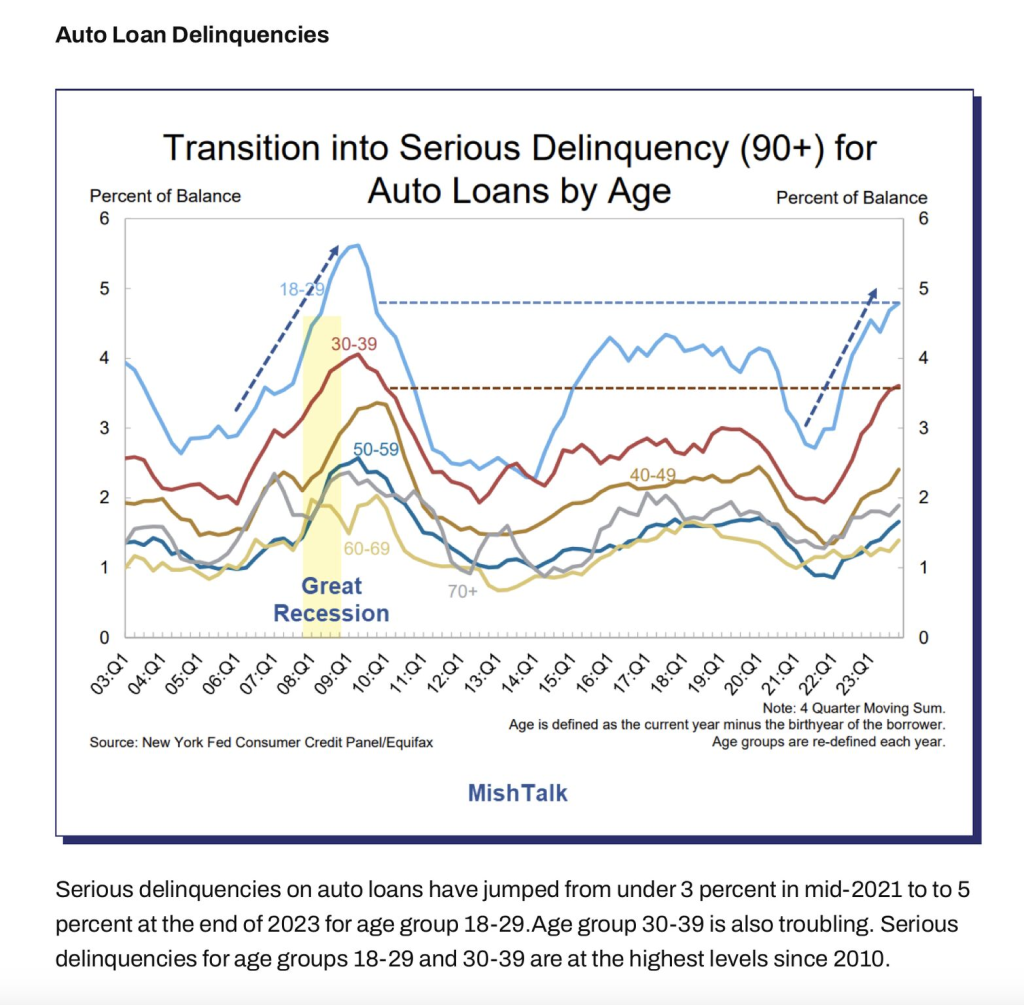

Serious auto delinquencies are on the rise.

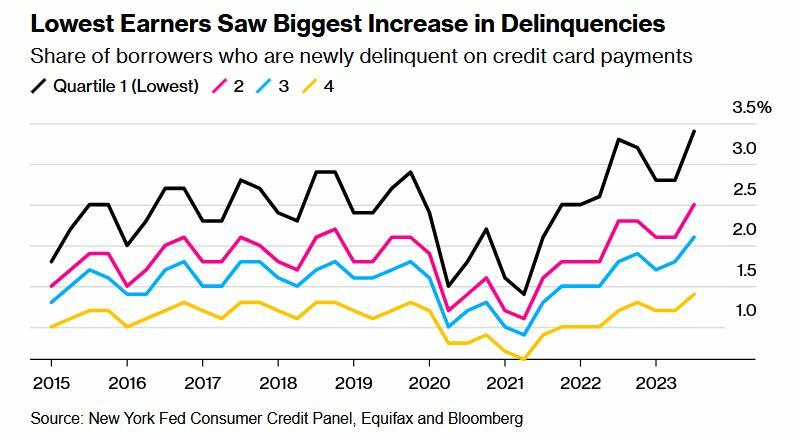

And lowest earners saw the biggest increase in credit card delinquenices.

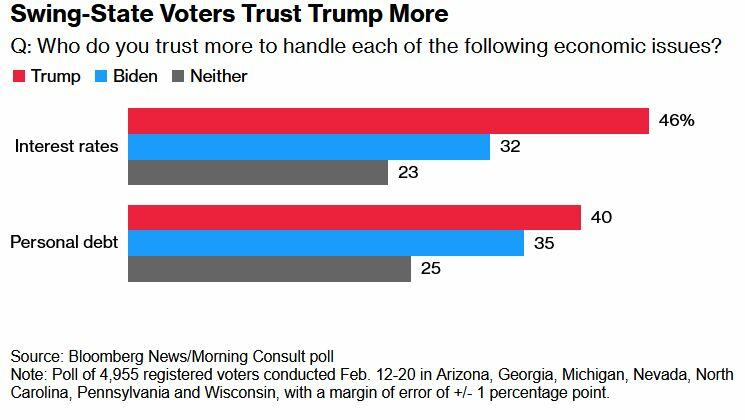

And who voters prefer as of today? Trump on interest rates and personal debt.

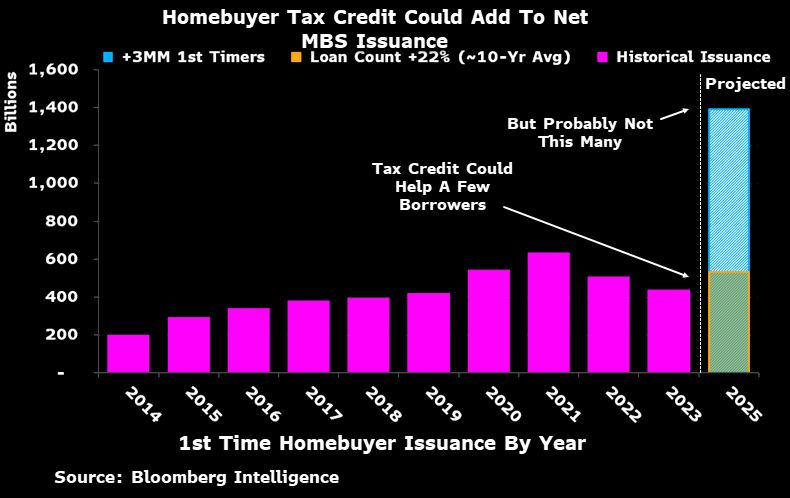

In addition to the absurd idea of removing title searches for government-guaranteed mortgages (now rely on attorney opinions), the Biden Administration is considering a homebuyer tax credit … that likely won’t help much.

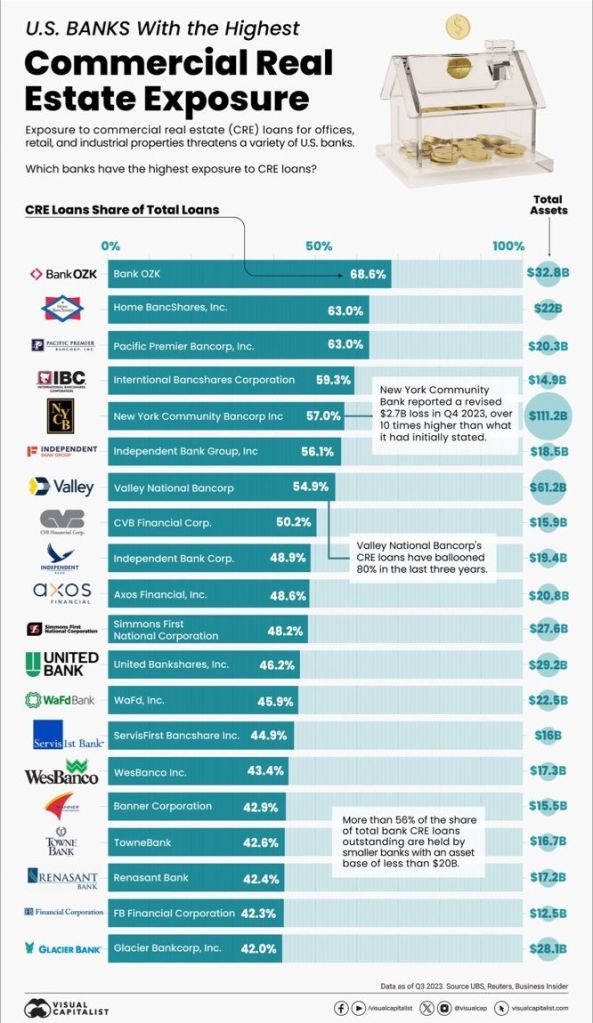

And if you want to see which lenders have the largest concentrations of commercial real estate (CRE) loans, BankOZK takes the cake as the most concentrated lender.

The more the Biden Administration tries to “help” make housing more affordable, paradoxically makes housing even MORE unaffordable.