by GreggraffinCI

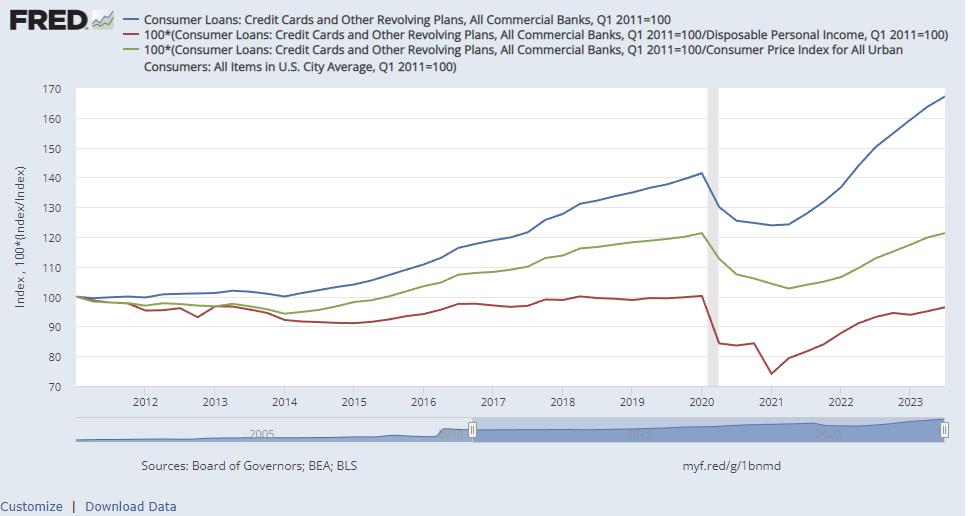

From a disposable income standpoint the Fed data agrees that the consumer is better able to service their debt now than they ever have. That peaked during the stimmie checks but that gap has closed from -25% to -5% in the past 2 years. Which is not a promising trend.

Adjusting for inflation the debt is equal to pre Covid but 20% higher than post GFC.

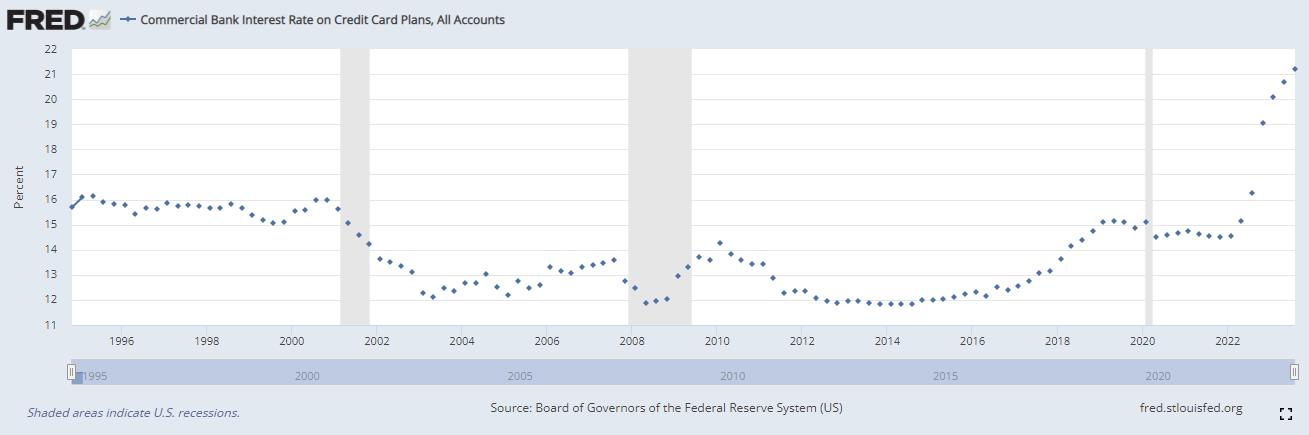

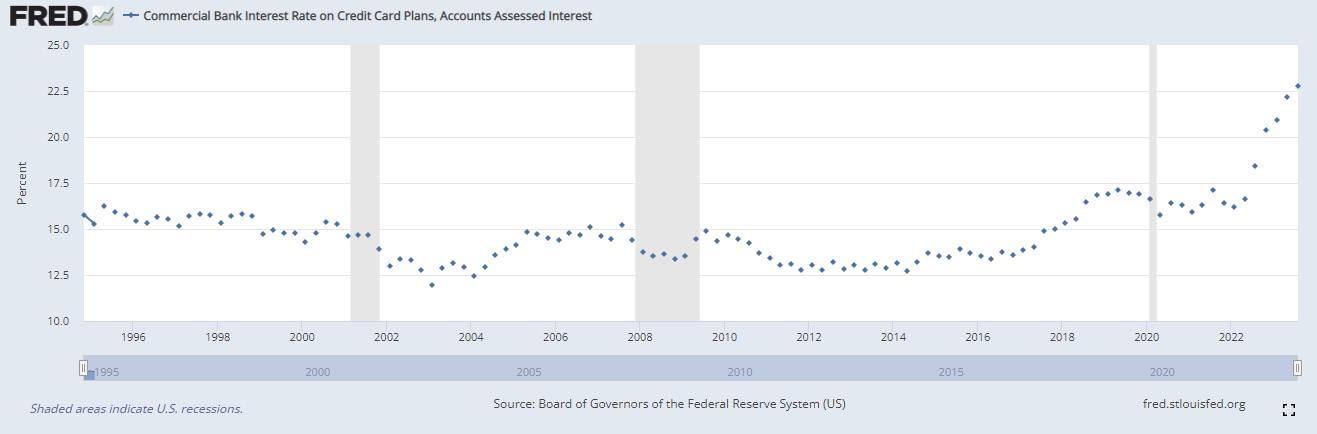

But interest rates ( fred.stlouisfed.org/series/TERMCBCCALLNS ) and the number of people paying interest on their credit cards ( fred.stlouisfed.org/series/TERMCBCCINTNS ) are both at all time highs.

Again, pointing to exponential growth in credit card debt and the increasing likelihood of delinquencies and defaults.

Check the section talking about Resolving Consumer Credit, March 2010 www.federalreserve.gov/releases/g19/revisions/

No matter how you look at it, we are screwed. The economy is propped up on debt, inflation has stayed strong due to debt, but someone will need to pay for these delinquencies.

Every debt cycle ends the same. Each one lasts 10 years or so and ends in a recession. Debt increases as people refinance their debt to better service it until banks start tightening credit and then people are unable to refinance their debt and go into default.

The beginning of COVID should have been the end of the debt cycle starting post GFC. But they turned on the printer and kicked the recession can down the road by devaluing the dollar. But now that the Fed has hiked rates and stopped purchasing MBS (QT) the money supply (M2) is actually decreasing for the first time on record.

As liquidity is being drained from the financial system banks are tightening their lending standards and are decreasing the amount of credit available to individuals while their debts are increasing.

When these individuals reach their credit limit and are unable to buy food on their cc they will have to start making a choice between paying their car loan, mortgage, cc bills and putting food on the table.

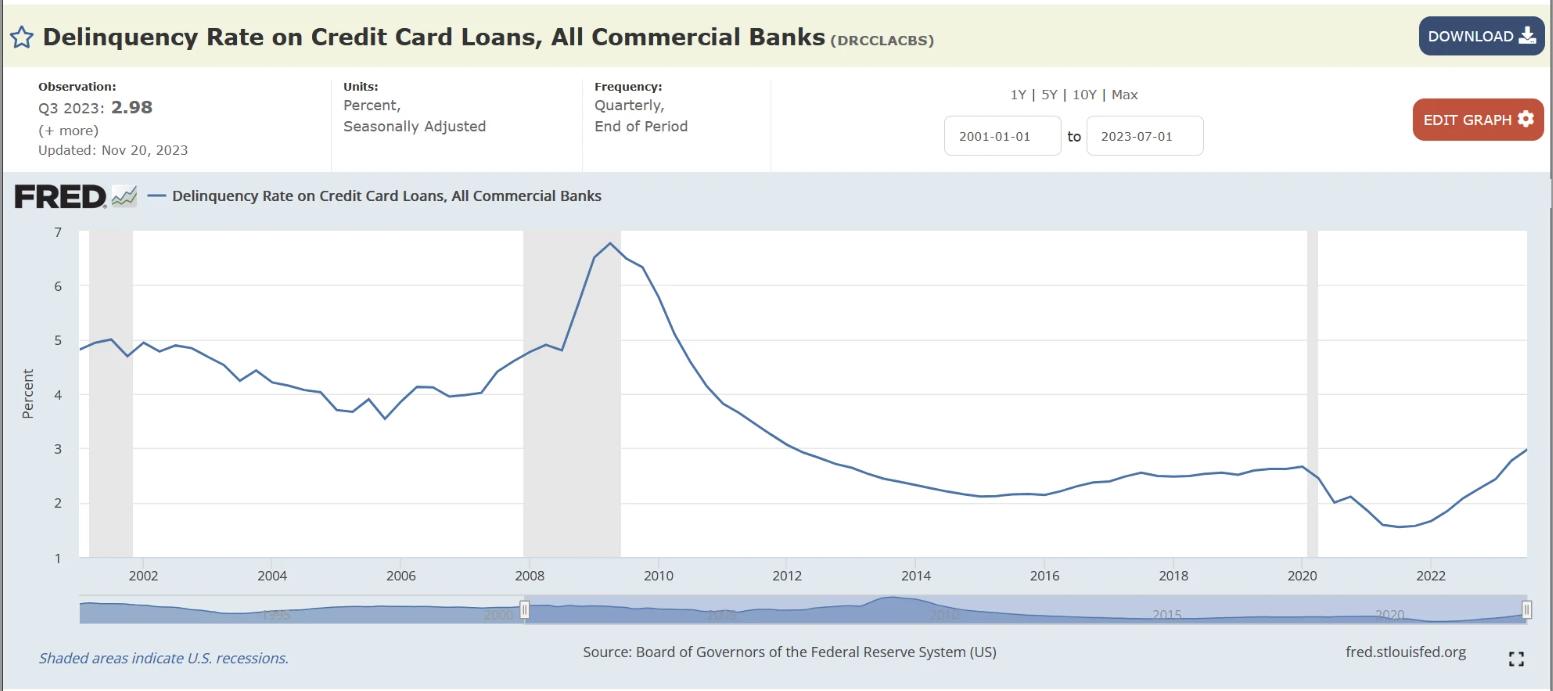

Which is why we are seeing delinquencies spike now. In the last 5 years rent has almost doubled, groceries have increased 50%, cc interest rates are up 50%, etc. The COL has increased beyond real income and people are reaching their credit limits and defaulting on debt obligations.

401k hardship withdrawals spike 300%

– Fidelity Investments pic.twitter.com/89RRZsPdsk

— Darth Powell 🦈🇺🇲🇺🇦🇵🇱🇫🇮 (@GRomePow) December 4, 2023