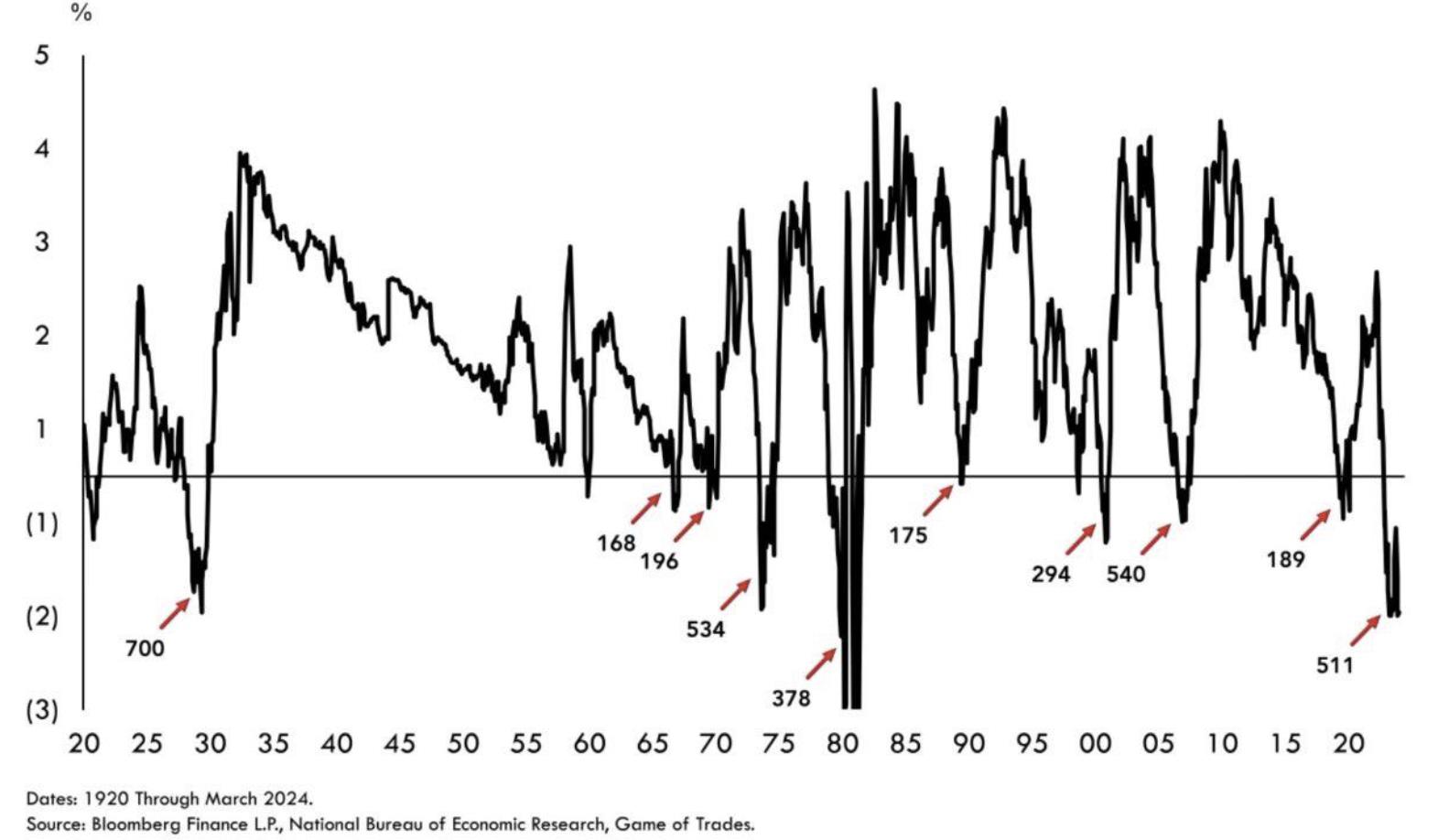

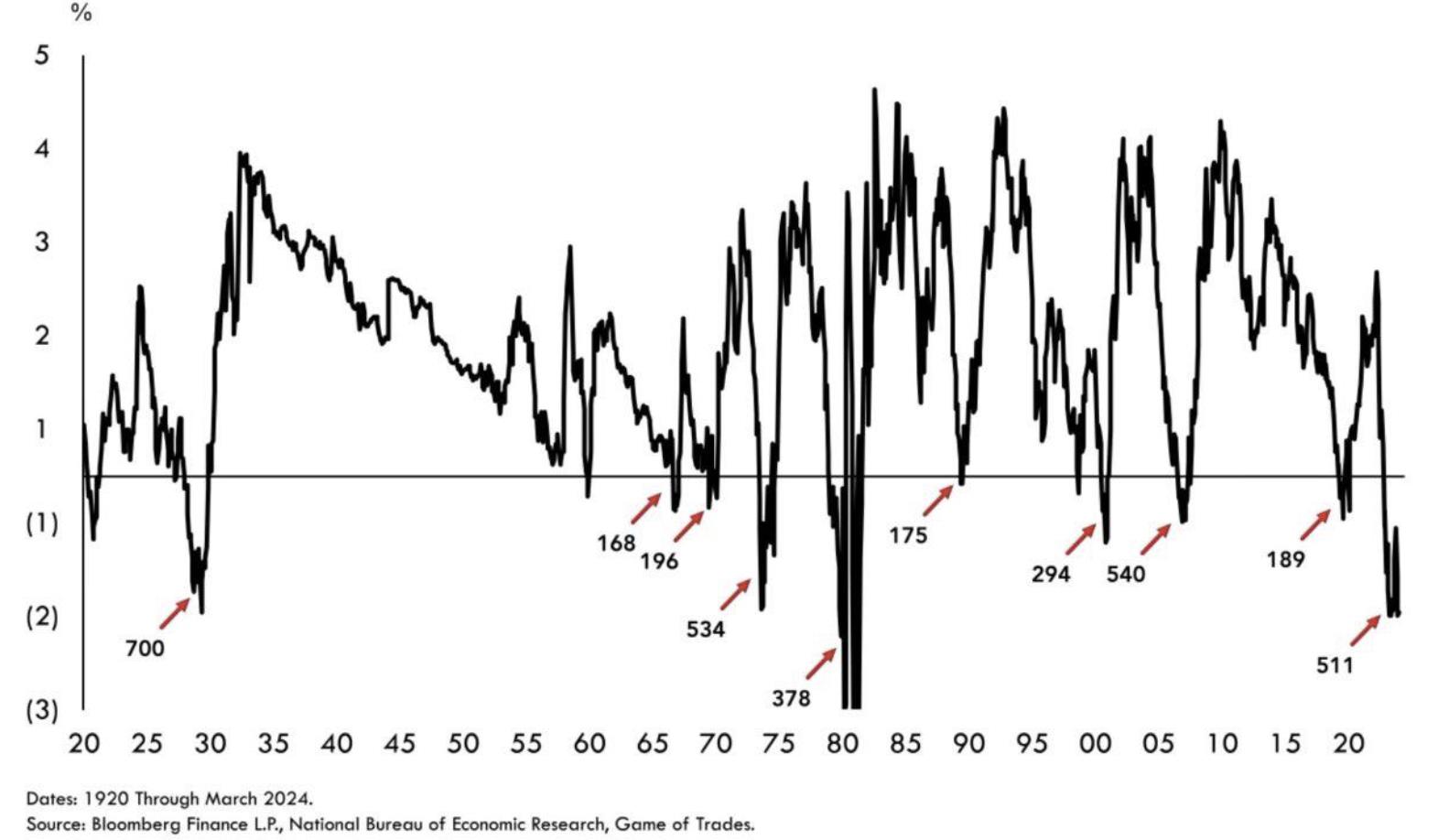

The reversion will be interesting. Either the long-term bills rate increases sharply, or the short yields plunge. I wonder which will happen?

h/t Ok_Significance_4008

Views:

234

Your go-to source for current events

The reversion will be interesting. Either the long-term bills rate increases sharply, or the short yields plunge. I wonder which will happen?

h/t Ok_Significance_4008