Back then, technology companies were the sole sector propping up the market from mid-1999 to March 2000. Today’s scenario bears a striking resemblance to those times.

It’s remarkable how today’s lack of leadership in the stock market echoes the period preceding the tech bust.

As shown in the chart below, technology companies were the only sector holding up the market from mid-1999 to March 2000.

Those times were strikingly similar to today. pic.twitter.com/fxzwMTEAKO

— Otavio (Tavi) Costa (@TaviCosta) November 10, 2023

“Visionary” Founders Are Starting To Crumble, Entire Sectors Will Be Next

Zero Hedge also noted that personal savings is near all time lows with credit card interest rates at record highs. So, these charts all just mean that things are heading in the direction that I have predicted, but we haven’t hit that point of no return yet, or in my parlance, the “oh shit” moment, that is going to spook the rest of the market and eventually cause a self-fulfilling prophecy of relentless selling as a result of both deleveraging and panic.

And while I haven’t really been specific about what the catalyst could be that pushes us over the line, certainly a couple of new examples presented themselves this week.

First, there was the bankruptcy of WeWork. The company had previously made its founder a billionaire and was once valued at $47 billion.

It sought Chapter 11 bankruptcy protection in New Jersey, announcing deals with most of its secured creditors and plans to cut leases that aren’t central to its operations. The proceedings will affect its U.S. and Canadian locations. In its preliminary filing, the office-sharing firm disclosed liabilities of approximately $18.65 billion, with assets tallying $15.06 billion.

This is one of the most stunning reversals and evaporation of “value” (pause for laughter) in recent memory. How much of a soft landing can our economy be in for when one solitary company has been responsible for the evaporation of nearly $50 billion in perceived valuation over the course of just a couple of years?

But wait, there’s more. WeWork’s bankruptcy isn’t just a spectacle of how our public markets have become completely euphoric and have blessed business models that never should have been conceived to begin with, but it’s also a commentary on one specific industry: commercial real estate.

For those unfamiliar with why commercial real estate might be the next bubble to pop, you can read this linked primer. But to put it simply, coming out of COVID, commercial office space is in less demand than it has ever been at any time over the last half-century. This demand evaporated at a point where the consumer, corporations, municipalities, and just about everybody tied to interest rates are starting to tighten their belts.

It also comes on the tail end of one of the largest “everything bubbles” in our country’s history. As a reminder, going into COVID, everybody thought valuations of everything from housing to the stock market were astronomical. Commercial real estate was part and parcel with this euphoric bubble. Now, it could be one of the pins that pricks this “everything bubble” to a point where it finally catches the attention of everybody else.

Little signs have been bubbling under the surface. Have you noticed? For example, how about the American Dream Mall in New Jersey that features an indoor theme park, water park, ski slope, & high-end luxury stores? (Euphoria, anyone?) It experienced a fourfold increase in losses in 2022, reaching $245 million. Challenges in drawing tenants and customers, coupled with a significant debt burden, have troubled the “America, fuck yeah!” of malls, which started 2023 by missing debt payments.

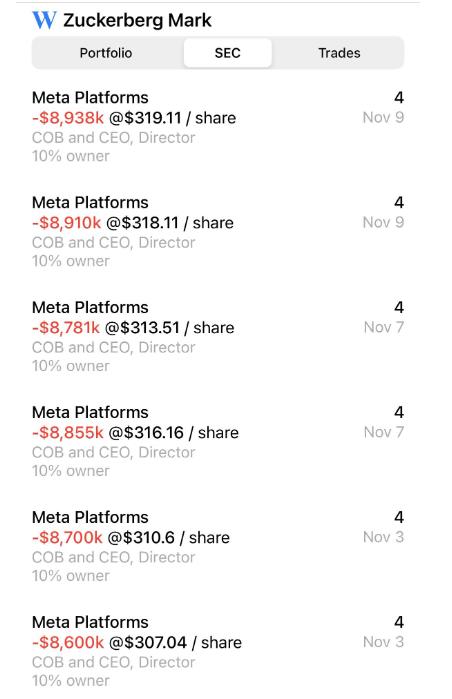

After 2 year pause Mark Zuckerberg started selling Meta stocks in November. Sold $52.8 mln by the moment. Bearish sign.

h/t ChampionshipUsed9855