Something is cracking.

Stocks can no longer handle higher yields. The breaking point is coming up quickly if rates continue higher.

— Michael Lebowitz, CFA (@michaellebowitz) October 19, 2023

US yield curve keeps bear-steepening w/2s/10y spread jumps to -19bps after Fed's Powell has given 'green light' for higher long-term bond yields w/10y near 5%. pic.twitter.com/IQTeDstpKp

— Holger Zschaepitz (@Schuldensuehner) October 20, 2023

This is unbelievable

In just 2 years, the mortgage payment on new houses has doubled

2021: Monthly payment was around $1500

2023: Monthly payment is around $3000

To make things worse, the consumer has been rapidly weakening and has just run out of excess savings from the… pic.twitter.com/aCcOnfV6fS

— Game of Trades (@GameofTrades_) October 19, 2023

Powell today: "Yields are doing our job".

3 out of the last 3 times bank lending was this tight, the economy went into recession:https://t.co/b2lHzic2s3

3 out of 3 times the Fed was easing:

In summary:

The Fed is not doing their job. pic.twitter.com/tv33rZUwxP

— Mac10 (@SuburbanDrone) October 19, 2023

Schiff: Bond yields are headed much higher fast!

It's clear that bond investors have lost confidence in the #Fed's ability to bring #inflation back down to 2%. That's why 30-year Treasuries are now yielding 5.1%. But 5.1% is not nearly high enough to offset 30 years of high inflation. So bond yields are headed much higher fast!

— Peter Schiff (@PeterSchiff) October 19, 2023

Powell Looks to a November Pause, Warns of More Rate Hikes if Needed

Federal Reserve Chair, Jerome Powell, raised alarms about lingering high inflation, suggesting that rate hikes are still on the table if the economy doesn’t cool down. His recent remarks hinted at an unstable economic outlook, where the current measures might be insufficient to curb escalating inflation. Despite some suggestions of maintaining steady rates in the near future, the persistent threat of “meaningful tightening” looms large. Powell’s warnings, coupled with concerns voiced by other Fed officials, paint a bleak picture of potential economic pitfalls ahead.

Excess savings in the United States continue to drop sharply.

Total excess savings are now down from $2.3 trillion at their peak to just ~$200 billion.

The bottom 80% of households current have ZERO excess savings remaining.

This is, by far, one of the fastest ever declines in… pic.twitter.com/gwIlQz7fOl

— The Kobeissi Letter (@KobeissiLetter) October 19, 2023

I would rather have the other side win right now.

Because then they will own the "soft landing". pic.twitter.com/oKMnQl8USw

— Mac10 (@SuburbanDrone) October 19, 2023

Market Still Isn’t Listening pic.twitter.com/g1nS9v7POz

— Barchart (@Barchart) October 19, 2023

John Rubino: Crash Alert: That “Spinning Out Of Control” Feeling

Let’s start with regional and local banks, where two bad things are happening. First, their “safe” bond portfolios have tanked in the past year, embedding paper losses of around $700 billion industry-wide. These losses will produce a steady drumbeat of bad earnings reports in the coming year. But in the meantime, as interest rates rise, money market funds are able to pay higher rates than bank accounts, causing depositors to move their savings to greener pastures. To keep their remaining depositors, banks are having to pay way up, which is eating their profits:

Zions Shares Decline as Deposit, Borrowing Costs Soar Tenfold

(Bloomberg) — Zions Bancorp slumped after the regional lender reported soaring deposit costs, as elevated interest rates force banks to pay up for customer funds.

The Salt Lake City-based lender said the cost of total deposits and borrowings soared tenfold in the third quarter to 2.1%, compared with 0.22% for the same period a year earlier. That was up 22 basis points from the second quarter alone as reciprocal deposits, which are often more costly than those gathered through typical checking accounts, doubled to $6 billion.

Zions also said non-performing assets rose 45% to $68 million, largely because of two suburban office commercial real estate loans totaling $46 million.

Credit card debt now exceeds $1 trillion in the US and a growing number of people are putting day-to-day expenses on plastic. The inevitable result is a spike in card defaults and plunging credit card company profits. Next comes a dramatic contraction in credit card balances as recession forces the newly poor to stop spending.

Discover Profit Tumbles 33% as Credit-Card Write-Offs Mount

(Bloomberg) — Discover Financial Services posted a 33% drop in third-quarter profit as write-offs climbed and the firm set aside more money to cover future loan losses.

Net income totaled $683 million, or $2.59 a share, the Riverwoods, Illinois-based credit-card lender said Wednesday in a statement. That missed the $3.17 average estimate of analysts surveyed by Bloomberg.

Discover, led by interim Chief Executive Officer John Owen, said net write-offs rose to 3.52% from 1.71% in last year’s third quarter. Provision for credit losses more than doubled to $1.7 billion.

Tesla disappoints twice

Tesla’s October 18 earnings report missed pretty much across the board:

- Tesla 3Q Adj EPS 66c, Est. 74c

- Tesla 3Q Rev. $23.4B (Up 9% Y/Y), Est. $24.06B

- Tesla 3Q Gross Margin 17.9%, Est. 18%

Free cash flow was $848 million, only a third of the expected $2.59 billion.

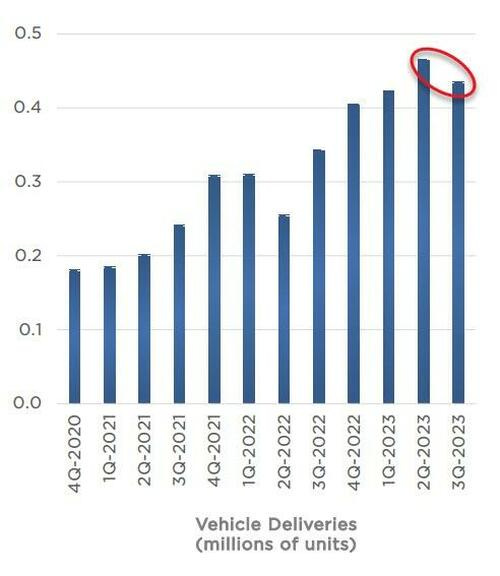

Deliveries rose YoY but declined sequentially: