Just as the tides of war appeared to turn on Ukraine when US support waned, so the inferno of inflation has turned back on the Fed as the whole economy subtly shifts to a hotter inflationary mode.

It’s hard to believe, but according to today’s news the stock market must have finally been schooled in inflation and what it will take for the Fed to beat it because the market is now “more hawkish than the Fed as June rate-cut odds fade.” It wasn’t long ago I was one of very few voices saying hopes for June rate cuts were likely overly ambitious. Now the market is pricing beyond June.

As Zero Hedge, long a rate-cut believer, put it,

The official narrative is breaking bad.

and, in terms of the economy,

‘Soft’ survey data is literally collapsing as ‘hard’ data improves gradually…

“Gradually and falteringly,” I might add:

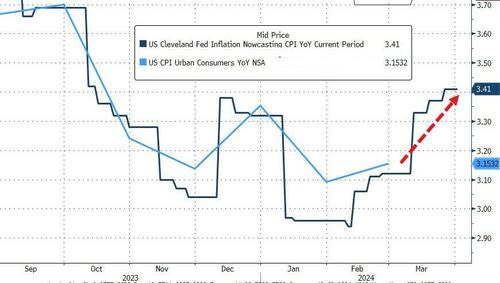

…and more worryingly, inflation signals are flashing red once again…

So, everything is unfolding as I’ve expected: Inflation is back to rising month after month and now year-on-year; Fed forecasts for how current inflation will come in when reported are also pushing back up; the stock market is falling hard as it gets used to the idea that Fed rate cuts are getting further and further away than it recently thought when it had them pegged for March.

The market is now once again pricing in less [fewer] rate-cuts than The Fed’s latest plot for this year and is notably less dovish through 2026…

“I thought it would be hard for the market to challenge the Fed on the hawkish side, but apparently it is willing to do so, in the face of some evidence….”

As the market is now pricing in just 65bps of rate-cuts in 2024 (remember in January it was pricing in almost 170bps of cuts)…

“While June is not off the table, market conviction for a first Fed cut by then is fading,” ING strategists including Benjamin Schroeder wrote in a note.

And, while the Fed is slower to grasp the inflationary evidence than the euphoric market has been until April hit, even Fed officials are now saying, “Not so fast.”

Fed officials still expects rate cuts this year, but not anytime soon.

Cleveland Federal Reserve President Loretta Mester said Tuesday she still expects interest rate cuts this year, but ruled out the next policy meeting in May.

Mester also indicated that the long-run path is higher than policymakers had previously thought. Her fellow policymaker, San Francisco Fed President Mary Daly, also said Tuesday she expects cuts this year but not until there’s more convincing evidence that inflation has been subdued….

Additional inflation readings will provide clues as to whether some higher-than-expected data points this year either were temporary blips or a sign that the progress on inflation “is stalling out,” she added.

“I do not expect I will have enough information by the time of the FOMC’s next meeting to make that determination,” Mester said.

Meanwhile, something else I’ve been warning about looks wrong at the Fed. The overnight funding rate (think “repo” loans) is suddenly climbing very high—something it is prone to do at the end of the year when lots of banks have trouble clearing their manifold year-end transactions, so need to borrow overnight funds from other banks; but it is not something that is supposed to be happening now:

I noted when it happened at the start of December, and in such a pronounced way at the end of December, that those two December events could be foreshocks of another coming repo crisis because we saw the same thing as a tip-off to the Repocalypse in 2019, which was why I forecast a late-year repo crisis in January of 2019 that arrived right on time in September.

The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Translate: “repo (repurchase agreement) loans.”

It’s possible the Fed may have a new battle on its hands:

Not only did stocks fall fairly hard today as they grasped, even if only momentarily, the truth about their fantasy Fed rate cuts, but Treasuries fell with yields rising back to where they were in November (which is where we particularly see how the market is now betting on Fed rate cuts).

One thing adding to those fears was that the US economy showed additional signs of a little expansion. Even worse in terms of the Fed being able to cut interest rates, the labor market, once gain, held tight. New job openings failed to settle any at all, even as new hires actually rose. The US Manufacturing Purchasing Managers’ Index also rose, giving a slight upturn in the manufacturing outlook. Prior to this subtle move, it had been essentially flatlining for months. Commodities rose in price, too. All creating some misgivings as to whether the incendiary forces of inflation are all turning back on the Fed.

Crude oil prices, another major inflation factor that I’ve said to keep an eye on and likely expect more trouble from, also rose with West Texas Intermediate breaking the $85/bbl barrier today. The war in Ukraine isn’t helping oil pressures on inflation, as Ukraine just hit Russia’s third-largest oil refinery, much to the anger of President Biden who hopes fuel prices will stay down in this election year, knowing full well what rising energy prices will do to all other prices this year.

As a result of all this good news for the economy that is bad news for the Fed’s inflation battle and for stocks, the S&P saw its worst day in about a month. The disconnect that occurred between rate-cut fantasies that lifted stocks and rate-cut reality could become a harsh reconnect for stocks.

Meanwhile the commercial real-estate mess just keeps getting worse. Moody’s notes office vacancy rates have hit their highest point in history. So, hang on: the year is starting to get rough.