Oh Susie QT. The Fed loves you. And The Fed has put a spell on the economy.

Where do we sit today? Bank credit growth has been negative for the last 26 weeks. As M2 Money growth has stalled.

What will The Fed do?

While the FOMC may start the discussions around tapering QT as soon as at this meeting, tapering itself is still a ways off, and the actual end of QT will come early next year.

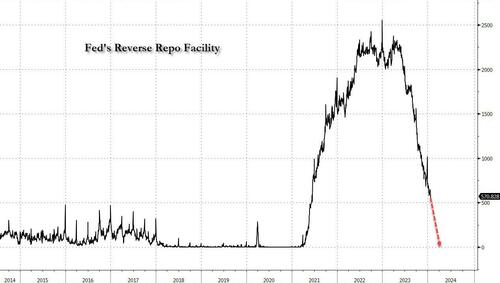

In January and May 2022, the FOMC published the principles and then the plan for QT. The fact of a taper this year is not news. More recent communication from Fed officials (for example from President Logan and Governor Waller) reinforced a preference for the reverse repo (RRP) facility to be drawn down to zero, and we infer that getting the RRP near zero will be the starting point for the taper.

Historically, the FOMC has taken at least two meetings to finalize these types of plan, and the December minutes stressed a desire to give the market lots of advance notice. As a baseline, we think the FOMC announces the parameters for the QT taper at its May meeting and enacts that taper in June, by cutting the runoff of Treasury securities in half. Because the Fed’s RRP facility has been declining rapidly, that timing could shift earlier by a month or so.

The change to shedding $30 billion per month in Treasuries would slow the pace of runoff materially, but there is clearly a chance that the subsequent pace is even slower. President Logan pointed out that running off the balance sheet slowly could ultimately allow the Fed to shrink the balance sheet even more while mitigating the risk of money market disruptions. A June taper would be consistent with our house view on the path of the RRP facility, which we expect to stand at approximately $225 billion at the end of May and be depleted by August.

We anticipate that reserves will remain broadly around current levels until RRP is depleted. But from there, we think reserves will ultimately fall to roughly $3.2 trillion, around $300 billion below current levels, and the FOMC will call off QT in early 2025. That view on the ending level of reserves reflects our outlook on the SOFR – IORB (Secured Overnight Funding Rate – Interest on Reserve Balances) spread turning positive, indicating the end of abundant reserves.

For broader markets, however, our strategy team does not expect the tapering and end of QT to be a significant event. Our rates strategists think the phenomenon is mostly in the price and, if anything, front-end swap spreads may have already overreacted to the news of an early taper. With a limited effect on rates, and the tapering and end of QT largely anticipated, our MBS and credit strategists similarly see few if any implications. Of course, some market narrative is focused on QT’s effects on the banking sector. While the intuitive notion that QT must destroy deposits is widespread, we have highlighted the data which show in fact that deposits have edged up, not down, in recent months as QT has progressed. Banks can always choose to bid for wholesale deposits, so instead of focusing on the quantity of “money” and how that changes, a better question is how bank funding costs are evolving.

So, the next step is for the Fed to shift from “talking about talking about tapering QT” to actually talking about tapering QT. Only after that step will we start to look for the end of QT, which the Fed will determine with an eye on money market conditions. In particular, the Fed is looking at whether SOFR is trading below the rate the Fed pays on reserves, in which case it will likely judge conditions to be accommodative, or above the rate the Fed pays on reserves, in which case the Fed’s calculus will change and the discussions about the end of QT will pick up steam.

The Fed’s balance sheet remains greatly expanded despite the increase in The Fed’s target rate. Nothing has been the same since the banking crisis of 2008-2009. And Covid in 2020.