by DesmondMilesDant

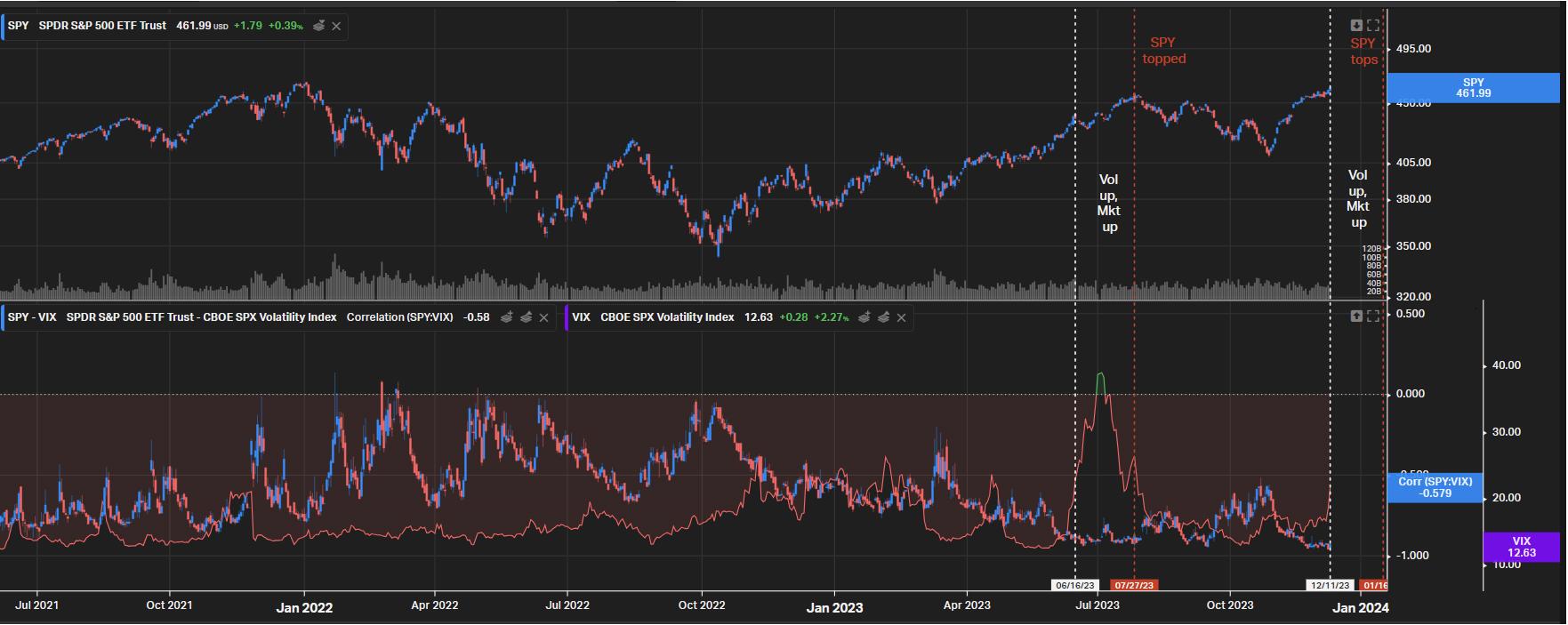

The SPY ETF is currently trading at $461.99, up 1.79% on the day. The SPY has been in an uptrend recently, with the stock topping out at $495.00 just yesterday. Today’s market volume for the SPY is up significantly from recent levels, with 120B shares traded so far today compared to an average of 80B over the past month. Meanwhile, the VIX volatility index is currently sitting at 12.63, up 0.28% on the day and relatively flat compared to recent levels

Basically what is happening is your coming CPI is euphoric 2.9/3% but your next CPI ( Dec CPI releases Jan) is higher to around 3.3% due to 0.4% mom because of holiday season. Macro bears are building shorts in b/w Dec OPEX – Jan OPEX. So now these strong flows are taking mkt higher ( on the back of seasonality flows ) hitting their SL taking their liquidity and then will probably dump on them around Jan such that Jan OPEX – March OPEX is when puts shall print. A lot of that will depend on Treasury QRA that releases Jan 31 where Janet Yellen will ramp up the issuance again.

Imagine by march 10yr at 6% (if Yellen ramps up issuance) Powell be like I’ve had enough we are doing YCC while Japan is exiting YCC.

Wall Street is wondering whether the financial system is running too low on liquidity

U.S. short-term financing markets saw a three-day spike in interest rates at month-end. That’s left Wall Street wondering whether the financial system is running out of cash.

A spike in repurchase agreements, or repo, where investors borrow against Treasury and other collateral, can be a sign that cash is getting scarce. Markets need a minimum amount of liquidity to function smoothly.

Eventually, the elevated level of the interest rate, called the Treasury GCF Repo Index , between Nov. 30 and Dec. 4 was explained by factors other than cash scarcity, such as month’s end book-closing by banks and hedge fund trading, interviews with more than half a dozen bank executives and market participants show.

The S&P 500 just hit a new 52 week high despite:

1. Magnificent 7 down $200 billion in market cap today

2. Treasury yields hitting their highest in 10 days

3. Fed rate CUT expectations pushed back to May 2024

4. Oil prices rising back above $70 per barrel

5. Bitcoin falling…

— The Kobeissi Letter (@KobeissiLetter) December 11, 2023

Views: 157