In a surprising development, CITIGROUP has decided to exit the distressed-debt trading business, sending shockwaves through financial markets. This move is not just a business decision; it’s a signal that the economy might be entering a distressed cycle.

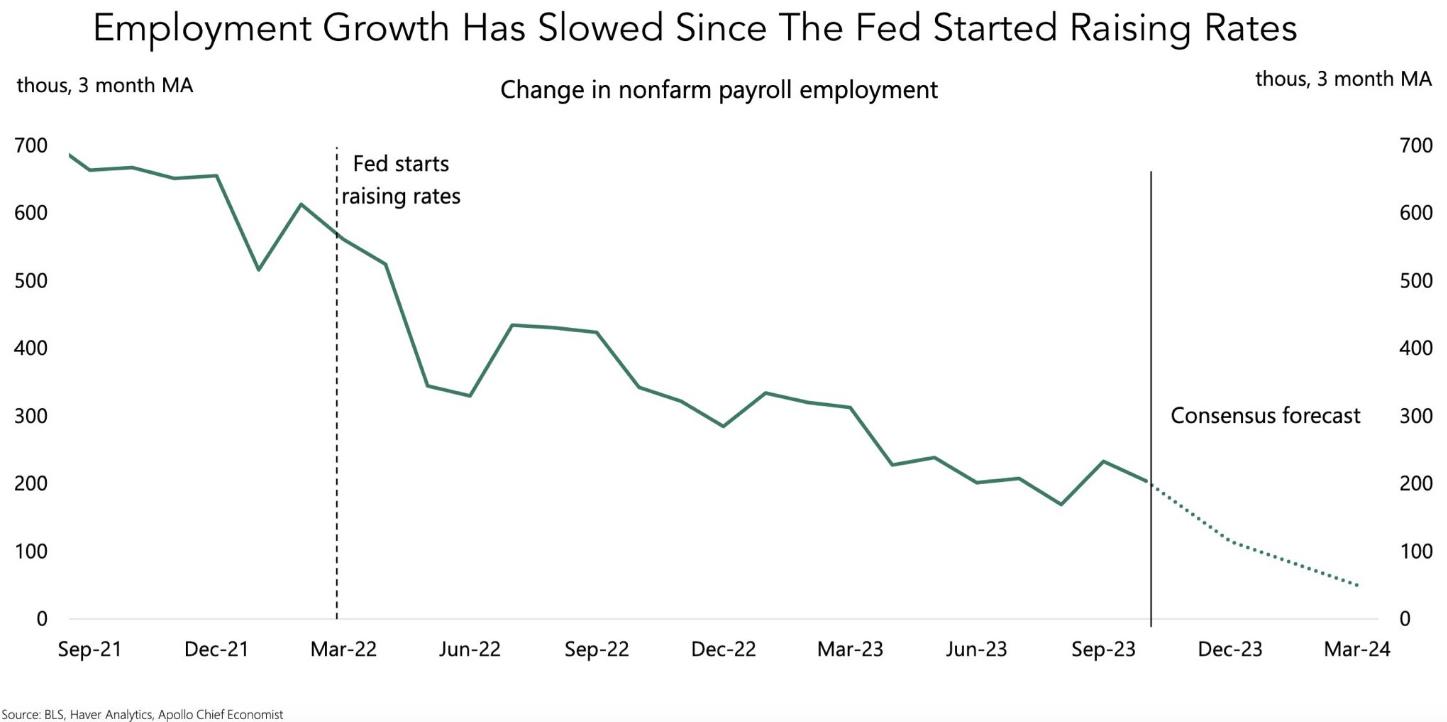

Several indicators point to an economic downturn on the horizon. Employment growth has slowed, and the 30-Year Treasury Yield recently closed below 4% for the first time since July. Investors seem to be following an old playbook of buying stocks before an anticipated rate-cutting cycle. However, history warns us that this strategy often ends in tears, as rate cuts are typically a precursor to an impending recession.

A particularly concerning signal is the 2-year US Treasury yield falling below the fed funds rate, suggesting that the Federal Reserve’s monetary policy is currently restrictive. This could potentially lead to a slowdown in economic growth. The rising number of delinquent commercial real-estate loans, reaching the highest level in a decade, adds to the growing list of red flags.

Wells Fargo and other banks are grappling with delinquent loans, but they are hesitant to put borrowers in default or declare actual losses. This reluctance reflects the fragility of the financial system, as institutions navigate the challenges of a potentially distressed market.

Renowned economist Harry Dent believes that the post-GFC (Global Financial Crisis) recovery has been entirely artificial and predicts a significant crash in 2024, which could be unprecedented in our lifetimes.

Adding to the gloom, a recent report indicates that 40% of small and medium-sized businesses (SMBs) in the U.S. were unable to pay their rent in full and on time in October. This extends a record-high 40% rent delinquency rate from September, challenging the narrative of a robust economic recovery.

While the federal government reported a surge in economic growth, Alignable’s October Rent Report reveals a starkly different reality for SMBs. Only 12% of small business owners reported significant growth, highlighting the growing disparity between official economic indicators and the struggles faced by businesses on the ground.

As these signals converge, it becomes increasingly clear that the economy is at a critical juncture. Investors, businesses, and policymakers should heed these warnings and brace themselves for potential challenges in the coming months.

CITIGROUP IS SAID TO EXIT DISTRESSED-DEBT TRADING BUSINESS

*talk about a signal, wow.

— Lawrence McDonald (@Convertbond) December 20, 2023

Just in case someone was wondering why Powell signaled rate cuts for next year pic.twitter.com/oQpDquIYy6

— Michael A. Arouet (@MichaelAArouet) December 21, 2023

Never foget, this time it’s different

Chart @IanRHarnett pic.twitter.com/WBHKyhspyt

— Michael A. Arouet (@MichaelAArouet) December 21, 2023

S&P 500 $SPX suffers biggest decline since September pic.twitter.com/ClyFVWlam0

— Win Smart, CFA (@WinfieldSmart) December 20, 2023

So the market is running an old playbook of buying stocks before a rate cutting cycle.

It almost always ends in tears once the rate cuts start because it indicates the economy is about to hit a recession.

You’re essentially picking up dimes in front of a steamroller. pic.twitter.com/QVczfnQ1fa

— QE Infinity (@StealthQE4) December 21, 2023

🇺🇸 Fed

The 2-year US Treasury yield below the fed funds rate indicates that the Fed's monetary policy is currently restrictive, which could potentially lead to a slowdown in economic growth

👉 t.co/GTvcwBGDHhh/t @MorganStanley #bonds #yields #fedfunds #Fed #rates pic.twitter.com/OP1ThCUya5

— ISABELNET (@ISABELNET_SA) December 21, 2023

Delinquent commercial real-estate loans hit highest level in a decade –

Wells Fargo and other banks not putting borrowers in default or declaring actual losses on their growing pile of delinquent loans.

*below excerpt from an article published in the Financial Times pic.twitter.com/5zwHAuSYH5

— Puru Saxena (@saxena_puru) December 20, 2023

40% Of SMBs Still Can’t Pay Their Rent, Extending High Delinquency From September Into October

‘No one is throwing good money after bad.’ Why 2024 looks like trouble for commercial real estate.

A “distressed cycle” refers to a phase in the economic cycle characterized by financial stress, downturns, and challenges, often leading to economic hardship and declining business conditions. During a distressed cycle, various indicators such as increased unemployment, declining asset values, rising debt levels, and financial instability may signal economic difficulties. It is a period when businesses and individuals may face financial distress, and policymakers may implement measures to address economic challenges and stimulate recovery. Distressed cycles are typically associated with recessions or economic contractions.