The song “Running on Empty” by Jackson Browne comes to mind when analyzing the state of American banking, especially regional banks.

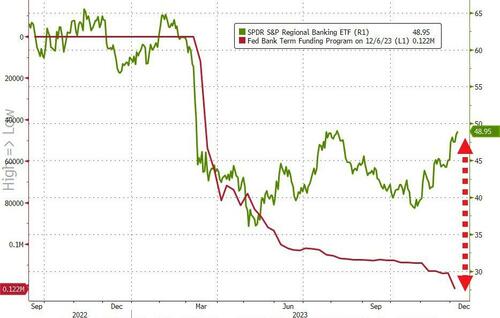

Yesterday we found out that inflows to money-market funds continue to be huge ($290BN in six weeks), and more importantly, regional banks’ usage of The Fed’s BTFP bailout facility surged to a new record high (even as regional banks surged…

Source: Bloomberg

And so, with that shitshow in mind, we await the glorious manipulation of The Fed’s bank deposits data to reinforce that equity confidence.

On a seasonally-adjusted basis, banks saw a $53.7BN deposit outflow…

Source: Bloomberg

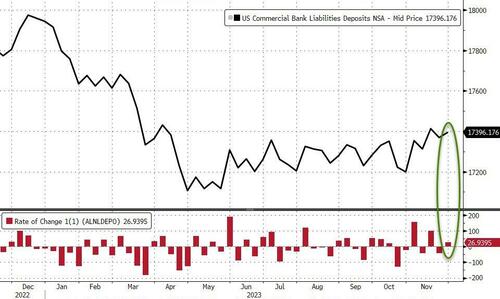

However, on a non-seasonally-adjusted basis, deposits rose by $27BN…

Source: Bloomberg

And even with the outflows (SA), the divergence between soaring money-market funds and bank deposits continues to widen…

Source: Bloomberg

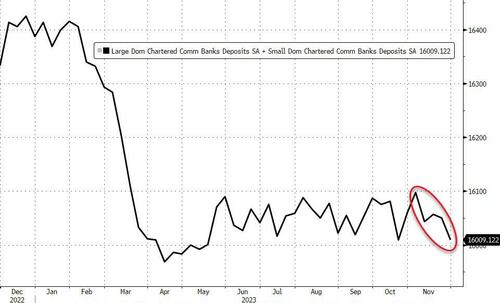

Excluding foreign bank deposits, domestic banks saw the third week of the last four of deposit outflows (-$40.6BN SA) with Large banks -$35BN (SA) and Small banks losing $5.7BN (SA). On an NSA basis, domestic banks saw inflows of $36.5BN last week with Large banks adding $32BN and Small banks adding $4BN…

Source: Bloomberg

That adds up to $88BN (SA) of deposit outflows in the last four weeks (bank to its lowest total since May…

Source: Bloomberg

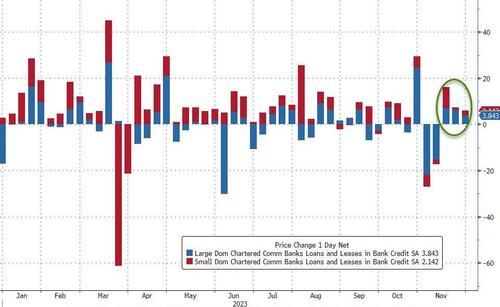

And on the other side of the ledger, despite deposits declining SA, loan volumes increased (SA) for the third week in a row with Small banks adding $2.1BN and Large banks adding $3.8BN…

Source: Bloomberg

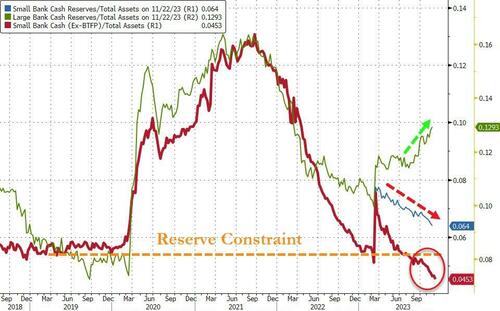

Finally, the key warning sign continues to trend ominously lower (Small Banks’ reserve constraint), supported above the critical level by The Fed’s emergency funds (for now)…

Source: Bloomberg

As the red line shows, without The Fed’s help, the crisis is back (and large bank cash needs a home – green line – like picking up a small bank from the FDIC).

Mortgage rates, despite coming down recently, are still up 151% under Biden. And home prices are up 33.2%. So much for affordable housing for those renting.

So, “Running on Empty” applies to middle class and their ability to afford housing.