by ValenTom

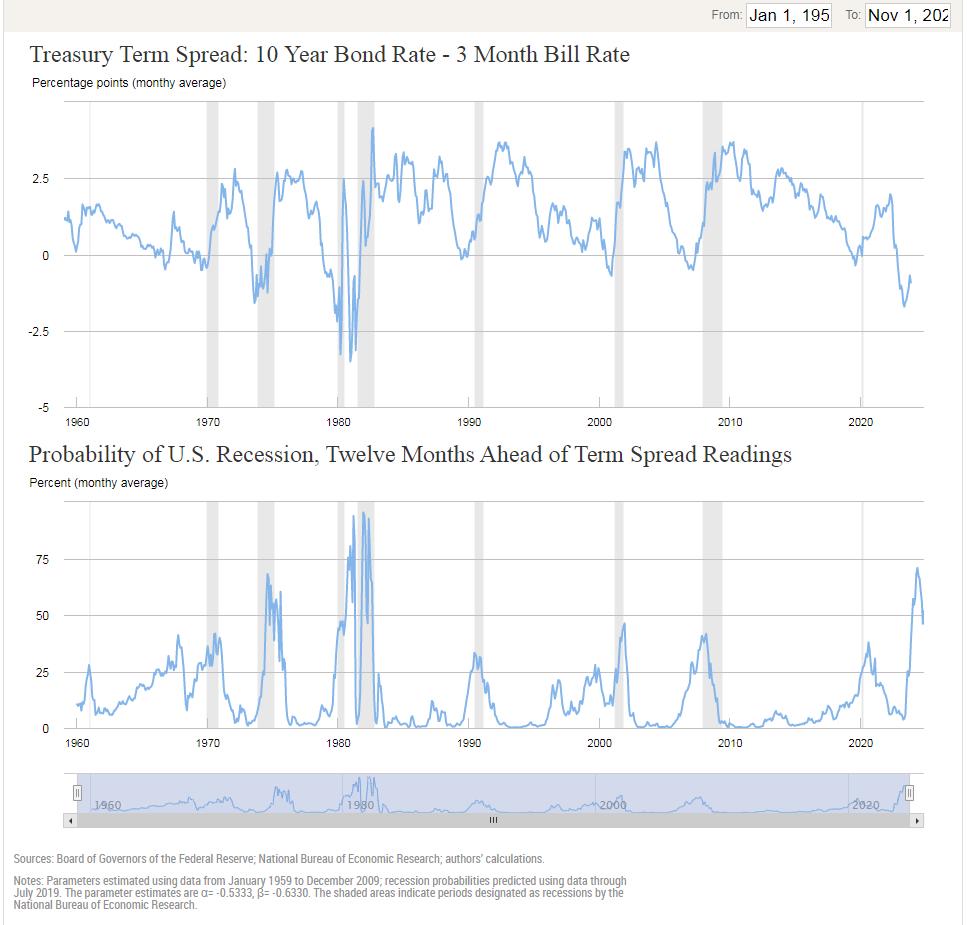

https://www.newyorkfed.org/research/capital_markets/ycfaq#/interactive

Rate cuts doesn’t mean the printer is coming back for fun. It means the printer is coming back due to need.

The broad economy is in a very high risk position right now and the global economy is deteriorating by the day. The market and economy are not reflecting the reality of the other.

-M2 money supply is decreasing at it’s fastest pace since the Depression

-China is in deflation

-Canada is on the verge of recession

-Germany is on the verge of recession

-CEO’s are beginning to discuss deflation potential

-The consumer is being hammered with student loans and high interest borrowing

-Freight is in recession

-California is in recession

-Available jobs are decreasing much quicker than expected

Rate cuts are great if people have jobs and money. Rate cuts are a lot less fun when millions of people are losing their jobs, the consumer halts spending, corporate earnings tank, housing supply rises due to the need to sell due to job losses and outpaces buyer demand and starts decreasing everyone’s sweet Covid equity gains.

Pay your debts, shore up the emergency funds, and hope you didn’t overpay for your house and car in the past few years!

The fed’s recession risk model shows us JUST NOW entering the high risk time period it is predicting. From now until November 2024 there are coin toss odds of a recession AT MINIMUM.

A Recession Is Right Around the Corner – The Economy Is Running on Fumes: Professor Steve Hanke

The Federal Reserve’s disregard for the quantity theory of money, which connects monetary supply with economic outcomes, seems flawed. The rapid increase in the money supply (M2) since 2020 led to high inflation, and its current sharp decline suggests an impending recession and possible deflation by 2025. This situation highlights concerns about the Fed’s current monetary strategy and the risk of economic downturns.

US Bankruptcy Tsunami May Stretch Into 2024

The U.S. retail sector faces a bleak outlook, potentially leading bankruptcies into next year due to persistent inflation and high interest rates. 2023 has already seen 591 corporate bankruptcies, the most since 2020, largely driven by the end of ultra-low interest rates. Many companies are teetering on the brink, unable to manage their debts in this challenging economic climate.

Do you believe the Fed would planning 3 cuts in 2024 if they didn't think there is a recession coming?

They know an election is coming and Trump will win if there is a recession in the months before the election. This is a pre-emptive plan to try to get the good times rolling… pic.twitter.com/7ugeouRwSf

— Wall Street Silver (@WallStreetSilv) December 14, 2023

Fed admits the American people are right: the economy sucks, with 70% of Americans under age 44 now stressed about their economic future.

An entire generation is missing their prime building years, stitching together Doordash gigs instead of building a foundation to buy a… pic.twitter.com/X2KthcbGxg

— Peter St Onge, Ph.D. (@profstonge) December 14, 2023