by Chris Black

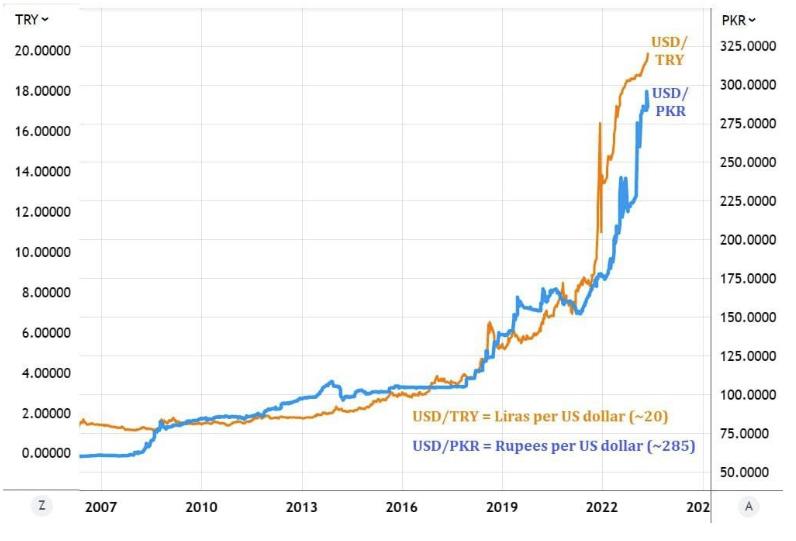

Pakistan is a disaster waiting to happen, but Turkey deserves its own post for being geopolitically unique.

Turkey’s central bank net reserve balance tumbled negative last week.

A black market for currency has formed, reminiscent of Venezuela.

Could see a scenario à la Venezuela since 2016 in Turkey over the next several years, where Lira goes to 30 (30 Lira per US dollar; it’s at 20.7 this morning) and then 300 when the hyperinflation kicks in.

Without a change in Turkey’s interest rate policy (Erdogan is committed to keeping (https://www.reuters.com/markets/asia/turkeys-erdogan-says-will-keep-cutting-rates-long-i-am-power-2022-10-08) rates far below inflation), baseline is USD/TRY to 26-28 by the end of the year.

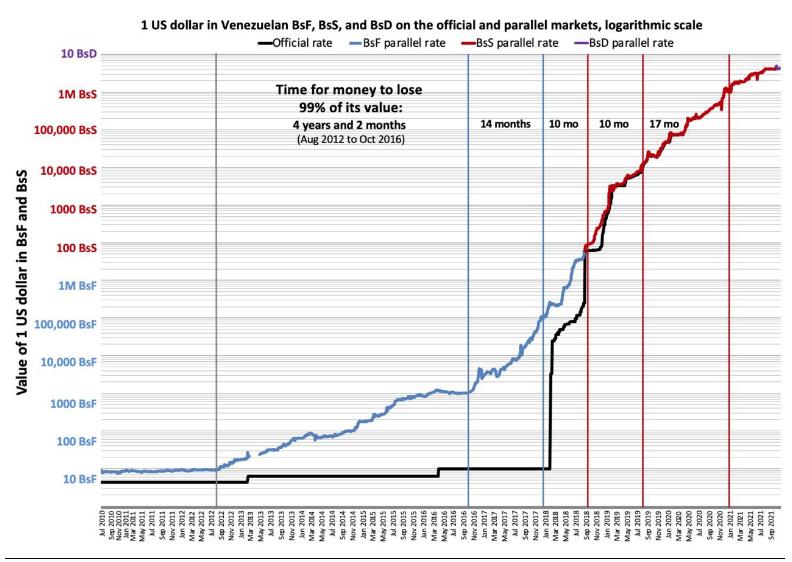

Second chart shows by comparison how hyperinflation evolved in Venezuela.

Each vertical line (after the first) is a 99% devaluation in bolivars.

With rupees, expect 350+ PKR per USD if China lets them default in June .

China may take-on Pakistan’s dollar-denominated IMF debt obligations, preventing default.

Erdogan has a way of punishing short sellers with face-ripping, central bank-sponsored short squeezes (at least two examples from 2021).

If you are positioned, have enough margin to survive.