by Chris Black

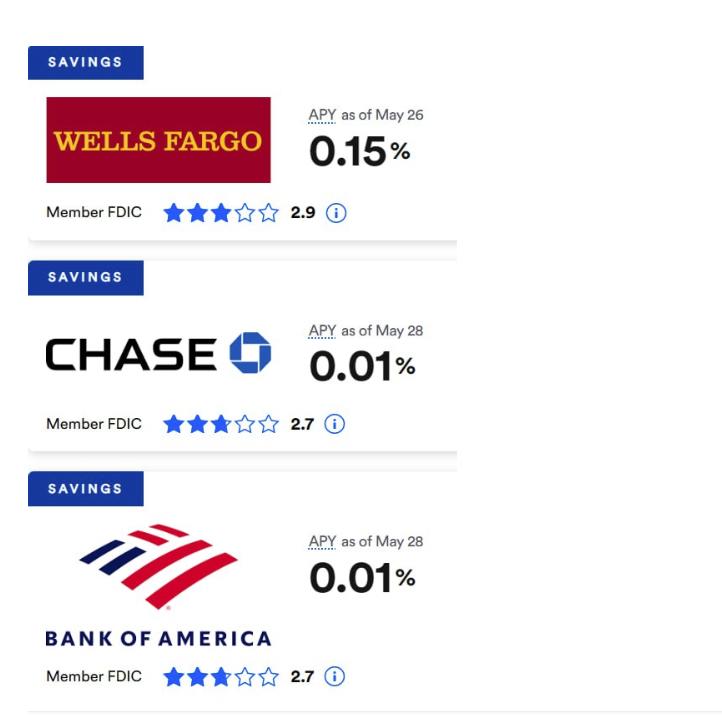

Goldman Sachs’ online bank, Marcus, is the only large bank offering a competitive interest rate (www.bankrate.com/banking/money-market/rates/) on its savings accounts – over 400 times that being offered by JPMorgan Chase, Bank of America, and even Citibank.

Marcus (www.marcus.com/us/en/savings/high-yield-savings) is the online banking platform offered by Goldman Sachs Bank USA – which is the FDIC-insured unit of Goldman Sachs that holds trillions of dollars in derivatives, including the kind of credit derivatives that unraveled & threatened the global economy in 2008.

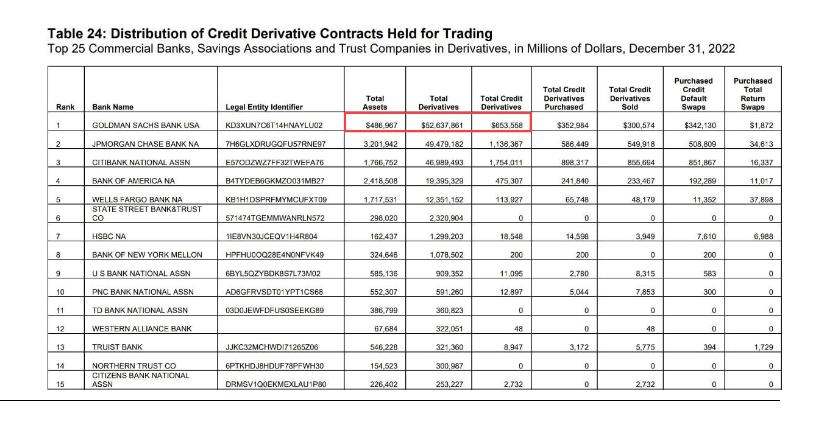

According to table 24 of the most recent report from the Office of the Comptroller of the Currency (OCC) (www.occ.gov/publications-and-resources/publications/quarterly-report-on-bank-trading-and-derivatives-activities/files/pub-derivatives-quarterly-qtr4-2022.pdf), Goldman Sachs Bank USA holds $487B in assets and $5,264B in derivatives – topping the list.

Credit derivatives tally up to $653B, which even exceeds the bank’s assets.

We suspect that the competitive rates are meant to attract deposits for the purpose of shoring up enough capital to meet margin requirements on its derivatives.

Not a good sign at all if true.

The April Stanford study suggests they’re the third largest insolvent bank.