No, I didn’t say the “deficit” was now a trillion dollars a year. I said the INTEREST alone on the US debt is now a trillion dollars per year! We used to worry that someday the deficit would hit a trillion dollars a year, and then it did that and worse for each of the last four years. Well, now the official estimate for this year’s interest — yes just the interest on the debt each year — is a trillion dollars. We’re snowed in!

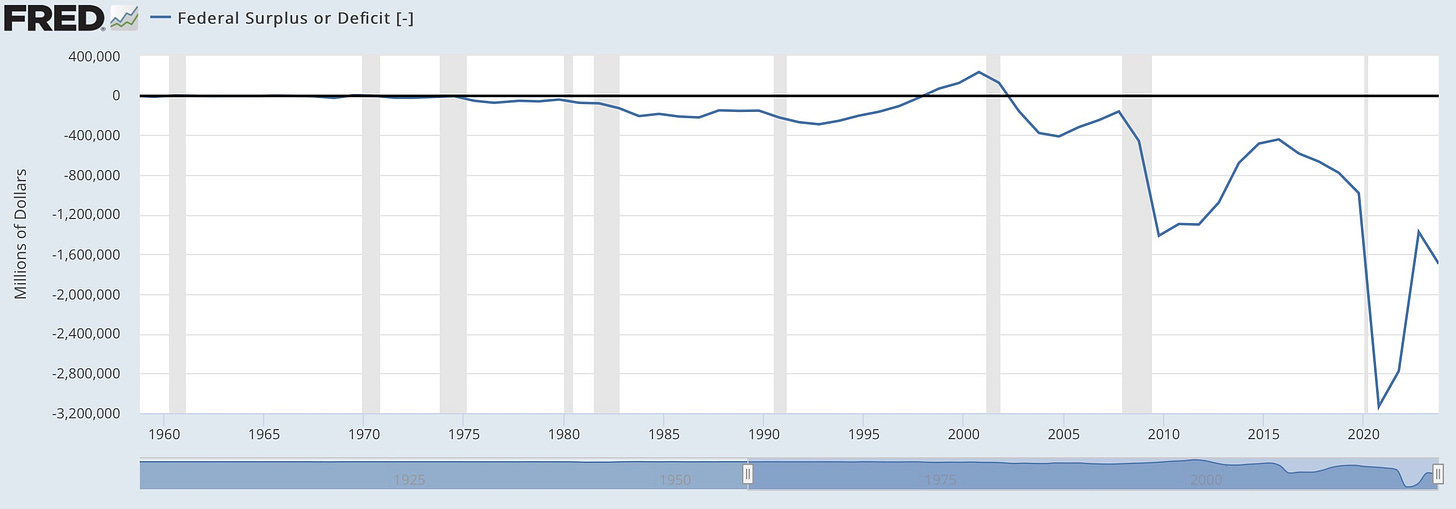

Do want to see a picture of the world’s worst avalanche? Here it is:

Almost nothing for decades, then crashing down the mountainside at a horrifying rate. You’d think someone looking out the chalet window and seeing that coming down on us might sound an alarm!

Last year’s interest payments on the sum total of all those annual deficits that we call the “US debt” closed at well over $800-billion after decades of piling up those deficits, but with Biden pushing trillion-dollar deficits year-after-year, the interest is growing so quickly it is now projected at over a trillion for this year.

Of course, the biggest contributor to the huge increase in interest payouts has been the combination of soaring interest rates on all new issuances on Treasuries to fund current spending PLUS the number of old Treasuries that mature each month and have to be refinanced at the new interest rates to pay for all the past spending we never paid for.

It’s piling up quickly now, Folks

Like a winter snowstorm where you wake up in the morning and find the whole front door has been buried in a snowdrift or an avalanche! So, if you thought the Big Bond Bust is over because Treasuries took a big turn down in yields over the past week, think again about the storm that is coming and the snow cornices that are already cracking far above us and all around:

Only a few more trips around the clock and we’re going to be coming up to that government funding decision again. Congress is not likely to make headway on its stalemate, so that COULD trigger another credit downgrade now that this high interest is screaming in our face, making credit agencies already a little more cautious, which could increase interest rates all on its own if it happens. Even if that doesn’t happen, the sudden awareness of how quickly interest is piling up to where it will break the trillion-dollar-a-year mark will certainly add weight to the Republican’s determination to drive an even harder bargain, making shutdown more likely. At least, one would think it will. And congress is more sharply divided now than it was under the last speaker.

Meanwhile, the Fed believes it can safely continue to roll off Treasuries at the quantitative tightening rate they have already firmly established (just like they believed that back in 2017-2019 when they found out they could not as it ended in disaster that required rapid bailouts with effectively new QE, and then they took the “effectively” out of it when Covid gave them all the excuse they needed and just piled headlong back into full-throated QE.

One Fed fathead said today that he believes we are on a “golden path” for conquering inflation with no recession at all.

“Because of some of the strangeness of this moment, there is the possibility of the golden path … that we got inflation down without a recession,” Goolsbee said on CNBC’s “Squawk Box.” “If that happened … it would just be a continuation of what we’ve already seen this year, which is unemployment up very modestly, while inflation has come down a lot. … That’s our goal.”

Apparently, the Fed still hasn’t gotten the memo that inflation has started rising again three months ago! They also haven’t said a word about needing to discontinue the stumble-stone path of QT because of the risk to bank reserves as they talk about stopping interest hikes, yet they still think, in old Bernanke 2008 style, there is no recession anywhere in sight. Keep up QT, and you’ll see a lot worse than recession!

The Fed’s continued QT will keep adding pressure to bond interest. Yet, I read more than one article today — some in the news below — thinking the great bond bear market is over now, even from a reliable analyst, though he asks it somewhat more as a question, but still worded like a likelihood in the article.

Think again! The Fed rolloff is forcing banks to reduce their reserves as money spent on new US Treasury issuances all comes out of millions of personal and business bank accounts to buy those Treasuries and gets transferred to the government in order to refinance the old Treasuries the Fed is rolling over. That rapidly reduces what the banks hold from deposits in reserves.

Then, as we’ve already seen to great detriment, the Treasuries the banks have remaining are devalued by the rising interest. That means bank reserves continue to become more imperiled behind the scenes, AND YOU HARDLY HEAR ANYONE TALKING ABOUT IT ANYMORE, as if it’s gone away just because the Fed isn’t saying a word about it … even though we already had a handful of major bank collapses this year over that issue. You’d think that would make us WATCHFUL!

However, if you think that is the only thing that will keep driving the bond bust, think what another year of those Fed roll-offs (maybe two years … or however long it takes until the next big thing breaks) will do to bond interest rates over the months as the bond market becomes oversaturated with all that US debt that the market has to carry plus all the Fed’s corporate debt.

Do you think the market can snooze through that debt storm and keep consuming the debt for a year or more, attracting all the buyers necessary for all that additional supply being FED into the market without interest rates rising on their own to attract additional buyers? Anyone sleeping through that storm is going to wake up and open the curtains to see nothing but white against the window from the drift or avalanche that piled over the chalet while they slept.

The only way all those bonds that the Fed is forcing the government to refinance elsewhere will find enough buyers without raising interest substantially higher is if the rest of the world goes to into an even more frigid winter so that Europe and Asia and others run to Treasuries as the only cabin still standing after the storm. That is not entirely unlikely since other central banks are doing the same thing, but it was not the basis for any statements I read today about the bond bear being over.

I say all these people are sleeping because they sure are dreaming.

And the Fed actually believes it can roll those massive additional trillions in debt into the market without causing a massive bond bust, stock crash, housing crash, bank failures and a recession!? These are the people who are supposed to know more about bonds than anyone, and they cannot even see the storm right above them. And, if you think they must know more than the few of us raising a ruckus about this, ask them how it was they didn’t see the 2018 stock-market bust coming that took the market down for the year, when the few of us in alternative financial media certainly did. Ask them how they didn’t see the 2019 repo crisis coming when the few others certainly did. Ask them why they stupidly thought they could solve it with overnight loans and claim that, even though they were rolling over well over a hundred-billion every “overnight,” that it wasn’t QE and continue to believe for months they wouldn’t have to go back to QE to resolve it. I certainly stated the opposite of that all along the way. Ask them how they couldn’t see that printing trillions of dollars in the face of global shortages wouldn’t create massive inflation. Ask all the idiot financial writers with high degrees in economics, finance or business why they couldn’t see that one coming? Ask them all how they didn’t see this year’s bank failures coming when what was happening to bank reserves was just math.

They created all of those things. Where they weren’t solely responsible, one can certainly say they were an essential cause in making it happen.

Today, another popular voice in the alt-right financial media is joining mine in claiming we are probably ALREADY IN a recession! You’ve seen me lay out my case. Now he lays out his in the headlines below to claim we’re already there.

Oh, and those claims I made that the big sales number reported recently, which gave the stock market a jolt of joy juice and juiced the Fed in thinking we’re going to get, not just a soft landing but a no landing (as in no recession) … well, more news below indicates retail sales didn’t go up at all (as I calculated based on my thoughts about where inflation really is so that not nearly enough inflation was taken out of those sales figures). Let’s put it this way, if sales went up, why are retail sales jobs being cut left and right?

Here is a link to an interview I did on Rethinking the Dollar this past weekend covering more of the facts behind the bond bust that is rapidly brewing up into a monster: “The Bond Bubble Bursting Will Bring Everything Down.”

And, in case you missed it yesterday, here’s the link to the interview on the Bob Unger Show again: “A Tour of America’s Collapsing Metrics.”