Signs of a potential market peak are emerging as the technology sector, which peaked in July, shows renewed vulnerability. This week, marked by the largest shooting star for Tech since July, is seen as a significant indicator. JPMorgan Chase & Co. quant strategists are raising concerns about the concentration of the market, drawing parallels with the dot-com bubble and emphasizing the risk of a substantial selloff.

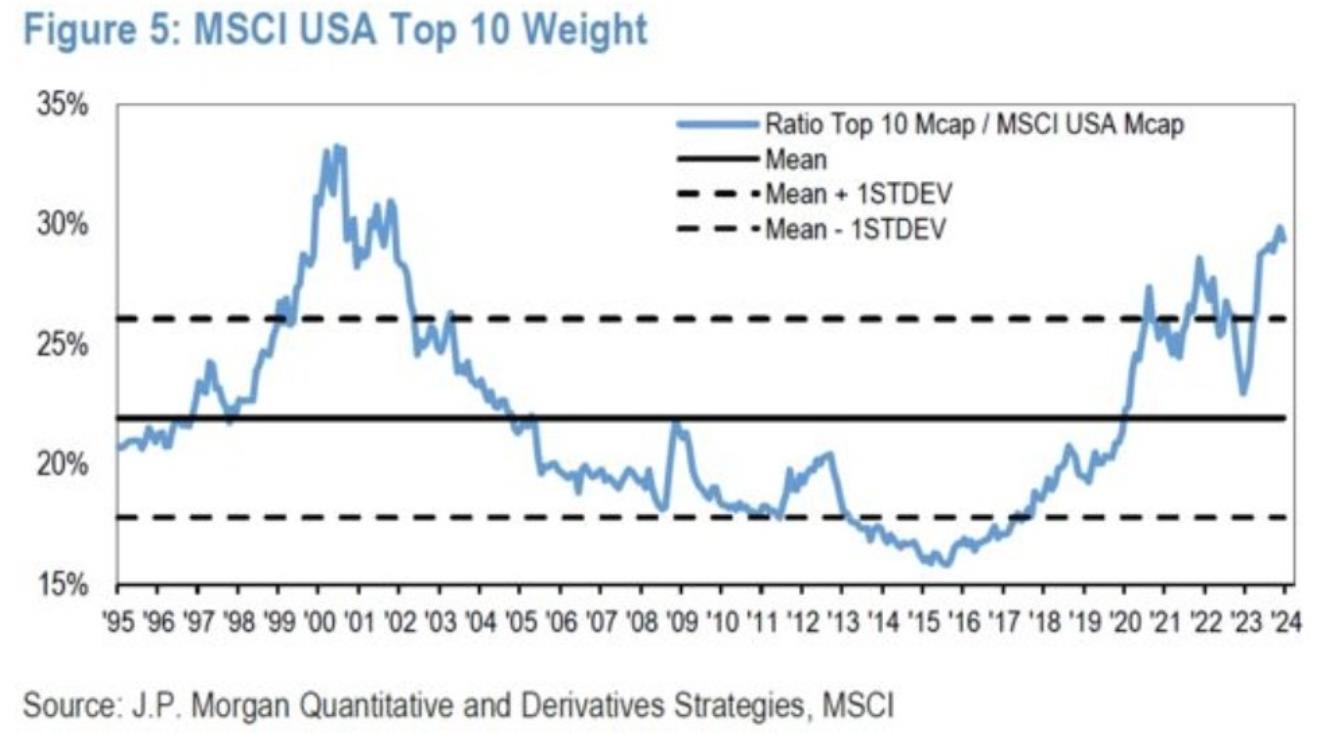

The dominance of the 10 largest stocks in U.S. equity markets is a focal point of concern. The strategists note that highly concentrated markets pose a clear and present risk to equity markets in 2024. They draw attention to the similarity between the current situation and the dot-com bubble, highlighting the potential for a significant market downturn.

The strategists emphasize that just as a limited number of stocks were responsible for the majority of gains in the MSCI USA, any drawdowns in the top 10 stocks could have a cascading effect, pulling the broader equity markets down with them. The warning underscores the fragility of market dynamics and the impact of concentrated market conditions.

In response to the challenging market environment, Google CEO Sundar Pichai has reportedly informed staff that cuts would continue throughout the year. This move aligns with broader concerns about economic and market conditions.

Adding to the cautionary notes, Deutsche Bank’s Chief Investment Officer (CIO) suggests that U.S. stocks are due for a “reality check,” anticipating a potential drop of 5% to 10%. This perspective aligns with the broader sentiment among financial analysts, reflecting a sense of apprehension and a need for vigilance in navigating the current market landscape.

Sources:

The odds of the market randomly peaking in conjunction with Tech earnings and FOMC are not coincidental. pic.twitter.com/1Wl57tcRQ1

— Mac10 (@SuburbanDrone) January 29, 2024

Ed Yardeni believes we are the beginning of a new asset bubble. https://t.co/9aEzrDcEe5

I suggest Ed Yardeni should have his prescription adjusted.

Optical and pharmaceutical. pic.twitter.com/g7Lr5kNBR3

— Mac10 (@SuburbanDrone) January 29, 2024

Earlier this week I said that the Tech sector peaked in July when Netflix kicked off Tech earnings reports.

This week was the largest shooting star for Tech since the July top. pic.twitter.com/wvV3Z3Pf28

— Mac10 (@SuburbanDrone) January 27, 2024

Google, $GOOGL, CEO Sundar Pichai warns staff that cuts would continue throughout the year, per BI.

— unusual_whales (@unusual_whales) January 30, 2024

Deutsche Bank's, $DB, CIO says US stocks are due for a "reality check" – a drop of 5% to 10%, per Bloomberg.

— unusual_whales (@unusual_whales) January 30, 2024