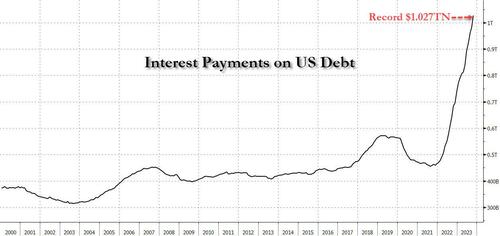

Another day, another dose of bad fiscal/monetary news. Not surprising with the US Treasury being run by Janet Yellen, who doesn’t seem to know much economics. In fact, with Biden/Congress spending like drunken sailors in port, inflation and The Fed’s counterattack, we see that interest of US debt just hit $1 TRILLION!

$1.027 trillion in interest is calculated by multiplying the average interest rate on marketable US Treasury debt (which according to the Treasury is 3.096% as of Oct 31) by the $26.003 trillion in marketable US debt (as of Oct 31) which nets off to $805 billion, and adding to this non-marketable debt interest (which as of Oct 31 was 2.884% multiplied by the amount of non-marketable debt which is $7.696 trillion) and which in turn is an additional $222 billion in interest. Add across and you get $1.027 trillion.

Naturally, this calculation of estimated real-time interest costs – which is entirely based on Treasury data – is different than what the Treasury actually paid. Interest costs in the fiscal year that ended Sept. 30 ultimately totaled $879.3 billion, up from $717.6 billion the previous year and about 14% of total outlays, however that number is merely lagging what the pro forma print currently is, and will inevitably catch up to it, and then lag on the other side even as pro forma interest payment start dropping (once interest rates plunge after the next QE/YCC is launched).

Fans of exponential functions, we got you covered: the unprecedented surge in both interest rates and interest expense in the past two years means that total US interest has doubled since April 2022 and that’s with the inherent lag in interest catch up – as a reminder, the vast majority of 5, 7, 10 and 30 year debt is still locked in at much lower interest rates, and as such, rates will continue to rise as all of the existing debt rolls into much higher rates over the coming years.

Looking ahead, the staggering surge in both yields and total long-term Treasuries in recent months confirms the government will continue to face an escalating interest bill. As a reminder, we were the first to point out that it took just one month after US federal debt first rose above $33 trillion for the first time, to spike by another $600 billion.

On the personal finance side, annual Interest payments on a 30-year, fixed-rate mortgage before Biden was $8,500, but after Biden it almost tripled to $24,300! That means that annual mortgage interest rose 186% under Biden.