by bitkogan

While White House economic advisor Jared Bernstein suggests that Yellow’s bankruptcy was the result of excess debt following multiple mergers, labeling it as more of a ‘Yellow-specific story’ than as a broader economic concern, I see the situation somewhat differently.

To me, this pattern of debt accumulation for acquisitions is rather indicative of a post-decade landscape shaped by low interest rates and liberal monetary policies. As interest rates rise, not all companies will weather the storm, and the number of bankruptcies we’ve witnessed is likely just the beginning.

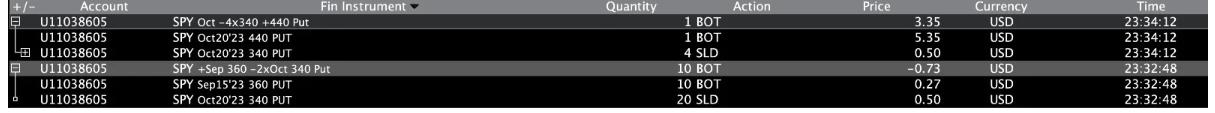

While I’m not one to dispute the White House’s economic advisor, I am, however, hedging my bets by purchasing an October put on SPY with a strike price of $440. With a low IV, it cost me a mere $535.

But why gamble even that small a sum provided that the economy and markets remain steady?

Well, to offset potential losses, I sold 24 deep OTM October puts with a $340 strike price, bolstering that move with the purchase of 10 September $360 puts as a precaution against unforeseen circumstances.

In the end, I actually came out ahead, netting a credit of $395. Granted, I needed around $23k in collateral (I always allocate $50k for a safety buffer), but the yield, albeit modest, is reliable. Plus, there’s always the added perk of potentially profiting from a market reversal, should one occur.

Disclaimer: This information is only for educational purposes. Do not make any investment decisions based on the information in this article. Do you own due diligence or consult your financial professional before making any investment decision.