The current scenario paints a stark picture of the market dynamics, as hedge funds find themselves in a position where net exposure to the “magnificent 7” has surged from 12% at the beginning of the year to a staggering 99%. This dramatic shift suggests a significant reduction in the number of buyers. High-profile investors like Warren Buffett made strategic moves, exiting UPS and making substantial reductions in HP and Chevron holdings. Soros Fund Management, overseeing George Soros’ Open Society Foundations, also made strategic shifts, selling Nvidia shares while acquiring a substantial 80,000 shares in Taiwan Semiconductor Manufacturing Company. Adding to the complex landscape, Apple insiders engaged in record monthly sales volume, totaling $88 million in October over the past two years. These maneuvers highlight a nuanced and dynamic market where investors, both institutional and insider, are making strategic adjustments amid changing market conditions and perceptions.

no buyers left: hedge fund net exposure to magnificent 7 was 12% at the start of the year. It is now 99%https://t.co/msnekVeQRd pic.twitter.com/DyUxkxkT64

— zerohedge (@zerohedge) November 15, 2023

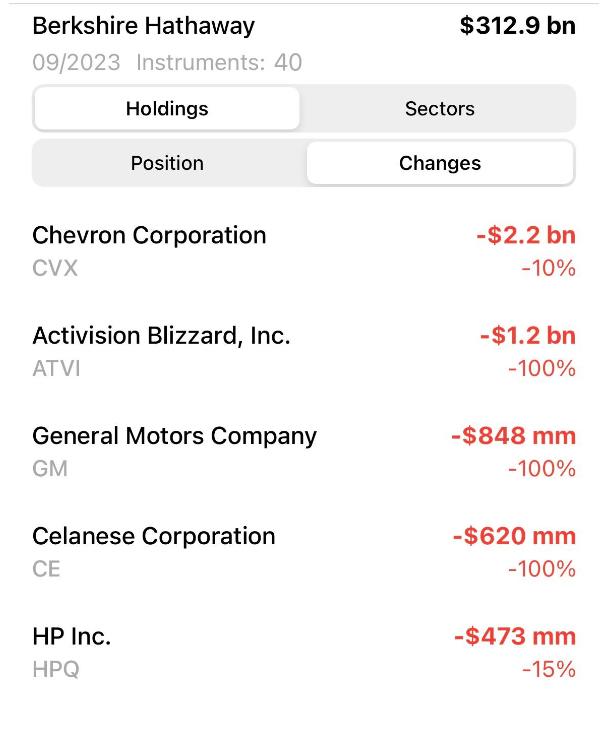

Warren Buffett exited his small stake of 59,400 shares in logistics company UPS, trimmed its ownership of computer and printer maker HP by 15% — with its stake falling in value by more than $1 billion — and reduced its stock holdings in oil major Chevron by 10%.

— unusual_whales (@unusual_whales) November 15, 2023

In 3Q 2023 Warren Buffett fully sold his positions in Activision Blizzard, General Motors and Celanese. Top-5 changes in his portfolio:

Soros Fund Management, the asset manager for billionaire George Soros' Open Society Foundations, has sold its 10,000 shares in Nvidia, $NVDA, and added 80,000 shares in Taiwan Semiconductor Manufactoring Company, $TSMC.

— unusual_whales (@unusual_whales) November 15, 2023

#recession … #StockMarket Bubble edition

Industry capture of analysts only goes so far apparently. https://t.co/6Idr2nS8so

— Invariant Perspective (@InvariantPersp1) November 15, 2023

h/t ChampionshipUsed9855