The US housing market is goin’ down!

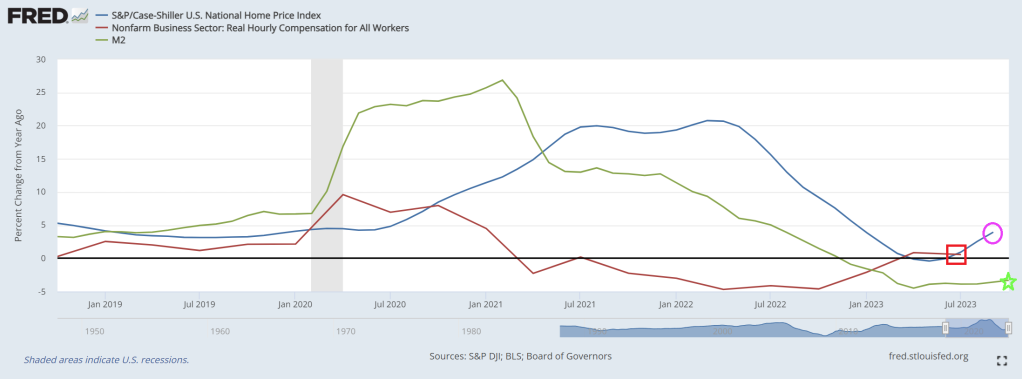

While the Case-Shiller National home price index is rising again, it has been slowing since March 2022. This is happening as “the honey pot” (aka, M2 Money printing) growth is now negative. While real hourly compensation growth is slightly, the average rate of growth since April 1, 2021, is -2.1%. (Not exactly what Biden wants to broadcast as a feature of Bidenomics).

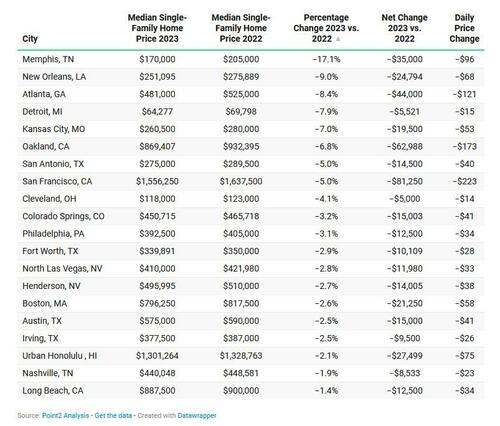

According to a recent report from Point2 Homes, many recently bought homes, particularly in the hottest regions, are deep in the red. On average, single-family homeowners have been shedding $223 in property value every day since they bought their homes last year.

Condo owners are faring even worse, losing up to $336 a day in San Francisco, or a stunning $122,500 a year.

“This double-blow market means that the most newly minted owners were first hit by the highest home prices in history, only to be cut off from building wealth by the current falling prices,” analysts wrote.

Some major markets are seeing massive net losses

Single-family homes in 16 cities examined in the analysis have faced price declines of over $10,000 over the past year.

Memphis saw the most significant single-family price plunge, as well as the second-largest decline in condo prices, which analysts say could be due to rising inventory in the city.

Condo prices in 37 cities are also weakening, including in New York and Oakland.

So, what does this mean for homeowners? Folks who shelled out plenty of cash last year to secure their deals are now grappling with depreciating property values, which means it’s harder to build equity.

And if they want to sell in today’s market, they risk reaping less for their homes than what they paid for them. Zillow reports new buyers won’t sell at a profit until they’ve spent over a decade in their homes.

In another report from Redfin, analysts estimated that more than 3% of homes sold at a loss between August to October this year. The median amount was recorded at around $40,000, although some properties lost up to six figures on the sale.

Again, San Francisco sellers reported the biggest losses, with 1 in 7 homeowners losing money on their sales. And Memphis TN leads in percentage loss at -17.1%!

There are a couple of factors that could be contributing to the Golden City’s housing woes, including the rise of remote work coupled with tech layoffs pushing residents to relocate to other areas.

“There are buyers out there, but they’re a lot more cautious and picky than they were when mortgage rates were low,” Redfin Premier real estate agent Andrea Chopp said in September.

“The Bay Area housing market was unsustainable before, so this correction is probably healthy, but the unfortunate thing is prices remain unaffordable for a lot of people—especially with rates now above 7%,” she said.

97% of sellers are in the money, though

It’s not all doom and gloom for sellers—at least not for those who’ve been residing in their homes for a long time and bought when prices were much lower than they are today.

In many markets, sellers have been reluctant to let go of their low mortgage rates and apply for a home loan at a much higher rate, and that’s keeping inventory tight and prices high.

In the three months ending July 31, 97% of sellers across the country sold for a profit, with the typical home selling 78.4%, or $203,232, more than the seller bought it for, says Redfin.

And while San Francisco has been reporting more losses than usual, the median homeowner is still reaping $625,500 more on their home sale compared to the original purchase price.

The Godfather of San Francisco property losses, California Governor Gavin Newsom.

Oh wait! That is Eddie Haskell from “Leave it to Beaver!”