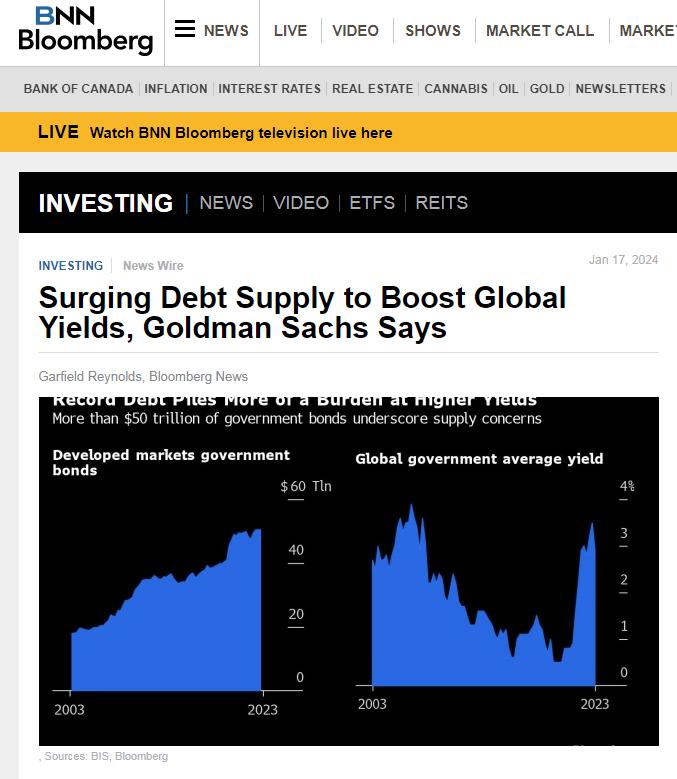

Hold onto your hats because Goldman Sachs is sounding the alarm on a rising tide of global debt. Brace yourself for elevated yields, people! According to the financial juggernaut, it’s all about escalated government borrowing and central banks doing some serious balance sheet downsizing.

In their crystal ball analysis of major developed bond markets (sorry, Japan, you’re not in the spotlight this time), Goldman Sachs is waving the flag of concern. The math here is simple: for every one percentage point rise in the public debt-to-GDP ratio, expect medium-term yields to jump at least two basis points throughout the decade. And oh, they conveniently exclude government bonds currently cozying up in central banks’ pockets, implying a broader impact on global financial markets.

Now, let’s talk corporate debt defaults – 2023 hit us with an 80% surge, marking the highest default rate in seven years (excluding that little hiccup during the Covid-19 crisis). Cue the ominous music. It seems the low-rated companies are taking the heat, especially those with negative cash flows, hefty debt loads, and weak liquidity – shoutout to the struggling media and entertainment sectors.

What’s the forecast for Corporate America? Well, with a colossal $13.7 trillion debt load on their shoulders, 2024 might not be a walk in the park. S&P Global Ratings is waving the caution flag, predicting more credit deterioration, especially for the lower-rated players. And despite potential rate cuts, financing costs are expected to remain stubbornly high.

Sources:

www.bnnbloomberg.ca/surging-debt-supply-to-boost-global-yields-goldman-sachs-says-1.2023374