“The total cost to invest is very high, and the return on that investment is very long and getting longer,” she said. Small manufacturing companies with young leaders “have never run a business with interest rates like this… it’s uncharted territory for us.”

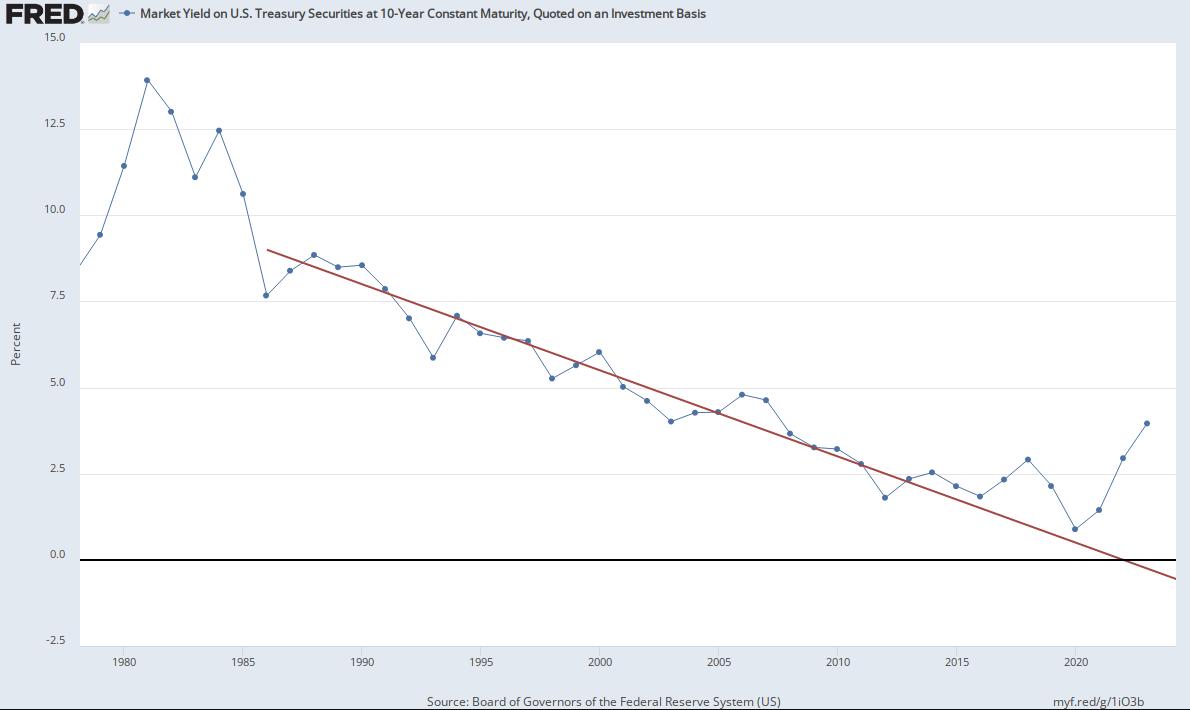

Look at the chart below and join a team:

-

No landing (the 10Y will stay at 4%+ and GDP won’t tank

-

Soft landing (10Y goes back to ~2% and levels off, returning to the 2011 – 2021 era)

-

Yikes (the red line trend = economy now requires Japanification interest rate levels)

It’s remarkable to me that the Fed keeps touting a 75bp cut this year. Is it not the case that in anticipation of such cuts, the economy will start to heat up again? It doesn’t seem to me as the correct way to tame inflation, but what do I know?

If I were them, I’d make rate cuts a surprise, rate increases and holds not a surprise.