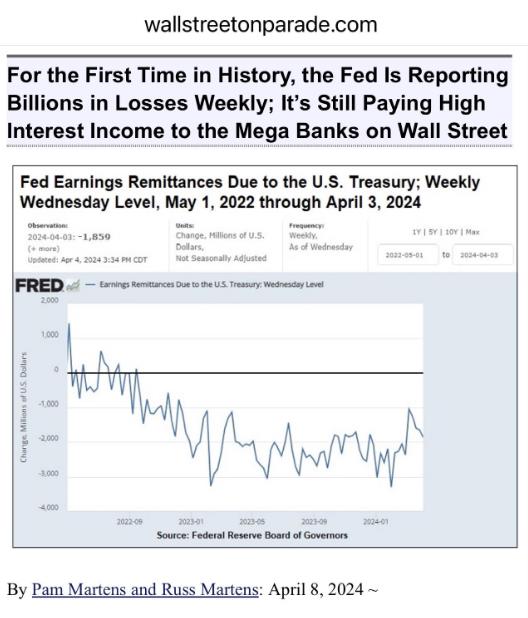

The Federal Reserve is losing billions of dollars weekly for the first time ever. Here’s the breakdown:

The Problem: The Fed gets low interest (~2%) on the massive amount of bonds it bought during economic stimulus programs (QE). However, they pay high interest rates (over 5%) to big banks for parking cash with them. This leads to significant losses.

Impact: These losses mean less money going to the US Treasury, potentially increasing national debt and impacting taxpayers.

Accounting Concerns: The Fed’s accounting methods are questioned. Critics argue they hide the true depth of the losses by not following standard practices.

Call to Action: The article urges readers to contact Senators and demand hearings on the Fed’s financial situation and potential conflicts with Wall Street.