The International Monetary Fund (IMF) has sounded the alarm, cautioning that certain hedge funds may have grown so large that they pose a systemic risk to the Treasury and repo markets, potentially affecting the broader financial system. According to the Global Financial Stability Report, leverage at hedge funds has surged to its highest level on record, as indicated by comprehensive data collected by the U.S. Securities and Exchange Commission (SEC) through Form PF.

Some hedge funds are too big to fail according to the IMF.

“Some of these funds may have become systemically important to the Treasury and repo markets, and stresses they face could affect the broader financial system.” – Global Financial Stability Report pic.twitter.com/yJMX6BbTTp

— Global Markets Investor (@GlobalMktObserv) April 19, 2024

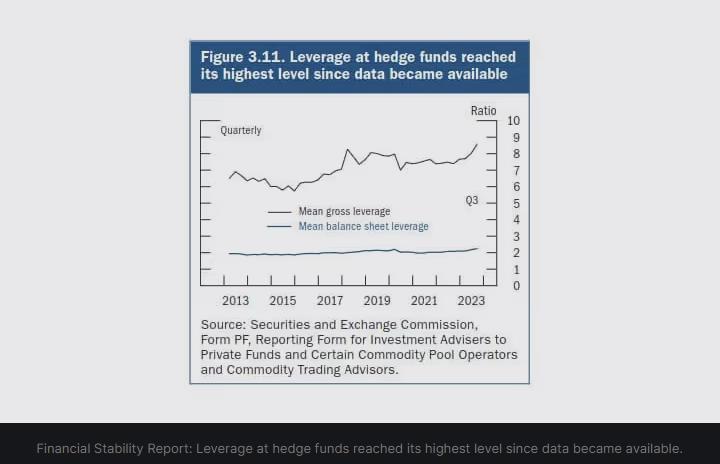

Leverage at hedge funds reached its highest level in available data

Comprehensive data collected through the U.S. Securities and Exchange Commission’s (SEC) Form PF indicated that measures of leverage averaged across all hedge funds increased further in the third quarter of 2023, reaching the highest level observed since the beginning of data availability.

Leverage increased when measured using either average on-balance-sheet leverage (blue line in figure 3.11)—which captures financial leverage from secured financing transactions, such as repurchase agreements and margin loans, but does not capture leverage embedded through derivatives—or average gross leverage of hedge funds (black line in figure 3.11), a broader measure that also incorporates off-balance-sheet derivatives exposures.

Leverage at the largest funds was significantly higher, with the average on-balance-sheet leverage of the top 15 hedge funds by gross asset value rising in the third quarter of 2023 to about 18-to-1 (figure 3.12). These high levels of leverage were facilitated, in part, by low haircuts on Treasury collateral in some markets where many funds obtain short-term financing.

More recent data from the March SCOOS suggested that hedge fund leverage flattened out as the use of financial leverage by hedge funds remained largely unchanged between mid-November 2023 and mid-February 2024 (figure 3.13).

dismal-jellyfish.com/fed-report-record-high-hedge-fund-leverage-in-2023/