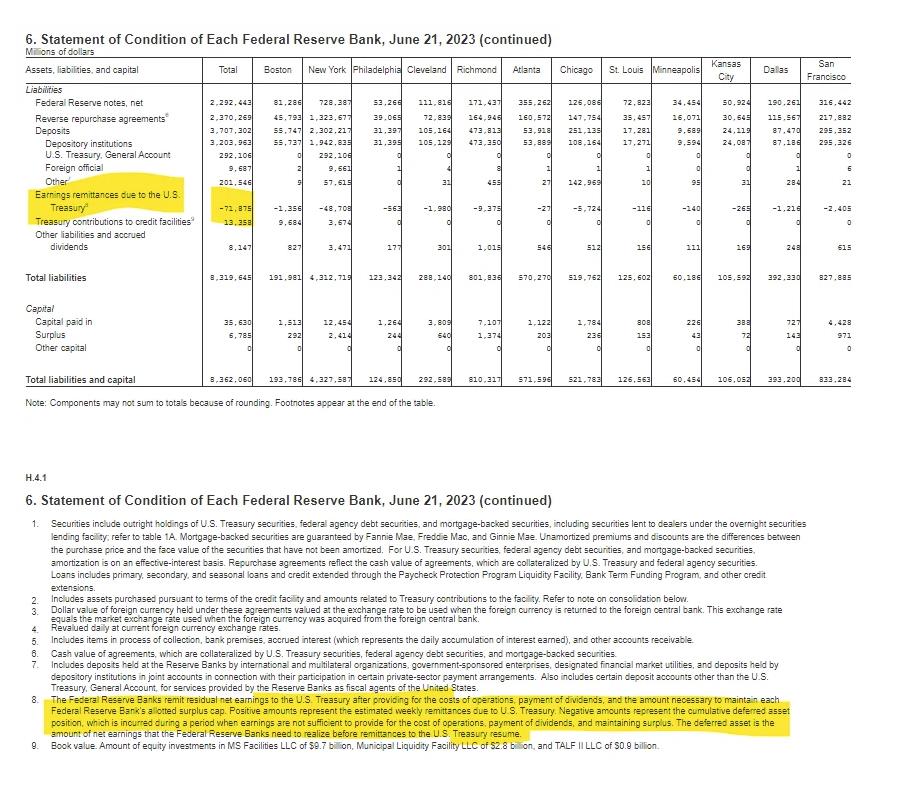

Liabilities and Capital: Liabilities: Earnings Remittances Due to the U.S. Treasury -71.875 billion as of 6/21/2023. Let’s talk about the Fed’s cumulative losses in 9 months that equal almost as much (-71.875 billion vs $76 billion) that they remitted to the U.S. Treasury for ALL of 2022…

https://fred.stlouisfed.org/series/RESPPLLOPNWW

Remember, the Fed is playing slight of hand here.

Storing losses on the balance sheet as an asset like what is happening above, rather than showing the loss on the income statement right away, is an old corporate accounting trick.

The Fed explains this in footnote:

The Federal Reserve Banks remit residual net earnings to the U.S. Treasury after providing for the costs of operations, payment of dividends, and the amount necessary to maintain each Federal Reserve Bank’s allotted surplus cap. Positive amounts represent the estimated weekly remittances due to U.S. Treasury. Negative amounts represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus. The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.

In other words, each week going forward, the linked chart will show the Fed’s total losses starting from September 2022. The bigger the negative number, the bigger the accumulated loss.

So, ‘wut mean’?

This number will get bigger to indicate the amount of money the Fed owes the treasury– -$71,875 million and counting. The Fed gets to just sit on this negative balance and when it starts making money for treasury again (from money it makes on interest and fees, lowering its operating expenses, paying less on dividends), will see that negative number start to shrink (in theory).

REMEMBER: These losses do not matter to the Fed. The Fed creates its own money, and cannot become insolvent.

However, losses in the six months since September now total More than half of all the earnings the Fed remitted over the entire year of 2022 (-$71.875 billions vs. $76.0 billion all of 2022):

During 2022, Reserve Banks transferred $76.0 billion from weekly earnings to the U.S. Treasury, and, in September 2022, most Reserve Banks suspended weekly remittances to the Treasury and started accumulating a deferred asset, which totaled $18.8 billion by the end of the year.

Again, a deferred asset has no implications for the Federal Reserve’s conduct of monetary policy or its ability to meet its financial obligations.

TLDRS:

The Federal Reserve has accumulated losses of $71.875 billion as of June 2023, nearly as much as the total earnings ($76 billion) remitted to the U.S. Treasury for all of 2022. These losses are stored as a deferred asset on the balance sheet.

This deferred asset represents the amount of earnings the Federal Reserve Banks need to accumulate before they can start remitting to the U.S. Treasury again. This occurs when the Fed’s earnings are not sufficient to cover operations cost, payment of dividends, and maintaining surplus.

Each week, this negative number will increase, indicating the growing amount the Fed owes the Treasury. When the Fed starts generating sufficient earnings again (from interests, fees, lowering operating expenses, paying less dividends), this negative balance should start decreasing.