by BoatSurfer600

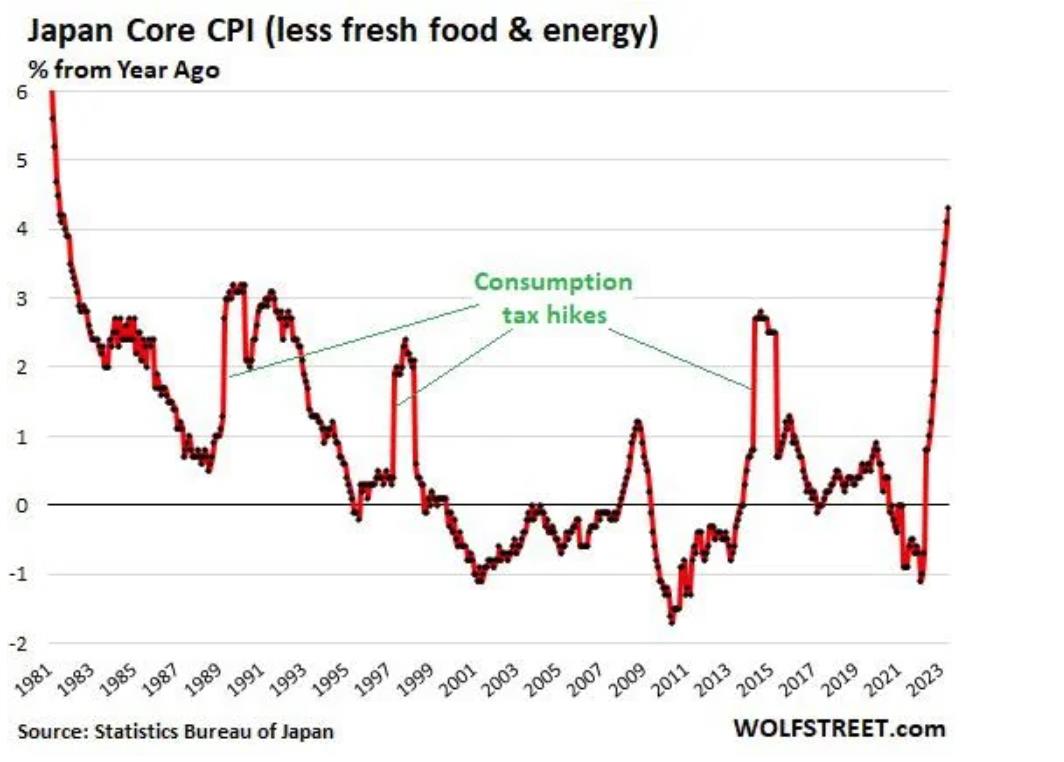

The Bank of Japan has been the total outlier in its reaction to the surge of inflation: It’s still practicing QE under the guise of yield curve control, which keeps the 10-year yield below 0.5%; and it’s still pushing its short them yields below 0%. It’s clearly doing this on purpose, because these folks aren’t blind; they’re clearly going to resolve Japan’s sovereign debt problem, the biggest in the developed world, by fueling inflation to devalue that debt — along with everything else denominated in yen — the classic way. And it’s working.

Views:

89