Source: www.federalreserve.gov/newsevents/pressreleases/other20230720a.htm

The Federal Reserve on Thursday announced that its new system for instant payments, the FedNow® Service, is now live. Banks and credit unions of all sizes can sign up and use this tool to instantly transfer money for their customers, any time of the day, on any day of the year.

“The Federal Reserve built the FedNow Service to help make everyday payments over the coming years faster and more convenient,” said Federal Reserve Chair Jerome H. Powell. “Over time, as more banks choose to use this new tool, the benefits to individuals and businesses will include enabling a person to immediately receive a paycheck, or a company to instantly access funds when an invoice is paid.”

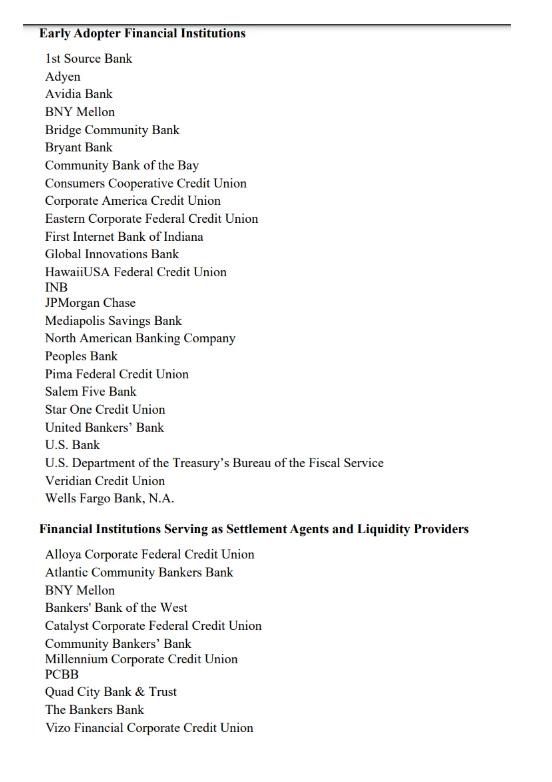

To start, 35 early-adopting banks and credit unions, as well as the U.S. Department of the Treasury’s Bureau of the Fiscal Service, are ready with instant payments capabilities via the FedNow Service. In addition, 16 service providers are ready to support payment processing for banks and credit unions.

When fully available, instant payments will provide substantial benefits for consumers and businesses, such as when rapid access to funds is useful, or when just-in-time payments help manage cash flows in bank accounts. For example, individuals can instantly receive their paychecks and use them the same day, and small businesses can more efficiently manage cash flows without processing delays. Over the coming years, customers of banks and credit unions that sign up for the service should be able to use their financial institution’s mobile app, website, and other interfaces to send instant payments quickly and securely.

As an interbank payment system, the FedNow Service operates alongside other longstanding Federal Reserve payment services such as Fedwire® and FedACH®. The Federal Reserve is committed to working with the more than 9,000 banks and credit unions across the country to support the widespread availability of this service for their customers over time.

Additional Questions and Answers

Previous post: FedNow Is Coming in July. What Is It, and What Does It Do?

On March 15, the Federal Reserve announced that the FedNow Service will launch in July 2023. FedNow will “facilitate nationwide reach of instant payment services by financial institutions—regardless of size or geographic location—around the clock, every day of the year.” But what exactly is the FedNow Service, and what does it do? In this article, we describe FedNow at a high level, offer answers to common and anticipated questions about the service, and explain how it will support the provision of instant payment services in the United States.

A New and Different Payment “Rail”

At its core, FedNow is an interbank instant payment infrastructure. Banks, credit unions, and other eligible institutions have accounts at the Federal Reserve. These Fed accounts allow institutions to hold reserves. Banks pay each other by transferring reserves from the paying bank’s Fed account to the receiving bank’s Fed account using several interbank payment options. FedNow is a new addition to the suite of options to make such transfers.

What differentiates FedNow from other payment rails is that it is specifically designed to support instant retail payments. With such payments in mind, FedNow’s most important feature is that it will operate 24 hours a day, seven days a week, year-round. With FedNow, financial institutions will be able to clear and settle retail payments instantly at any time, including nights and weekends.

Still, FedNow shares some characteristics with existing payment systems. It is an interbank system, like ACH and Fedwire. In addition, FedNow, like Fedwire but in contrast to ACH, will be a real-time gross settlement (RTGS) system. This means that every transaction of FedNow will be processed in real time, whenever the paying bank chooses to send the payment, and settled on a gross basis, payment by payment, rather than periodically settling several payments in batch.

Will retail customers get to use FedNow directly? The short answer is no, at least not directly. Instead, FedNow will support instant payment services, to which individuals will have access through their financial institutions, if these institutions adopt FedNow. Banks and credit unions that offer retail payment services will be able to use FedNow to clear and settle retail transactions and instantly make funds available to both merchant and customer.

Supporting Instant Retail Payments

If banks can already use an effective RTGS system like Fedwire to settle their payments, why is it necessary to build a new system? The answer is that existing interbank payment systems in the United States are not well suited to support instant retail payments. The goal of an instant retail payment system is to allow consumers and businesses to transfer funds at any time, from anywhere, and for these funds to be available to the recipient immediately. Imagine that Alice has lost her wallet and needs cash to take a taxi back home, late on a Saturday night. With a phone and an instant payment service app available, Bob would be able to send Alice or the taxi driver funds immediately, from across the country, and these funds would be available to pay for the taxi ride right away.

The connection between an interbank payment system and an instant retail payment system (the FedNow Service) may not be immediately obvious. So, let’s break down what happens in the example above. For Bob to send Alice cash with an interbank payment system, Bob needs to instruct his bank to debit his account, Bob’s bank needs to send cash to Alice’s bank, and Alice’s bank must credit her account. If Alice and Bob don’t have the same bank, any fund transfer between them requires an interbank transfer.

In principle, Alice’s bank could agree to extend an advance to Bob’s bank. This would allow the transfer between Bob and Alice to occur even if the transfer between their banks is delayed. However, doing so creates an interbank exposure that would need to be settled later. If instant payment usage grows enough, such interbank exposures could become large, and managing the risk they create could be complex and costly. This risk is eliminated if Bob’s bank can settle its obligation to Alice’s bank in real time, when Alice’s bank credits her account. Since individuals may have the need to send each other funds at any time, including late on weekend nights, as in our example, eliminating the risk that could arise from the resulting interbank exposures requires banks to have the ability to clear and settle transactions, and also make funds available—all within seconds, at any time. FedNow will do that.

Where Does Fedwire Stand?

Couldn’t Fedwire Funds Service’s hours of operations have been extended to allow it to support instant retail payments? There are several reasons why this would not have been practical; let us focus on one. Systems that operate 24 hours a day, seven days a week, 365 days a year need to be updated from time to time, without service interruption. The technology that supports Fedwire is not designed to do that effectively. Fedwire’s technology updates typically happen on weekends, when the service is not operating. FedNow, by contrast, is built to make the service upgradable without needing to shut it down.

FedNow will not replace Fedwire. FedNow is meant to support instant retail payments with a maximum value of $500,000; in most cases, financial institutions needing to make large, dollar-denominated RTGS transfers will continue to use the Fedwire Funds Service.

To Sum Up

FedNow is a new interbank RTGS payment system that will support instant clearing and settling of retail transactions. Individuals will not have access to FedNow directly, but instead will have access to the instant payment services offered by their financial institutions. FedNow will allow participating institutions to transfer funds between their customers and provide immediate availability without incurring credit exposures. Because of their speed and convenience, instant payments, whether between individuals or between a business and a customer, are expected to grow in the United States, as they have grown abroad. With FedNow, the Federal Reserve is supporting the growth of this segment of the payment industry.

TLDRS:

The Federal Reserve’s new FedNow Service launched.

- FedNow is essentially a new, fast, interbank payment system, like a new “payment rail” that connects all banks, credit unions, and similar institutions that hold accounts with the Federal Reserve.

- Unlike existing systems, FedNow is designed specifically for instant retail payments.

- That means it will be operational 24/7/365, enabling banks to clear and settle retail payments in real-time, regardless of when they’re made.

- It shares some qualities with current payment systems like ACH and Fedwire but will be a real-time gross settlement (RTGS) system, meaning transactions get processed instantly whenever they’re sent and are settled one-by-one rather than in batches.

- As an individual, ‘we’ won’t use FedNow directly.

- Instead, our banks or credit unions can adopt the system and use it to instantly clear and settle retail transactions.

- This allows folks or a business instantly access funds from completed transactions.

- Existing systems like Fedwire aren’t ideal for instant retail payments, as their operating hours and technological capabilities don’t allow for the speed, immediacy, and continuous operation needed for this kind of service.

- FedNow won’t replace Fedwire. While it’s designed for instant retail payments, it’s capped at transactions up to $500,000.

- For larger transfers, institutions will still use the Fedwire Funds Service.