via Mike Shedlock:

For the rest of the year, there was only a slight change in the market’s expectations of rate hikes or cuts following the CPI release.

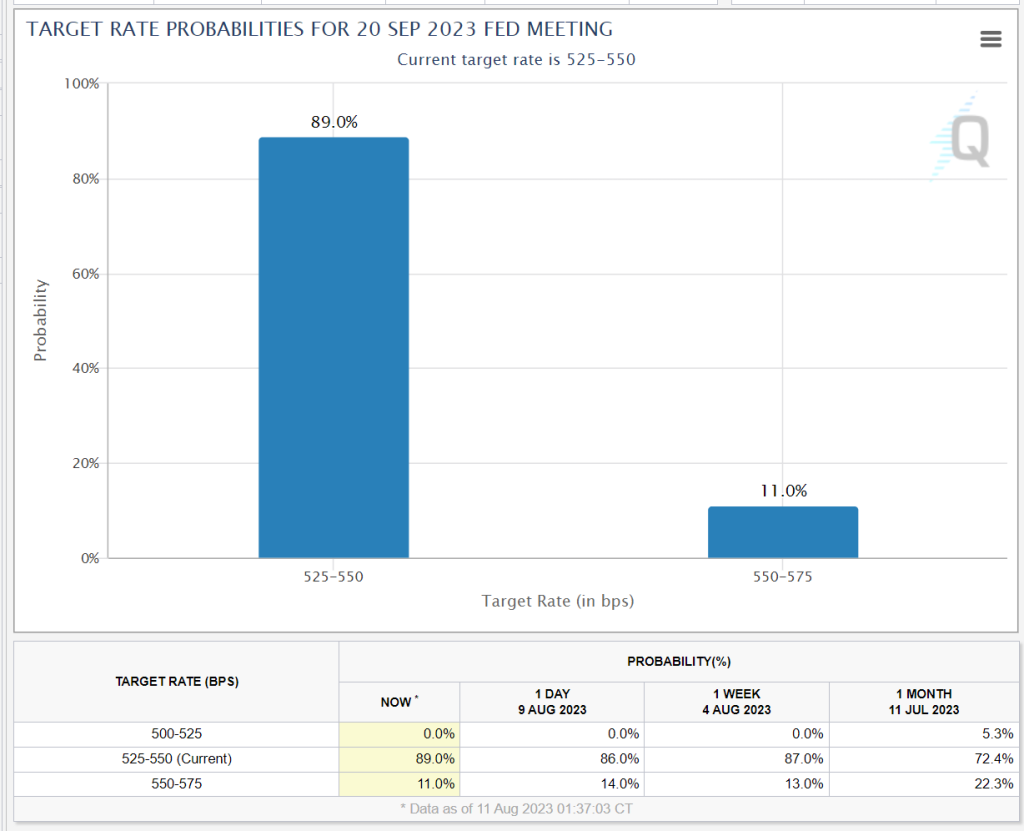

Ahead of the CPI inflation release, the market perceived there was a 14 percent chance of a quarter point hike by the Fed on September 20.

After the CPI report, the odds dropped to 11 percent. Similar small changes took place in the November and December oods.

Target Rate Probabilities November 1

The changes for November were only 1 percent or so.

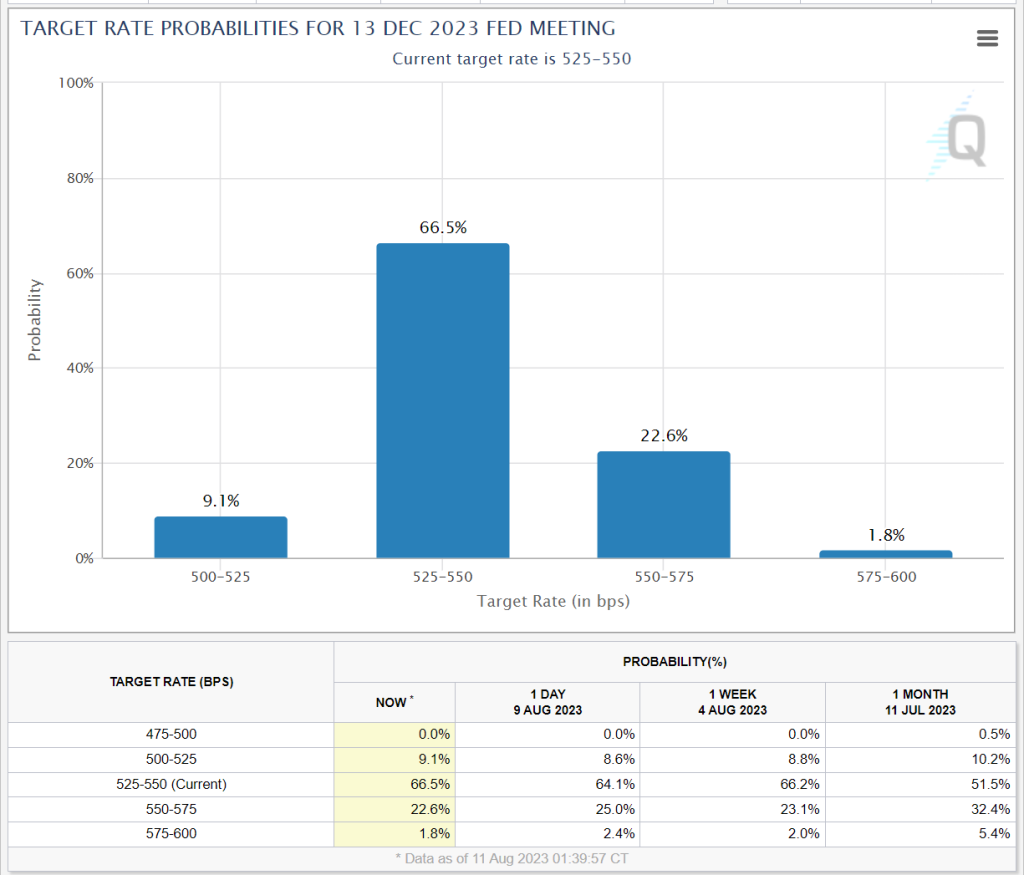

Target Rate Probabilities December 13

For the December meeting, the odds changed from 1 to 2 percent.

The CPI data had almost no impact on market perceptions of rate hikes or cuts by the Fed.

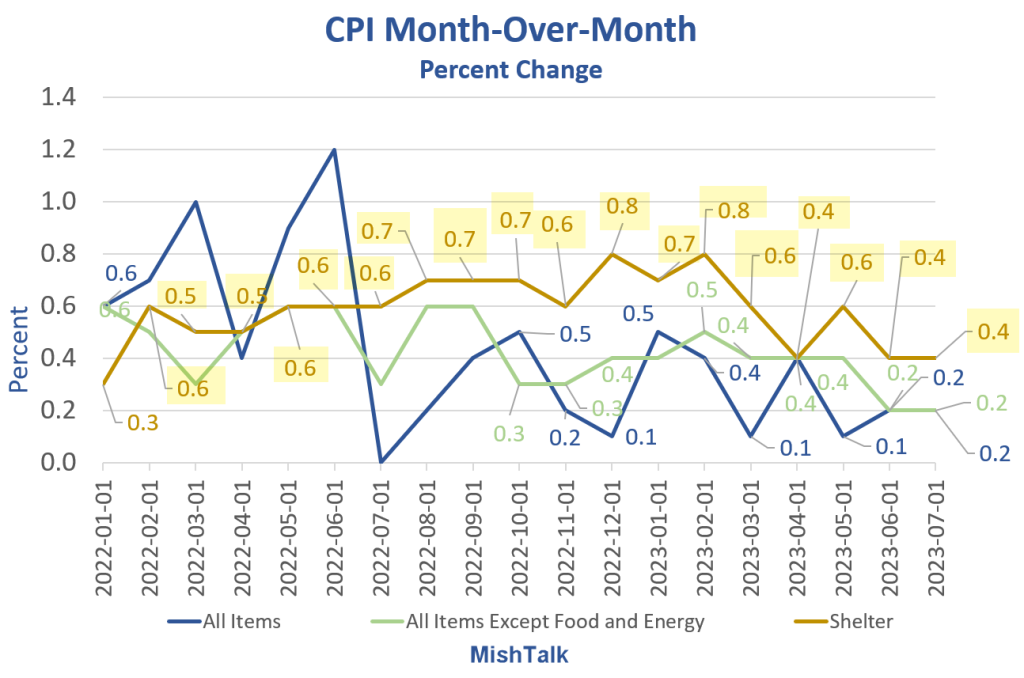

CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase

For the 18th straight month the price of shelter has risen at least 0.4 percent. For a year, analysts have predicted not just a slowing pace of increases, but falling prices.

For further discussion of the CPI data, please see CPI Rises 0.2 Percent, Shelter Again Accounts for Most of the Increase.