Shock of shocks: sticky CPI came in at 4.4% for 12 months ending in Apr, about twice the pre-pandemic average; these 3%+ inflation rates are absolutely structural and will continue – do yourself a favor and don't listen to the people who called inflation "transitory"… pic.twitter.com/hhbrTbioLv

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 15, 2024

6 measure of inflation for your consideration; note that every metric is back above the 2.0% target for Apr and none are trending toward that 2.0% target… pic.twitter.com/1NH466x4Wq

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 15, 2024

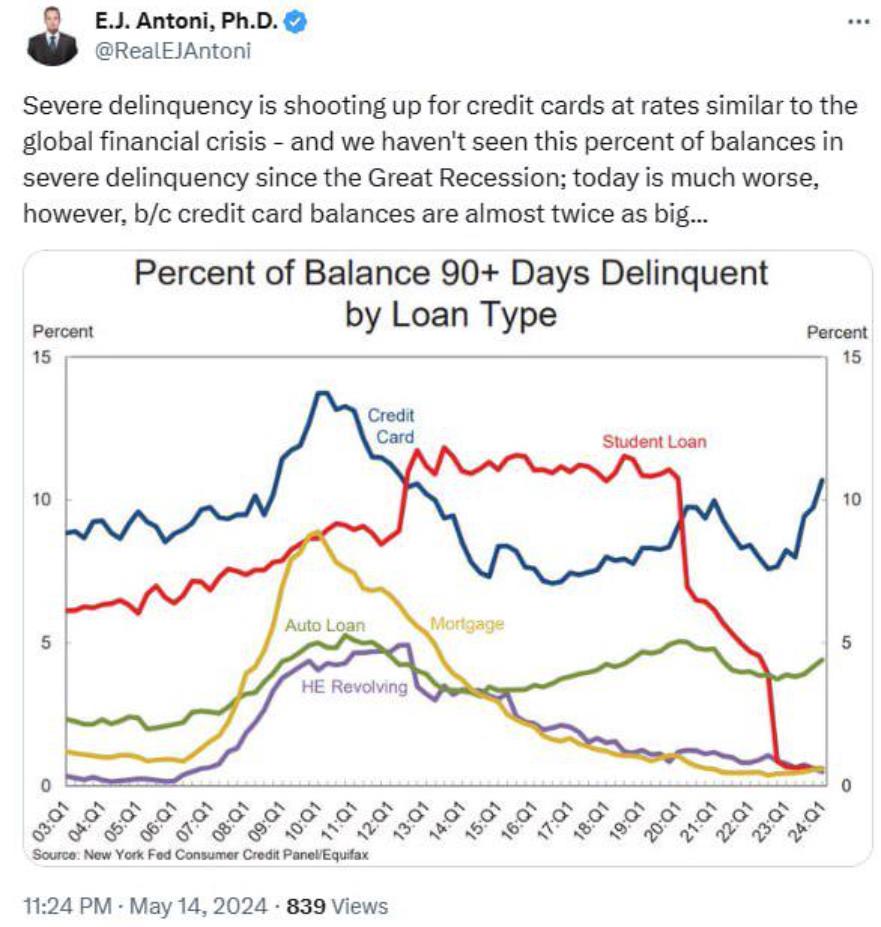

More Americans are falling behind on their credit card bills.

About 8.9% of credit card balances fell into delinquency over the last year, according to the Federal Reserve Bank of New York — a sign that a growing number of borrowers are feeling the strain of rising prices and high interest rates.

“Everything is more expensive. Debt is more expensive. Rent is more expensive. Food, gas, everything,” says Charlie Wise, senior vice president at TransUnion, the credit reporting firm. “Even with relatively healthy wage gains we’ve seen over last several years, many consumers just aren’t keeping up with the price pressures.”

Maxed-out borrowers are a big concern

The New York Fed’s report shows the pain is not evenly spread. While many households are on solid financial footing, almost 1 in 5 cardholders is “maxed out,” using at least 90% of their credit card limit. That’s worrisome, the report says, because maxed-out borrowers are much more likely to fall behind on their bills.People under 30 and those who live in low-income neighborhoods were particularly likely to be maxed out, according to the report. Among Generation Z borrowers, about 1 in 6 was close to exhausting their credit, compared with 4.8% of baby boomers.

www.npr.org/2024/05/14/1251295805/credit-cards-debt-inflation

While Powell reiterates “Wait-And-See” approach to Fed’s monetary policy…

And the bank CEO’s want us to believe everyone is still flush with covid stimulus cash.

Health insurance costs are way above where they were 8 years ago but, according to the bean counters at BLS, the price is almost exactly the same as this time in '16 – absolutely incredible how bad this component of CPI is at capturing the cost to American families: pic.twitter.com/nIPmKMKWnl

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 15, 2024

Many common foodstuffs have seen prices rise 25% or more since Jan '21 – middle class can't avoid these price increases; they're getting absolutely crushed: pic.twitter.com/2NyVNVre0g

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 15, 2024

CVL Fed: 10-year inflation expectations shot up again for May to 2.5%, tying the rate from Nov '22, the highest rate since Oct '07 – no one believes the Fed will get us back to 2.0%, not even over a decade: pic.twitter.com/z7oj53YVvz

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 15, 2024

More rate cut fanboy behavior from @nytimes pic.twitter.com/Ytagjf1qo0

— Gay Bear Research, LLC (@GayBearRes) May 15, 2024

Doocy To KJP: ‘Why Do You Think Americans Are So Down On President Biden Right Now?’