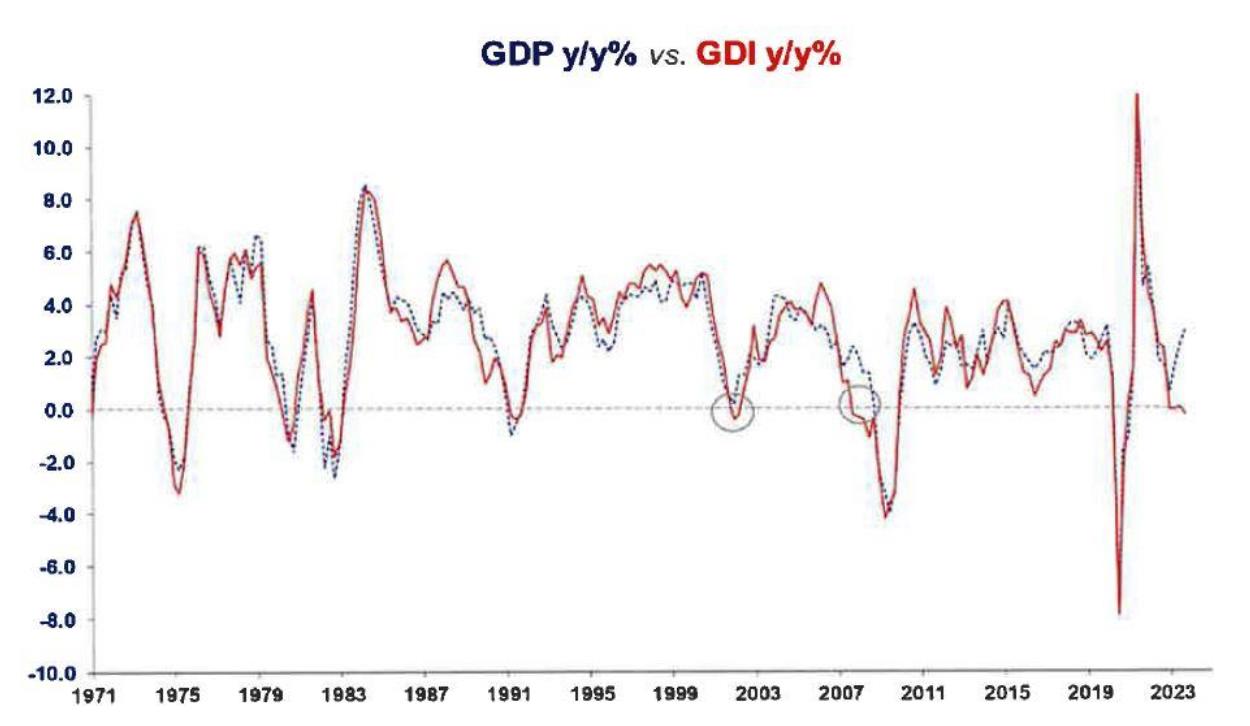

When Gross Domestic Income (GDI) and Gross Domestic Product (GDP) part ways, it’s a red flag. Contrary to popular belief, Fed rate drops often precede stock plunges, signaling economic slowdown. A staggering 96% of Americans worry about the economy, per Intuit Credit Karma.

Unprecedentedly, less than 10% of companies boast strong Altman Z-scores, reflecting a concerning financial landscape. November’s Commercial Chapter 11 bankruptcies spiked 141% YoY to 842, per Epiq Bankruptcy. The 30-day z-score on the $spx indicates a bearish trend.

Amidst optimistic pivots, reality hits: a 100bp or even 200bp cut in the FED funds rate won’t deter the impending default cycle. Massive rate slashes are necessary, as history reveals Fed cuts during recessions, not falling inflation. Earnings dip in recessions, cautioning against hasty wishes.

Gasoline hitting a two-year low signifies economic downturn, warns Societe Generale. The inevitable U.S. downturn looms, emphasizing the urgency for careful economic navigation.

Sources:

This is Dan Nathan’s favorite chart and mine too.

Everyone seems to think when the Fed drops rates it’s going to be bullish af.

History shows you it’s the exact opposite. Stocks drop hard because it means the economy is slowing down.

The chart can’t be any more clear: pic.twitter.com/UcRZuADM8S

— QE Infinity (@StealthQE4) December 7, 2023

96% of Americans are concerned about the current state of the economy, per Intuit Credit Karma.

— unusual_whales (@unusual_whales) December 7, 2023

I'm so old I remember when 2000 was a bubble. pic.twitter.com/YRph8HbzzW

— Sven Henrich (@NorthmanTrader) December 7, 2023

The percentage of companies with strong Altman Z-scores (profitability, leverage, liquidity, solvency, activity ratios) has dropped below 10% for the first time ever.@johnauthers pic.twitter.com/DHn6LnHxua

— Daily Chartbook (@dailychartbook) December 8, 2023

Lost in all the excitement about a pivot is the reality that 100bp or even 200bp cut in FED funds rate accomplishes nothing in terms of staving off the impending default cycle. Having 4% junk rated debt roll at 7.5% ( instead of 8.7%) isn't going to help. The FED would have to… t.co/EkXKm8xCxX

— steph pomboy (@spomboy) December 4, 2023

Makes perfect sense with November Commercial Chapter 11 bankruptcies up to 842, an 141% increase YoY per Epiq Bankruptcy t.co/AppvjKOML6 t.co/3DBa1S2Dcc

— Danielle DiMartino Booth (@DiMartinoBooth) December 8, 2023

30-day z-score on the $spx shows a bearish divergence pic.twitter.com/BvfunviqaM

— Michael J. Kramer (@MichaelMOTTCM) December 8, 2023

The Fed usually cuts because of recessions, not because of inflation going down. As disappointing as it is, earnings go down in recessions taking equities with them. Be careful what you wish for. pic.twitter.com/HLYmdhzHm5

— Michael A. Arouet (@MichaelAArouet) December 7, 2023

Gasoline fell to a 2-year low yesterday pic.twitter.com/Idxpwjnsg8

— Barchart (@Barchart) December 8, 2023

A U.S. Downturn is inevitable warns Societe Generale pic.twitter.com/nbV42DUDK4

— Barchart (@Barchart) December 8, 2023