The warning signs are becoming more pronounced, and it appears that a recession may be looming closer than expected.

Tightening liquidity is often a precursor to economic downturns. This is evident in the increasing number of companies closing their doors and factories declaring bankruptcy. These are clear indicators of economic distress that should not be underestimated.

There’s been a noticeable shift in the flow of money out of the economy. This monetary exodus is putting additional strain on an already fragile economic situation, heightening concerns among experts.

Adding to the complexity is the Employee Retention Credit (ERC) program, which appears to be channeling funds disproportionately to the wealthy. This has raised questions about the equity and effectiveness of economic policies.

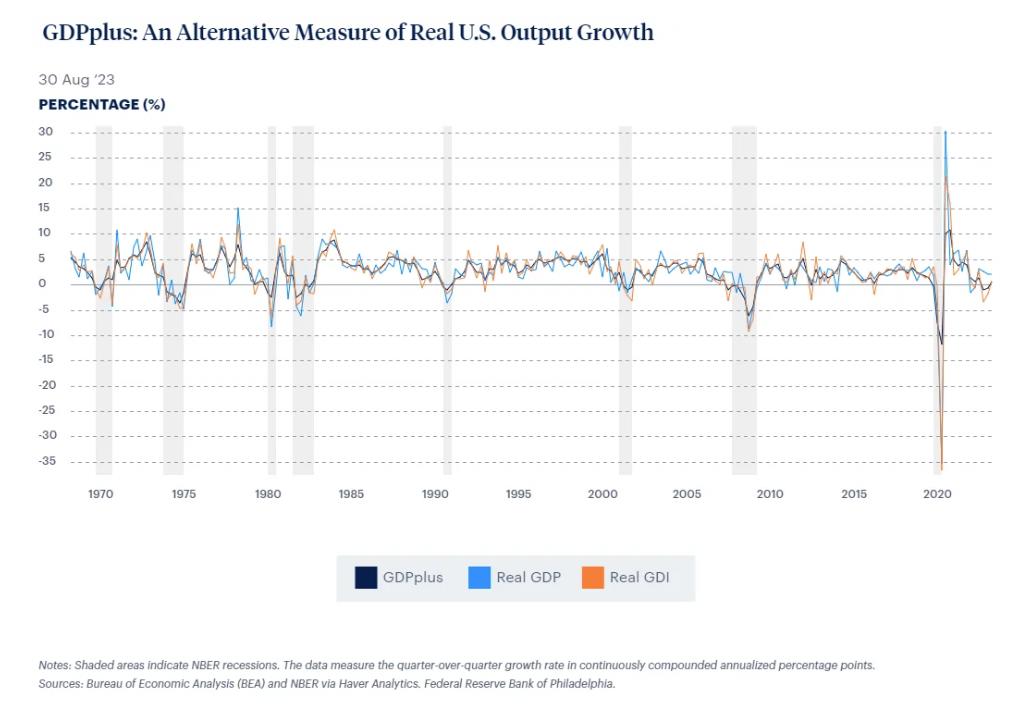

When you couple these factors with two consecutive quarters of negative GDPplus growth, it’s a clear signal that we’ve entered a recession. The recent surge in the 10-year Treasury yield to a new cycle high of 4.732% is further evidence of economic instability.

Interestingly, Americans are flocking to casinos at record levels, possibly as a response to economic uncertainty. This suggests that people are looking for alternative ways to secure their financial future.

Existing home sales typically decline before recessions, and this trend is concerning. The collapse in multifamily starts is another alarming development. While it may not immediately impact construction employment on existing projects, companies will likely start shedding workers as financing conditions for new multifamily housing projects become nearly impossible.

The job market is showing signs of pessimism. The expectation of being offered a new job has declined in August, dropping to 18.7% from 21.1% a year ago, according to CNBC.

These interconnected factors paint a concerning picture of an economy facing serious challenges, raising the specter of an impending recession.

Looks like when it gets really tight you don't have to wait long for recession pic.twitter.com/yWjKvpucYo

— Win Smart, CFA (@WinfieldSmart) September 19, 2023

Optimistic Earnings Outlook pic.twitter.com/qvoiDMPXOV

— Win Smart, CFA (@WinfieldSmart) September 19, 2023

"The fact is, we are seeing companies closing, factories in bankruptcy…we've seen a definite turn in terms of money coming out of the economy…while the ERC pumps money into the hands of the wealthy"https://t.co/vf2AgHOnoF

— Danielle DiMartino Booth (@DiMartinoBooth) September 19, 2023

https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/gdpplus

*10Y HITS 4.732, NEW CYCLE HIGH

— Don Johnson (@DonMiami3) September 19, 2023

Americans are hitting the casinos at an all time record level, per BI.

— unusual_whales (@unusual_whales) September 19, 2023

There’s the multifamily starts collapse we’ve been waiting for – while it won’t effect construction employment on existing projects – companies will shed workers as their new builds in the MFH pipeline freeze up w/near impossible financing conditions. pic.twitter.com/fPfoKReivS

— Don Johnson (@DonMiami3) September 19, 2023

The expectations of being offered a new job has declined in August, falling to 18.7% from 21.1% a year ago, per CNBC.

— unusual_whales (@unusual_whales) September 19, 2023