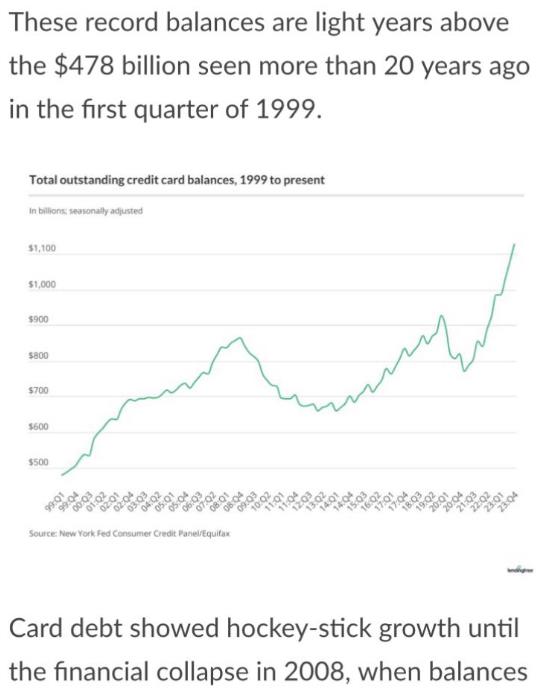

Personal credit card debt hits $1 trillion; student loan repayments resume; rent and wages stagnate; emergency funds lacking. Ye, its bad!

This is gonna have to stop at some point and that’s when the fun begins.

Wages haven’t kept up with inflation for like the last half century.

Four months ago

Delinquencies rise on mortgages, auto loans and credit cards

Seven months ago

Credit card debt hits $1T for the first time ever

Three months ago

Record-breaking Holiday Spending Fueled by Reckless Credit Card Usage

Six months ago

hope this helps pic.twitter.com/FYP3WIxeee

— Dario Perkins (@darioperkins) March 21, 2024

h/t B3stAuD1t0rofA11tiME

Views:

249