In the ever-evolving landscape of financial dynamics, a disconcerting narrative unfolds. Credit card delinquency rates have surpassed pre-pandemic levels, marking a troubling turn in the economic trajectory. The report from the Federal Reserve Bank of Philadelphia paints a stark picture of the challenges faced by consumers, revealing alarming statistics that demand our attention.

Delving into the heart of the matter, the report reveals that credit card delinquency rates have surpassed pre-pandemic levels. A staggering 3.2% of card balances were at least 30 days past due as of September, marking the highest figure in over a decade. This surge, up by over 40 basis points from the previous quarter, paints a grim picture of the economic challenges faced by cardholders.

In a distressing twist, the share of borrowers making only the minimum payment has breached the 10% mark for the first time since 2019. For those carrying an average credit card balance of over $6,000, paying just the minimum becomes a daunting prospect. Brace yourself for a financial odyssey spanning 17 years and accumulating over $9,063 in interest.

The average credit card balance has skyrocketed to a 10-year high, standing tall at over $6,000. This represents a formidable 15% increase from the previous year. As consumers grapple with mounting debts, the repercussions echo throughout the financial landscape.

A chilling record has been shattered as the average Annual Percentage Rate (APR) for credit cards hits an unprecedented 20%. This ominous milestone further tightens the financial noose around consumers, raising concerns about the affordability of credit.

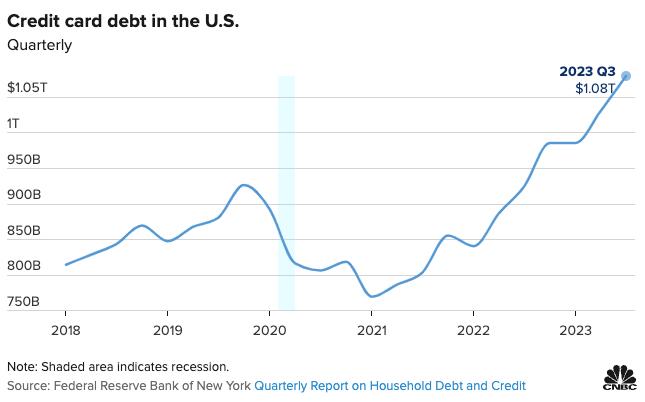

In a historic moment, U.S. credit card debt has crossed the formidable $1 trillion mark for the first time. Federal Reserve data underscores the severity of the situation, revealing that the average credit card interest rate stands at a staggering 21%. The economy teeters on the brink, yet paradoxically, U.S. consumer sentiment remains at a 2-1/2-year high.

As the nation grapples with soaring credit card debt and unprecedented interest rates, a peculiar paradox emerges. Despite the financial storm, U.S. consumer sentiment stands at a 2-1/2-year high. This incongruity begs the question: is something about to break, or is there an undercurrent of resilience in the face of adversity?

The turbulent seas of credit card delinquency, ballooning balances, and exorbitant interest rates present a formidable challenge for consumers. As the nation navigates these uncharted waters, the looming question remains: Can the resilience of consumer sentiment weather the storm, or are we on the precipice of a financial reckoning? Only time will unveil the answers as the economy stands at a crossroads, balancing on the edge of uncertainty.

Sources:

https://www.aol.com/news/credit-card-debt-hits-record-163036377.html

Average credit card balance hits a 10-year high at OVER $6,000 – up 15% from last year.

Average APR? A record-breaking 20%.

Paying just the minimum on a $6,000 balance?

Brace yourself for 17 years and over $9,063 in interest.

The consumer is in a tough spot. pic.twitter.com/FBYlIJB3NB

— Genevieve Roch-Decter, CFA (@GRDecter) November 13, 2023

https://www.aol.com/news/credit-card-debt-hits-record-163036377.html