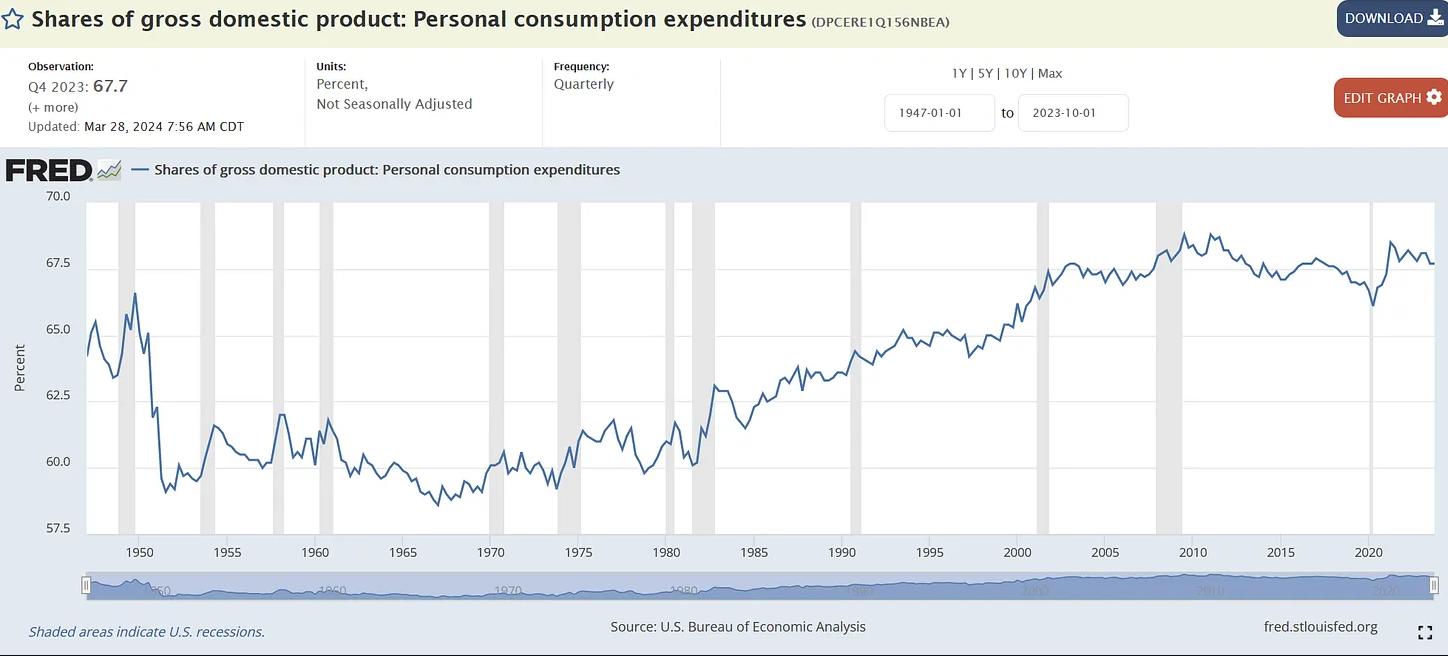

Consumer sentiment has plummeted, mirroring levels seen before previous bear markets, including the market slump in 2021. This downturn, coupled with record-high US credit card delinquency rates in Q4 2023, with nearly 3.5% of card balances over 30 days past due, signals potential financial turmoil. Moreover, serious delinquency rates (90+ days) are rising at the fastest pace since the Great Financial Crisis. Adding to the economic concerns, the impending “phantom debt” crisis looms large, driven by future installment payments from ‘buy now, pay later’ programs, posing a significant threat to already indebted Americans.

Sources:

Consumer Sentiment just imploded.

I would point out to bulls that the last two times consumer sentiment crashed, preceded bear market. AND, as we see this is the same level of sentiment that killed the market in 2021.

Cue rampant belief in imminent Fed bailout. Imminent… pic.twitter.com/jNHJSKVBRG

— Mac10 (@SuburbanDrone) May 10, 2024

globalmarketsinvestor.substack.com/p/are-us-consumers-finances-seriously?r=l7uw3

‘Phantom debt’ is soon going to become a huge problem for already indebted Americans.

Phantom debt describes future installment payments from the ‘buy now, pay later’ programs.

Headlines to be made soon?@business

— Wealthion (@wealthion) May 10, 2024

“Phantom Debt” is a little extra pic.twitter.com/AHYV9lLPjx

— Gay Bear Research, LLC (@GayBearRes) May 8, 2024

The Tragedy Of Bidenomics! Consumers Using Debt, Draining Saving To Cope With Inflation (Phantom Debt Soaring While Biden Makes Light Of The Disaster)t.co/0Og0gyH2s4 pic.twitter.com/5Hw4T4hB2R

— Citizenwatchreport (@Citizenwatchrep) May 10, 2024

Everything is fine …… 🔥🔥🔥 pic.twitter.com/PTz3yv6oHP

— Wall Street Silver (@WallStreetSilv) May 10, 2024

BOOM: consumer sentiment plunges 12.7% M/M in the initial May reading as inflation expectations climb even further to 3.5% short-term and 3.1% long-term, both highest since Nov '23; Powell & Co. have completely lost the inflation fight and don't care b/c it's an election year… pic.twitter.com/R5HzZHvULB

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 10, 2024