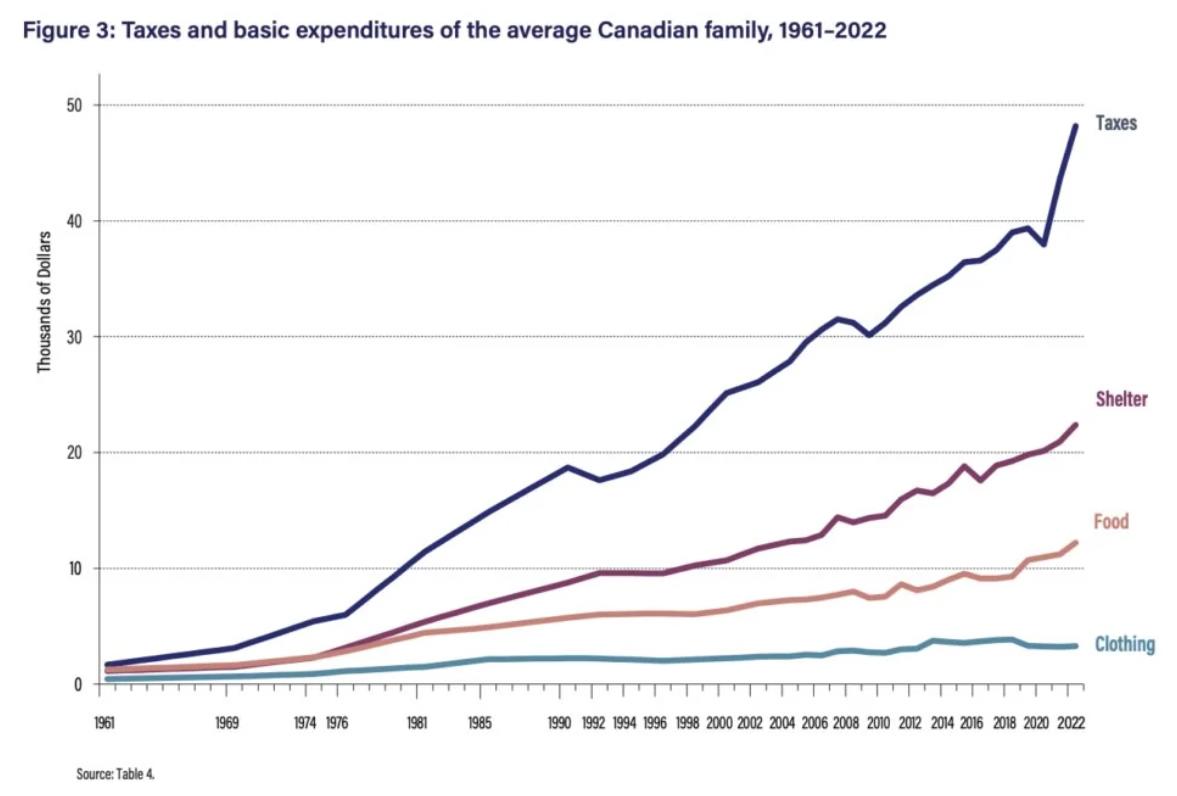

The Fraser Institute’s 2024 edition of the Canadian Consumer Tax Index reveals that the average Canadian family spends a significant portion of its income on taxes. In 2023, the average Canadian family earned an income of $109,235 and paid $46,988 in total taxes, which amounts to 43.0% of their income. In comparison, the same family spent $38,930 (or 35.6% of its income) on basic necessities such as food, housing, and clothing.

This trend is not new. The Fraser Institute has been tracking the tax burden on Canadian families since 1961. Over the decades, the total tax bill for the average Canadian family has increased by 2,705%, outpacing the growth in expenditures on shelter (2,006%), food (901%), and clothing (478%). This indicates that taxes have grown much more rapidly than any other single expenditure for Canadian families.

The total tax burden includes various types of taxes such as income taxes, sales taxes, property taxes, and carbon taxes. The increase in these taxes has contributed to the overall rise in the tax burden on Canadian families.

The high tax burden has significant implications for Canadian families. With a larger portion of their income going towards taxes, families have less disposable income to spend on essential goods and services. This can lead to financial strain, especially for middle and lower-income families who may already be struggling with the rising costs of living.

🇨🇦Canada: Taxes have become the most significant item in family budgets, and taxes have grown more rapidly than any other single item pic.twitter.com/OtV580pflj

— Tracy (𝒞𝒽𝒾 ) (@chigrl) August 8, 2024

Sources:

https://www.fraserinstitute.org/article/taxes-remain-largest-expense-for-canadian-families-2024

h/t TonyLiberty

266 views