via DAVID JENSEN:

On Wednesday January 3, 2024 the Bank of Canada (BoC) restarted its Overnight Repurchase (Repo) operation with an initial injection of $4.85 Billion CAD into the financial system – one or more bank or eligible financial institution lacked sufficient overnight liquidity and was unwilling or unable to sell assets to raise such capital or the BoC saw interest rates at risk of rising due to a market liquidity shortage.

The January 3 BoC repo injection has now increased to $10 Billion in the January 8 overnight market.

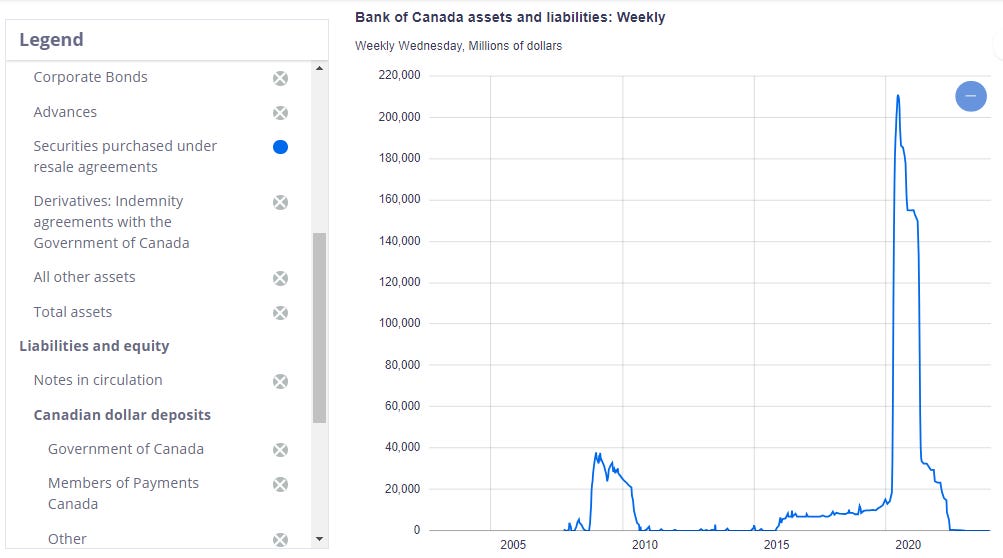

As can be seen below in this chart that is updated by the BoC every Wednesday, the BoC is most active with its Repo operation during times of financial crisis such as the 2008 Financial Crisis and the 2020 COVID fright.

Given the shock increase in the BoC and Fed central bank rates that have risen from 0% to ca. 5% since March 2022, knock-on to the next banking disruption has been anticipated as bank balance sheets have been widely hit with losses – many of them unrealized losses.

In this presentation to the Fed Board of Governors, it is stated, at the end of September 2022 when the Fed Funds Rate rate had just risen to 3.25% over the prior six months, that 722 different US banks faced unrealized losses of more than 50% of their net balance sheet capital. By the spring of 2023, some analysts estimated that the number of US banks facing loss of 50% or more of their bank capital had risen to over 2,000.

The loss of balance sheet capital at Canadian banks is unclear but it will include losses on unhedged bond holding from rising rates as well as declines in mortgage and bond portfolios due to increasing borrower default risk.

Neither the central planners at our central banks who have orchestrated increasingly loose monetary policy and serial bubbles over the past 4 decades nor the banks themselves are eager to have banks selling devalued assets into the market clarifying the condition of their balance sheets just as the central banks attempt to ‘normalize’ interest rate policy after a decade of zero percent rates.

…