Ripped off REAL GOOD!

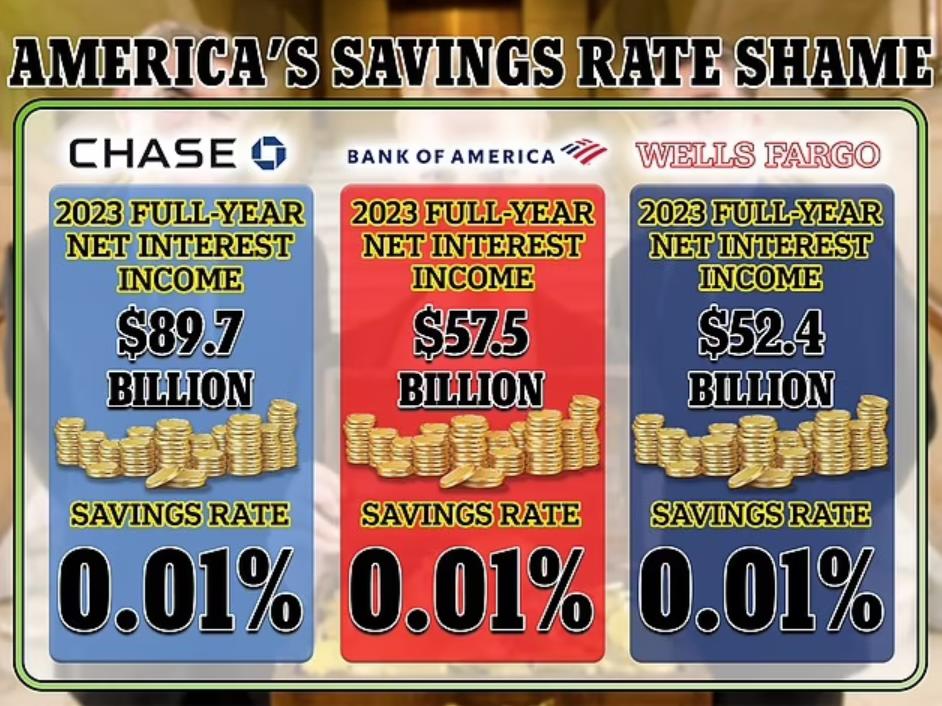

America’s savings rate shame: Three biggest US banks last year raked in $200B from higher interest rates on loans but pay only 0.01% to savers – is YOUR bank ripping you off?

America’s three biggest banks raked in nearly $200 billion from higher interest rates last year – yet have failed to pass on bigger yields to savers.

The Federal Reserve’s relentless tightening cycle has taken interest rates to a 22-year high – boosting the amount JPMorgan Chase, Bank of America (BofA) and Wells Fargo can charge on loans to customers.

But analysis by DailyMail.com shows that all three have failed to raise the annual percentage yield (APY) on their basic savings accounts beyond 0.01 percent.

By comparison, those same banks typically charge between 5 and 7 percent interest on their 30-year fixed-rate mortgages.

It is the latest assulat by banks on thier customers – as they shut branches at an alarming rate, incouding 41 in just one week.

The firms have been put to shame by a host of smaller providers who now offer yields as high as 5 percent on standard savings accounts.

According to the Federal Reserve, the highest CD rate was for a three-month CD term in December 1980, which reached an average of 18.65%

You could get 10-12% interest earned on your savings accounts back in 1980!

Not anymore!

Most banks pay a pathetic 1% or LESS now.

h/t BLOWED UP REAL GOOD